Schedule a Call Back

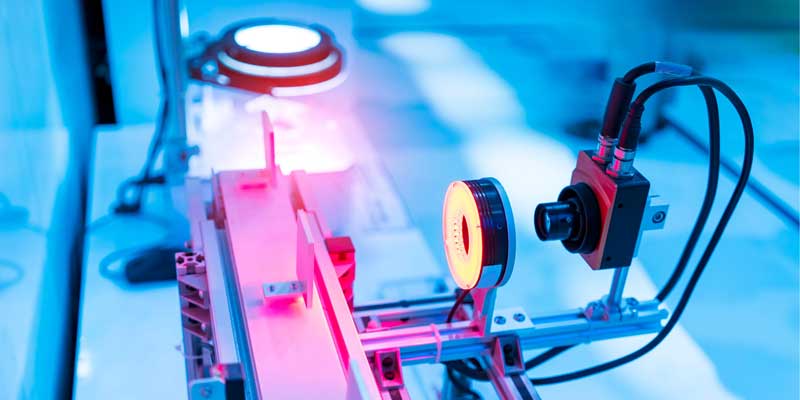

3D cameras to drive machine vision market growth

Articles

Articles- Mar 01,24

3D cameras are projected to drive the global machine vision market over the next five years, fuelled by strong growth within mobile robots and robotic picking. The predicted CAGR for 3D cameras of 13 per cent out to 2028 is anticipated to be much higher than the single digit CAGR of 6.4 per cent anticipated for the global machine vision market as a whole. Revenue for 3D machine vision cameras is expected to grow from $767 million in 2022 to almost $1.6 billion in 2028, with particularly strong growth projected for time-of-flight and stereo-vision cameras.

Interact Analysis published the first edition of its report on the global machine vision market, which generated revenue of $6.26 billion in 2023, down -2.8 per cent from 2022. Despite this slight contraction, we predict a steady growth rate of 6.4 per cent over the forecast period, with modest growth of 1.4 per cent expected in 2024.

Figure 1: Strong growth of 13% is predicted for the 3D camera market over the next 5 years

Types of 3D machine vision camera 3D cameras can be divided into 4 product types, each of which has key features and advantages for different applications.

Structured light 3D cameras involve projecting a known pattern or sequence of light onto a surface and analysing the deformation or distortion of this pattern when it interacts with an object. The camera observes how the structured light is deformed and from this information it can calculate the depth and shape of objects in the scene. These cameras are mostly utilised when precise measurements and image acquisition are required, and are currently being deployed in bin picking applications. Structured light 3D cameras are often more expensive than other 3D camera types. An example of this camera would be Zivid 2.

Stereo-vision cameras are imaging devices equipped with two cameras that perceive depth through binocular disparity. These cameras capture a pair of slightly offset images of the same scene. The disparity between corresponding points in the images is then used to calculate the depth information for objects in the scene. These cameras are most typically used in robotics and are particularly useful for autonomous driving, which provides significant growth potential. An example of this camera would be Basler’s Stereo cameras.

Time-of-Flight 3D cameras are imaging devices that determine the distance to objects in a scene by measuring the time it takes for light to travel from the camera to the object and back. These cameras are most typically used when high speed, but lower quality, image acquisition is needed. Time-of-flight 3D cameras are also a cheaper option for mobile robots, enabling them to avoid obstacles and navigate around other robots. An example of this camera would be Lucid’s Helios 2.

Laser triangulation 3D cameras employ the principle of laser triangulation to measure distances and create three-dimensional representations of objects or scenes. These cameras employ lasers to project a laser line or pattern onto the target surface, and a camera observes the deformation or displacement of this line/pattern as it interacts with the object. The information captured is then processed to determine the depth or three-dimensional structure of the object. These cameras offer high accuracy and resolution, and are more typically used for quality inspection, although they also can also be used to guide mobile robots. An example of this camera would be LMI’s Chroma-Scan.

