Schedule a Call Back

search Result

Private capex revival remains unlikely in 2025, says RBI survey

The findings differ from the RBI’s Financial Stability Report (FSR), which indicated that India’s economic growth is poised to recover in 2025, driven by strong consumer and business confidence. Read more

Manufacturing expected to be a key driver of expansion in India; OPEC

Consumer confidence rose to 98.5 in March from 95.1 in January, driven partly by the on-going election cycle, expected to bolster spending, particularly in rural areasRead more

Revolutionising financing for small and medium enterprises

Exclusion of many MSMEs from formal lending ecosystems often inhibits their growth. Trade Receivables electronic Discounting System (TReDS) can be an useful tool for MSMEs to address cash flow challenges, opines Sundeep Mohindru.Read more

India: Leading global manufacturing

On April 11, 2024, the Asian Development Bank (ADB) - following the International Monetary Fund (IMF), World Bank, and Moody’s - raised India’s GDP growth forecast for 2024-25 to 7 per cent from the 6.7 per cent projected in December 2023Read more

Morgan Stanley says India unlikely to match China's 8-10% growth

Government officials have said the economy will likely grow 7 per cent in the fiscal year that begins in April, after an expected expansion of 7.6 per cent this financial yearRead more

IMF projects 6.3% growth for India despite inflation challenges

Contrary to the Reserve Bank of India's (RBI) forecast of 7%, the IMF's growth projection for the ongoing financial year, concluding on March 31, 2024, is slightly lower.Read more

India's private capex faces challenges amidst optimism

India Ratings and Research (Ind-Ra) suggests a potential uptick in private investment if certain economic conditions persist.Read more

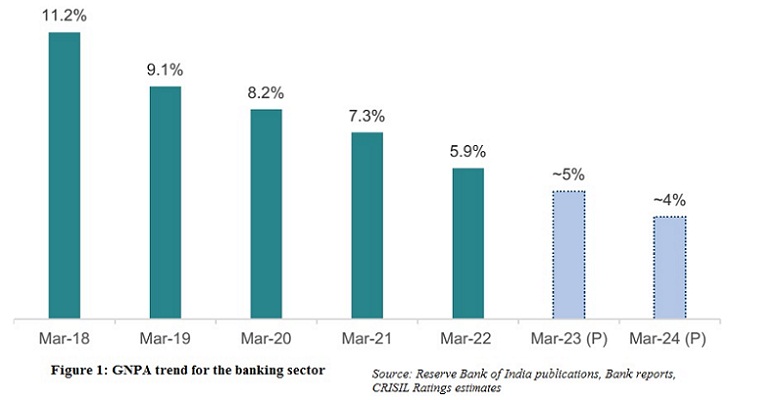

Bank GNPAs may touch low of 4% by FY24; MSMEs remain a concern area

Gross non-performing assets (GNPAs) of corporate segment is likely to fall below 2% next fiscal from a peak of 16% as on March 31, 2018; GNPAs of MSME (micro, small and medium enterprises) segment may rise to 10-11% by FY24 from approximately 9.3% as on March 31, 2022, says CRISIL Ratings.Read more

MSME body CIMSME requests RBI to extend repayment period under ECLGS

CIMSME urged for extension of repayment under ECLGS 1.0 from three to five years after the moratorium period. It also requested the extension for all MSMEs without any restriction.Read more

RBI takes steps to reduce COVID 19 stress on financial system

RBI has decided to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 75 basis points to 4.40 per cent from 5.15 per cent with immediate effectRead more