Schedule a Call Back

PLI scheme: Need for a course correction

Articles

Articles- Dec 01,23

Related Stories

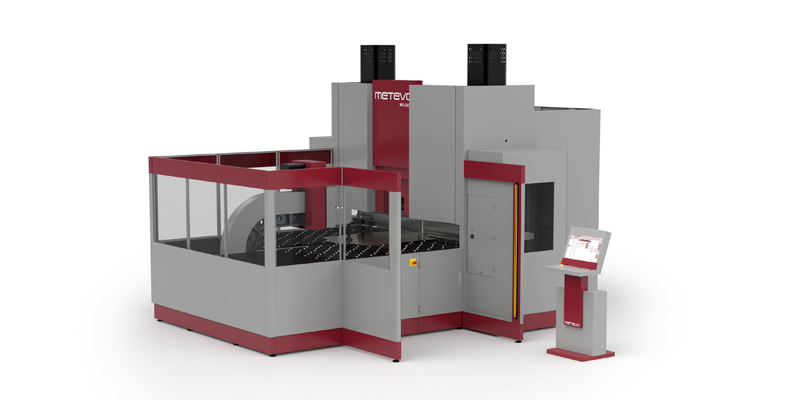

Salvagnini partners with Lanhao to launch Metevo panel benders globally

Salvagnini signed a cooperation agreement with Lanhao to distribute Metevo panel benders across Asia, Middle East, and South America.

Read more

Crown Worldwide Group expands India footprint with new logistics facility

Crown Worldwide Group inaugurated a 76,000 sq. ft. EDGE-certified logistics and storage facility in Bengaluru, reinforcing its India growth strategy.

Read more

Gandhi Automations’ Prime high speed doors built for safety and reliability

These high speed doors are versatile and robust, ensuring long-lasting performance.

Read more