Schedule a Call Back

Charting a ‘self-reliant path’ for India’s stainless steel industry

Articles

Articles- Sep 27,25

- Recognises stainless steel as a strategic sector for sustainable development.

- Secures critical raw materials like nickel, molybdenum, and ferrochrome through integration and partnerships.

- Creates industrial clusters to strengthen MSMEs, quality standards, and competitiveness.

- Incentivises R&D and the development of advanced stainless steel grades.

- Builds a robust ecosystem for scrap recycling and green manufacturing.

- Positions India as a global hub for high-value stainless steel products.

- Secure supply chains for critical inputs

- Advance R&D in specialty grades and alloys

- Scale up circular economy practices

- Embed green and energy-efficient technologies

- Establish globally competitive clusters

Related Stories

CEAT Partners CleanMax for 59 MW Hybrid Wind–Solar Power Project

CEAT has partnered with CleanMax to source ~59 MW of hybrid wind–solar power for its Halol and Kanchipuram plants, boosting clean energy use to around 60 per cent and cutting emissions significant..

Read more

IESA to Launch Vision 2047 Battery Roadmap at IBMSCS 2026

IESA will unveil its Vision 2047 white paper at IBMSCS 2026 in Hyderabad, outlining a strategic roadmap to build a competitive, self-reliant domestic battery ecosystem for India.

Read more

Musashi India Expands Bengaluru Plant to Boost Transmission Output

Musashi India has completed Phase 2 of its Bengaluru plant expansion to scale production.

Read moreRelated Products

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

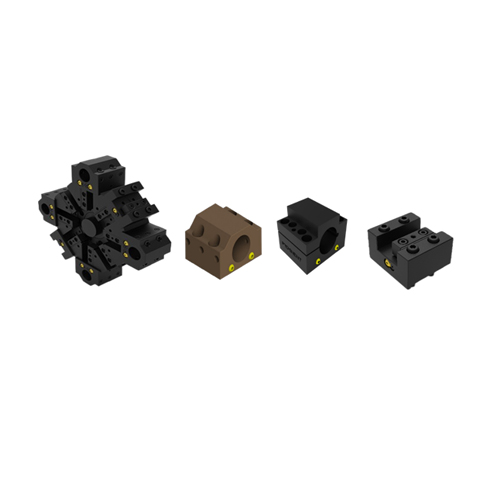

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.