Schedule a Call Back

Indian Machine Tools Industry Gains Amid Shifting Global Dynamics

Articles

Articles- Dec 18,25

In the last few months, Indian machine tools industry has witnessed a stream of investment from global players. Examples like Phillips Machine Tools opening Manufacturing Expertise Center in Chakan (Pune), Tsugami launching a plant in Chennai, or Silmax opening new manufacturing facility in Bengaluru indicate that India is high on the radar of global firms looking to boost precision engineering in the country. “India is positioned as one of the most promising emerging markets for machine tools. The country offers robust domestic demand, rapid industrialisation and a vibrant ecosystem covering automotive, aerospace, defence and precision engineering. The company identifies several strengths in India, including high-quality engineering talent, competitive manufacturing costs and a willingness among industries to adopt advanced technologies. Areas for improvement, including the need for wider automation adoption, increased localisation of specialised tooling and stronger industry–academia collaboration. These gaps represent significant opportunities for global players to contribute technology, expertise and advanced manufacturing capabilities,” opines Dr Dario Maria Fumagalli, President & CEO, Silmax.

K Balasubramaniam, Founder, Tsugami Precision India adds, “The foremost driver is India’s expanding economy. A GDP growth rate of over 7 per cent signals robust manufacturing activity, and machine tools form the backbone of manufacturing sector. As industries shift toward higher-technology production at scale, demand for precision equipment will only increase. A strong machine tool sector is a hallmark of advanced economies, and India is now moving in that direction.”

Often described as the “mother industry” of manufacturing, it provides the backbone for production across automobiles, aerospace, defence, railways, electronics, medical devices, and general engineering. India’s rise as the world’s fifth-largest manufacturing economy has brought the machine tools sector into sharp focus.

Rajesh Mandlik, CEO of Setco Spindles India Pvt Ltd, says, "The machine tool industry forms the backbone of manufacturing, as virtually every component is produced either through metal cutting or metal forming. Metal cutting currently has a stronger contribution, although metal forming has been expanding steadily. Metal forming covers presses, foundries, castings, laser cutting and forming systems, friction welding machines, and related technologies. Metal cutting spans a wider spectrum, including vertical and horizontal machining centres, turning centres, grinding machines, and several high-precision categories. Together, these two segments define the structure of the industry."

With a market size exceeding $1.7 billion in FY 2024–25, the industry is expanding steadily, driven by the growing need for precision engineering, higher degrees of automation, and the country’s overarching ambition to strengthen self-reliance through programmes such as Make in India and the Production Linked Incentive (PLI) schemes.

India’s position in the global order

Globally, the machine tools industry has entered a difficult phase. After several years of steady expansion, worldwide production declined by over 5 per cent in 2024, affected by geopolitical tensions, supply-chain disruptions, high energy prices in Europe, and shifting trade policies. Structural shifts in major customer industries—particularly the automotive sector transitioning to electric and digital platforms—have further slowed capital investments. Regions are moving at different speeds: Europe has witnessed weaker industrial activity, China is confronting pressures arising from global trade realignments, while India has emerged as a positive outlier due to its infrastructure drive, manufacturing expansion, and growing role in international supply-chain diversification.

A notable shift has taken place in the attitudes and capabilities of Indian manufacturers themselves. Over the past decade, quality consciousness has deepened, replacing the earlier culture of improvisation. Access to digital tools, greater collaboration, and a sharp rise in entrepreneurship have collectively raised industry maturity. Indian manufacturers today are far more open to adopting global best practices, strengthening partnerships, and investing in advanced machinery. This evolution has positioned India as an increasingly attractive partner for global firms.

Trade pressures and realignments

Recent tariff war has added complexity. The 50 per cent US tariff on goods imported from India has affected exports of auto components and engineering goods in the last few months. Even so, India’s machine tools sector remains relatively shielded due to its diversified customer base, strong domestic demand, and the growth of new verticals such as aerospace, railways, electronics and defence.

