Schedule a Call Back

search Result

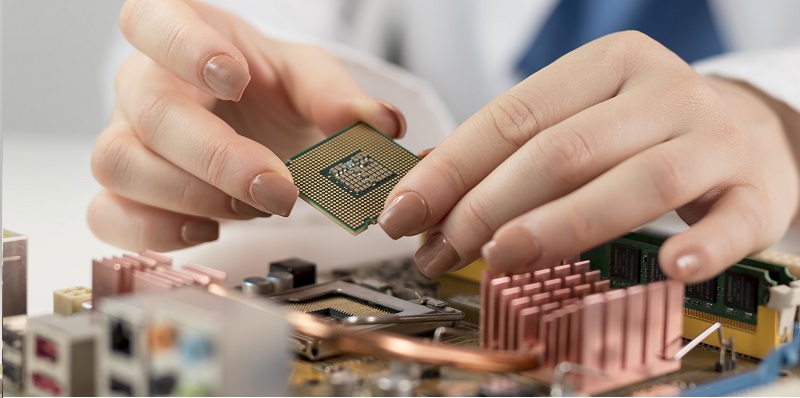

Component PLI top ask of electronic firms for upcoming Budget

The industry body has also asked for a Rs 400-450 billion package for the components ecosystem, extended over six-seven years.Read more

43% Indian MSMEs to increase digitalisation budget

Vi has launched an enhanced Digital Assessment Tool, both in English and Hindi as an extension of its dedicated MSME program.Read more

Section 43B(h): Boon turning into bane

India is home to the world’s biggest micro, small and medium enterprises (MSMEs) community (more than 60 million) who contribute around 29.7 per cent of the country’s GDP. Read more

Budgeting for growth?

The interim budget 2024-25, announced by Union Finance Minister Nirmala Sitharaman on February 1, 2024, has allocated Rs 11.11 trillion as capital expenditure (capex) for the next financial year – which is 3.4 per cent of the GDP and 11.1 per cent more than the planned capex of Rs 10 trillion for FY24.Read more

Industry leaders react positively to the interim budget 2024-25

The Interim Budget also contained a number of announcements and strategies indicating directions and development approach for making India Viksit Bharat by 2047. Here are the reactions from the industry leaders on the interim budget 2024-25.Read more

Interim budget 2024: Driving mobility on green path

With a goal to achieve India’s net zero emission target by 2070, the interim budget 2024-25 announces some measures to strengthen the electric vehicle (EV) ecosystem and charging infrastructure. Here is what the EV industry leaders have to say about the budget.Read more

Budget 2024: Economic railway corridors to optimise logistics: Akshat Pushp

The emphasis on dedicated freight corridors is particularly noteworthy, presenting a potential game-changer for the supply chain sector, said Akshat Pushp, Chief Business Officer, Apollo Supply Chain.Read more

Budget proposes Rs 1 trn corpus to boost investment in sunrise technologies

The Union Finance Minister Nirmala Sitharaman, while presenting the Interim Budget 2024-25, also proposed a new scheme for strengthening deep-tech technologies for defence purposes and expediting ‘atmanirbharta’.Read more

Interim budget 2024-25: Govt plans Rs 11.11 trillion capex for this year

FM Nirmala Sitharaman proposed setting up of a corpus of Rs one trillion for India’s tech savvy youth. For railways, three major economic railway corridor programmes - energy, mineral and cement corridors, port connectivity corridors, and high traffic density corridors - will be implemented.Read more

IESA proposes key reforms for India's Energy Storage Sector ahead of budget session

This initiative aims to extend electricity access across the country. In the previous year's Union Budget, Viability Gap Funding for 4GWh of projects was announced as part of a $4 billion 'Green Growth' package.Read more