Schedule a Call Back

Johnson Matthey sells Catalyst Technologies biz to Honeywell for £ 1.8 bn

Industry News

Industry News- May 22,25

- Strong valuation: The sale values CT at 13.3x EBITDA, representing a significant premium to analyst benchmarks and the current JM Group trading multiple.

- Cash return: JM plans to return £ 1.4 billion to shareholders post-completion and maintain annual cash returns of at least £ 130 million in FY2025/26, growing to £ 200 million in FY2026/27 and beyond.

- Core focus: JM will concentrate on Clean Air and PGMS businesses, which operate in durable markets with favourable long-term prospects and are underpinned by the Group’s deep platinum group metals expertise.

- Profit and efficiency gains: The streamlined Group expects at least mid-single digit CAGR in underlying operating profit between FY2024/25 and FY2027/28, with free cash flow projected to reach £ 250 million by FY2027/28.

Related Stories

Honeywell unveils made-in-India CCTV cameras for security tech sector

Class 1 certified cameras fully designed and manufactured in India, delivering enterprise-level cybersecurity, advanced features, and seamless integration.

Read more

Johnson Matthey sells Catalyst Technologies biz to Honeywell for £ 1.8 bn

Following this sale, Johnson Matthey will be repositioned as a more focused and efficient business centred on its global Clean Air and Platinum Group Metal Services (PGMS) divisions.

Read more

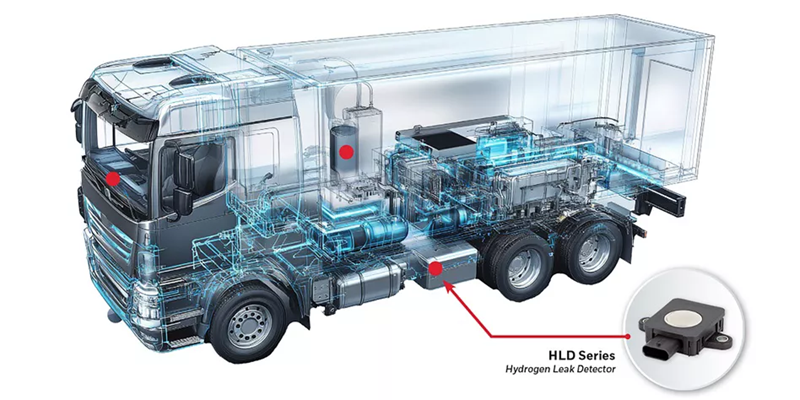

Honeywell launches new leak detection sensor

Hydrogen is colorless, odorless, highly flammable and rapidly diffused, making a leak difficult to detect and allowing the gas to easily escape a storage tank or pipe through seals and joints, crea..

Read moreRelated Products

Programmable Controllers - Pcd-33a Series

Pro-Med Instruments (P) Ltd offers a wide range of programmable controllers - PCD-33A Series.

Gasket Graphite Powder

Arihant Packing & Gasket Company offers a wide range of gasket graphite powder.

Asahi Kasei expands 3D printing filament sales in North America

Asahi Kasei, a leading resin and compounding technology provider, has initiated the sales of 3D printing (3DP) filaments in North America through Asahi Kasei Plastics North America (APNA). The soft la Read more