One of the most persistent challenges for Indian machine tool manufacturers is the overwhelming presence of imports, which surged by 22 per cent in FY25. Much of this demand is for high-tech or high-precision machines that domestic manufacturers are still scaling toward. Global competitors enjoy substantial advantages—shorter delivery times, readiness to fulfil large-volume orders, and deeply established R&D ecosystems. India, in contrast, is dominated by small and medium enterprises (SMEs) that often lack the economies of scale required to compete head-to-head in specialised categories.

The government’s Scheme for Enhancement of Competitiveness in the Capital Goods Sector, particularly Phase II, aims to address this gap by promoting the indigenisation of machine tools and critical subsystems. However, long-term competitiveness will depend on India’s ability to grow its base of large-scale manufacturers, strengthen engineering R&D, and develop customised solutions for industry-specific requirements.

Emerging sectors beyond automotive

Automotive and auto components industry continues to be the leading drivers of machine tools in India. However, several other industries are also contributing significantly to demand. Defence and aerospace are expanding due to import-substitution mandates, domestic procurement policies, and growing capabilities in precision manufacturing. Railways and metro systems, which require machining for bogies, wheelsets, coaches, and engine components, are another major engine of demand. Electronics manufacturing—especially smartphones, wearables, and semiconductor components—requires micro-tools and high-speed CNC systems for miniaturised components. Medical devices, with stringent machining and finishing requirements, represent yet another high-growth opportunity.

“Electronic manufacturing is one area where the growth is extremely visible. Several global electronics companies have expanded their presence in South India. India has now become a major exporter of smartphones to the US. Semiconductors represent another sunrise sector. Large investments are being made, particularly in Gujarat, as India aims to build a domestic chip ecosystem. Aerospace manufacturing is gaining momentum with Airbus setting up operations in Vadodara, Boeing expanding in Telangana, and further developments in Nagpur. Defence manufacturing is also undergoing transformation with increased privatisation and PSU investments. All these evolving industries are accelerating demand for machine tools,” comments Rajesh Mandlik.

These sectors underline a broader shift: Indian manufacturers are increasingly competing in global markets while supporting sophisticated domestic demand. The result is a dual strategy of “Make in India for India” and “Make in India for the World”, both of which are gaining traction.

Balasubramaniam observes, “Only a few countries possess the scale to sustain a mature machine tool industry. Among the top ten producers globally, India remains in the lower tier. China, meanwhile, is rapidly advancing. However, this disparity reflects India’s historical demand profile rather than capability. As demand grows, the industry will inevitably climb the value chain. Electronics, aerospace and other precision-intensive sectors are expected to grow significantly, driving proportional demand for precision machining.”

Technology transformation: Automation, AI and more

Automation has become the defining investment priority for machine shops and OEMs. Indian machine tools are now routinely designed with embedded sensors, IoT connectivity, predictive analytics, and real-time monitoring. The integration of HMIs and digital dashboards has improved accuracy, reduced downtime, and enhanced operator productivity. Robotics—particularly collaborative robots—is being adopted for repetitive loading and unloading tasks, especially in high-volume manufacturing environments.

Dr Dario Maria Fumagalli explains, “Automation is reshaping the modern shop floor by enhancing productivity, consistency and safety. CNC automation, robotic handling, IoT-based monitoring and real-time machine diagnostics have become central to advanced manufacturing. AI is further accelerating this transformation through predictive maintenance, tool-wear analytics, adaptive machining and the automatic optimisation of cutting parameters. For tool manufacturers, AI enables the design of more efficient tool geometries and performance simulations, resulting in higher accuracy and reduced setup time for customers.”

Artificial intelligence (AI) is beginning to influence machining through predictive maintenance, tool-wear tracking, quality monitoring and adaptive machining. Hybrid processes that blend additive manufacturing and subtractive machining are emerging in aerospace, defence and EV components, where intricate geometries and lightweight structures offer a competitive advantage.

