Schedule a Call Back

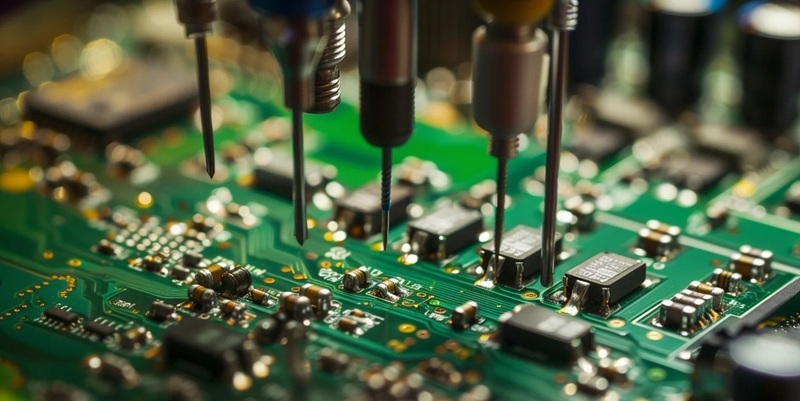

India needs to create its own smart-manufacturing ecosystem

Interviews

Interviews- May 02,18

Related Stories

Minda Corp, Toyodenso Form JV for Automotive Switches

The joint venture will set up a greenfield facility in Noida (Uttar Pradesh) with operations expected to commence in the second half of FY 2026–27

Read more

China’s Rare Earth Elements Curb Jolts Indian Auto Sector into Action

While Rare Earth Elements (REE) based components are utilised in traditional ICE vehicles, the production of EVs is fundamentally reliant on them—without REEs, manufacturing an EV is virtually imp..

Read more

Can Academia-Industry Ties Power India’s Manufacturing?

India's industrial sector has exhibited tremendous resilience and appetite for growth. However, the academia-industry collaboration will be crucial for India to become a worldwide manufacturing powe..

Read moreRelated Products

Heavy Industrial Ovens

Hansa Enterprises offers a wide range of heavy industrial ovens.

High Quality Industrial Ovens

Hansa Enterprises offers a wide range of high quality industrial ovens. Read more

Hydro Extractor

Guruson International offers a wide range of cone hydro extractor. Read more