Schedule a Call Back

Auto forging: Looking for a technological renaissance

Articles

Articles- Jun 01,19

Related Stories

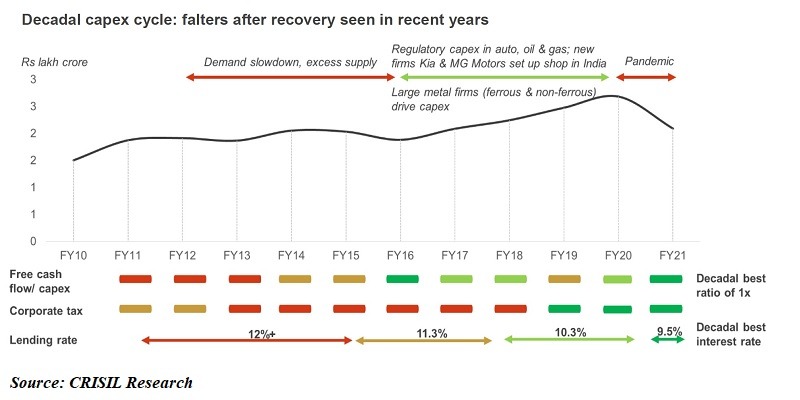

Capex cycle likely to be back, but...

According to The Economic Times report, listed Indian corporates reported record reserves and surplus of Rs 66.04 trillion as of March 31, 2021, up 17 per cent from Rs 56.48 trillion as of March 31,..

Read more

Industrial investments in India to rise 30% in FY22-24: CRISIL

Without PLI scheme, capex would have likely taken nearly two years to touch pre-pandemic levels, says CRISIL Research. PLI holds the potential to generate Rs 2.2 lakh crore worth of capex over the s..

Read more

Auto forging: Looking for a technological renaissance

India is lagging behind in terms of innovation and the country is still dependent on foreign machines to manufacture forgings.

Read moreRelated Products

Auto Casting Components

Micro Melt offers a wide range of auto

parts casting components.

Robofinish Iron Casting Fettlingrcf

Grind Master Machines Pvt Ltd offers a wide range of robofinish iron casting fettling CF-HD series.

Casting Components

Micro Melt offers a wide range of auto parts casting components. Read more