While large OEMs are embracing Industry 4.0, SMEs continue to face challenges due to costs and skill gaps. Bridging this divide will be crucial for India’s long-term competitiveness.

Critical constraints and new imperative

Despite India producing large numbers of engineers, only a small proportion are considered industry-ready. This is partly due to reduced hands-on learning and fewer structured training programmes. Public sector enterprises once played a major role in training new engineers; their decline has transferred the responsibility to private industry, which now must invest more in skilling. Machine tool companies are expanding programmes in CNC operations, maintenance, and programming to build a more capable workforce.

Sustainability is now central to capital investment decisions. Newer machine tools deliver up to 25 per cent energy savings, while lightweighting, recycling, and life-extension approaches are becoming standard. As climate-neutral manufacturing accelerates, demand is rising for machines capable of processing new materials, hydrogen components, battery systems and microelectronics. Manufacturers increasingly see sustainability not just as an environmental necessity, but as a competitive differentiator that aligns with global supply-chain expectations.

Precision for becoming resilience

India stands at a pivotal moment. As global firms seek alternatives to China, India has the opportunity to position itself not just as a low-cost destination but as a centre for original technologies and intellectual property. Industry leaders anticipate the machine tools sector will grow around 10 per cent in FY26, supported by strong domestic demand and expanded exports to the Middle East, Africa, and Southeast Asia. Companies are also preparing for new business models, including leasing and pay-per-output models, which could redefine customer relationships.

As global protectionism and geopolitical uncertainties rise, resilience and diversification will become essential. If India successfully scales its capabilities, strengthens its innovation pipeline, and aligns sustainability with competitiveness, its machine tools industry could emerge as one of the defining pillars of global manufacturing in the decade ahead.

Rajesh Mandlik concludes, "The industry has been growing at a compound annual rate of 11 per cent. Several years ago, we projected that the market would reach around Rs 320 billion by 2025, and we have come remarkably close to that estimate. For 2031, we foresee a market of approximately Rs 500–520 billion, and current trends support this outlook. However, our import dependence remains high. While we are the fourth-largest consumer, we stand only ninth in production, which indicates a sizeable gap. This disparity represents substantial opportunity: if domestic manufacturers can bridge the difference between consumption and production, the industry can unlock significant growth within India itself."

Related Stories

For the foreseeable future, multiple fuels will coexist and grow: Farrokh Cooper

In this conversation with Rakesh Rao, Farrokh Cooper, CMD, Cooper Corporation, shares his views on manufacturing, technology and the road ahead.

Read more

Positioning PVNA Group as a global clean mobility partner: Viveka Bhandari

The aim is to position the PVNA Group as a trusted global partner for advanced mechatronic and clean mobility solutions

Read more

Indian Machine Tools Industry Gains Amid Shifting Global Dynamics

India’s machine tools industry is attracting strong global investment, driven by rising domestic demand, precision manufacturing growth and supply-chain realignments, even as global markets slow. ..

Read moreRelated Products

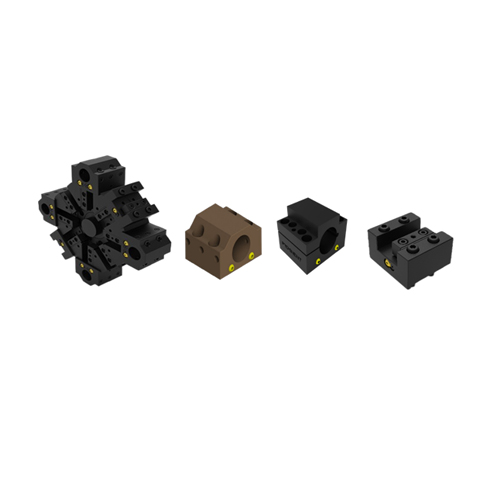

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.