Figure 2: Despite being cheaper products, strong market growth is the forecast for stereo-vision and time-of-flight 3D cameras

The graphs above show expected changes to market share for each product type within the 3D camera market. What is particularly interesting is the projected growth for both stereo-vision cameras and time-of-flight cameras. Although they have respectively gained just three per cent and two per cent market share, this is considerable as both camera systems are far cheaper than the other two product types. We predict a CAGR of 19 per cent for stereo-vision cameras and a CAGR of 17.3 per cent for time-of-flight cameras over the forecast period, which is far stronger than the overall growth forecast for the 3D machine vision camera market.

New developments in the 3D machine vision market

With many new 3D cameras hitting the market, here are some notable and new products that have hit the market recently.

Photoneo’s MotionCam 3D is renowned for its 3D image acquisition, where it uses parallel structured light technology to scan in motion at up to 40m/s with high resolution and no blurry images.

Lucid Vision Labs has just launched a new type of time-of-flight camera called the Helios2 Ray, which features a 0.3 M pixel resolution for distances up to 8.3m and 30 fps frame rate. It has four laser diodes, allowing the camera to generate real-time 3D point clouds, even in sunlight.

Orbecc has launched the Gemini 2 XL stereo-vision 3D camera, designed specifically for demanding lighting conditions. It can measure depths from 0.4m to 20m, capturing frame-rates of up to 20 fps. This camera is designed primarily for visual systems in robotics and AI-based vision systems.

Why is the market for 3D machine vision cameras growing so fast?

Key factors generating such high growth for 3D cameras over long term include anticipated price declines for all 3D camera types. This enables customers to upgrade their systems to include 3D cameras and replace slower, less accurate 2D systems. Strong growth is forecast in particular for robots, with a single 3D camera capable of carrying out the same tasks as several 2D cameras, resulting in robots becoming faster and more compact.

The market for 3D cameras continues to grow, with many new vendors entering the market each year. This allows for price competition and drives prices down, allowing more customers to adopt 3D vision systems. Pricing is especially aggressive in China where vendors are selling products at a cheaper price to gain market share from well-established western companies, and this is driving growth in the longer term.

Figure 3: Autonomous driving and bin picking have projected CAGRs of 20.8% and 19.2% respectively

Market growth is particularly high in applications such as autonomous driving and bin picking. These two machine vision applications have the largest CAGR in our forecast and both applications really benefit from the implementation of 3D cameras. Autonomous driving, especially for mobile robots, is an extremely large growth area, where vendors are now integrating one (or more) 3D cameras to guide the robot. We provide in-depth information on mobile robots (where the market grew by 33 per cent in 2022) and you can find out more by clicking here. We also provide in-depth insight into the robotic picking market, which we also anticipate will grow significantly over the coming years.

Bin picking, including palletizing and de-palletising, is also a major growth area for 3D machine vision cameras. The expansion of the 3D camera market helps in substantial year-on-year growth in sales of picking robots.

About the author:

Jonathan Sparkes is the Research Analyst at Interact Analysis (IA). An experienced professional, analytical, and highly educated researcher, Jonathan gained his analysis and modelling skills from a BSc in Mathematics. He works in IA’s industrial automation sector with a focus on machine vision and is particularly interested in how technology can be used to improve systems.

Related Stories

Hindalco partners with Ador Welding to enhance employees’ welding skills

Ador Welding Ltd and Hindalco School of Excellence have launched two key initiatives - the Training of Trainers (TOT) program and the Evaluation and Certification of Trainees in the welding trade.

Read more

Indore’s RR CAT plans AI-driven innovations in welding

RRCAT’s proposal, which aligns with the government's AI (artificial intelligence) vision in Amrit Kaal, has already secured approval at the Department of Atomic Energy (DAE) level.

Read more

SKF India dedicates a song to mechanics

SKF India - a manufacturer of bearings, seals, lubrication and lubrication systems – has released "Heroes of the Road”, a heartfelt song dedicated to the unsung heroes of the automotive industry..

Read moreRelated Products

Laser Control Micro Compact Nt

Blum-Novotest Measuring & Testing Technology Pvt Ltd offers a wide range of laser control micro compact NT.

Wireless Remote Control Siren

Forbix Semicon Technologies Pvt Ltd offers a wide range of wireless remote control siren.

Repairing of Time Makes Digital Portable Metal Hardness Tester

Aqua Excel Chemtest manufactures a wide range of soil test kits. Read more