Schedule a Call Back

Indian construction equipment industry up 23% in Q3 FY23

Articles

Articles- Feb 24,23

Indian Construction Equipment Manufacturers Association (ICEMA) the nodal body representing the Construction Equipment industry (OEMs, suppliers and FIs) in the country and is affiliated to Confederation of Indian Industry (CII) announced industry results for quarter 3, FY23. The Indian Construction Equipment industry clocked strong year-on-year (YoY) sales growth of 23 per cent in the third quarter of the current fiscal over Q3 FY22. A total of 27,817 units of Construction Equipment were sold in Q3 FY23 out of which 2,252 were exported. This uptrend in Q3 results of FY23 comes on the back of improved performance across all equipment segments, that is earthmoving, material handling, material processing, and road construction equipment. In detail, the total of earthmoving equipment sold were 20,063 units, material handling equipment were 3,075 units, concrete equipment to 2,679 units, road construction equipment were 1,418 units and material processing equipment sold were 582 units.

The positive industry performance in Q3 of FY23 has primarily been powered by the robust 22 per cent YoY sales growth of Earthmoving Equipment (EME), which accounts for nearly three-fourths of total CE sales. Though backhoe loader sales which account for about half of the earthmoving equipment sales have been declining in recent months of November and December, excavator sales with more than 30 per cent share in total EME sales, have been on the rise during this period, leading to the upward trend observed in the overall sales of earthmoving equipment. The material handling equipment mainly comprising pick and carry cranes, observed a YoY sales growth of 56 per cent during the third quarter, while road construction equipment sales grew by 12 per cent.

A similar trend has been witnessed in the Quarter-on-Quarter (QoQ) growth as well. Sales in Q3 FY23 were up by 21 per cent as compared to Q2 sales in the current fiscal year. While earthmoving equipment with its lion’s share of CE sales grew 19 per cent over the last quarter, material handling equipment and concrete equipment recorded QoQ sales growth of 25 per cent and 18 per cent respectively in the third quarter of FY23. Material processing equipment registered a 5 per cent quarterly growth while road construction equipment, which had showed worrying downward trends over the last two quarters, staged a recovery with a whopping 75 per cent QoQ growth in Q3 of the current fiscal year, albeit on a low base.

“The third quarter growth in CE sales has been primarily driven by the accelerated pace of metro and high-speed rail construction,” said Dimitrov Krishnan, President ICEMA and Managing Director Volvo CE India Pvt Ltd. “The pace of road construction, the largest end-user segment contributing nearly 40 per cent of the total CE demand in the country, has also picked up in the last month of the third quarter along with increased mining activity, which helped the industry record an encouraging growth in the third quarter,” he added.

Additional drivers of construction equipment sales in Q3 of FY23 included post-monsoon resumption of business and settling down of the ongoing inflationary trends in global commodity prices. However, factors such as continuation of the Russia-Ukraine war and unpredictable, re-emerging cycles of Covid, continue to cause worry for the industry’s growth trajectory.

Commenting on the healthy growth in CE industry sales in Q3 of the current fiscal, V G Sakthikumar, Convener, ICEMA Industry Analysis and Insights Panel and Managing Director, Schwing Stetter India Pvt Ltd, said, “In the results of the third quarter of FY23, we can see very encouraging signs of the industry emerging from the headwinds of the past two years and gathering momentum for future growth. Both domestic and export markets have performed better than the previous quarter and the mood of the industry is optimistic in view of the expected further increase in the pace of execution of infrastructure projects in the next quarter.”

The ICEMA panel on industry analysis and insights provides robust and credible market intelligence by collating, generating, and analysing industry data. The value-added quarterly CE industry report is among the several industry reports collated based on data shared by its member companies which represent about 95 per cent of the OEMs operating in the Indian Construction Equipment industry.

Related Stories

Elastocon: Engineering Uninterrupted Conveying

Kamlesh Jain, Managing Director of Elastocon, presents the five year vision of the company.

Read more

Gandhi Automations’ Prime Metallic high-speed door offers security & efficiency

Gandhi Automations’ Prime Metallic high-speed doors are becoming essential for modern industries, providing enhanced security, energy efficiency, and streamlined logistics.

Read more

SIT plans to introduce new power transmission solutions in India: Amit Nangre

In this interview, Amit Nangre, Executive Director, SIT PTC India Pvt Ltd, shares insights on the company’s growth journey, challenges, and future opportunities.

Read moreRelated Products

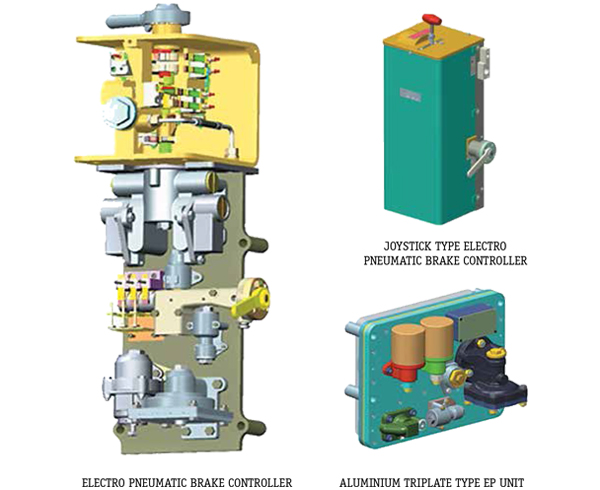

Electro - Pneumatic Brake System for Emu

Escorts Kubota Limited offers a wide range of electro - pneumatic brake system for EMU.

Indef Powered Crane Kit

Hercules Hoists Ltd offers a wide range of Indef powered crane kit.

Jib Crane

DC Hoist & Instruments Pvt Ltd offers a wide range of Jib crane.