Schedule a Call Back

Infra thrust and manufacturing reforms define Budget 2026–27

Industry News

Industry News- Feb 02,26

- Public capital expenditure raised to Rs 12.2 trillion in FY2027, up from Rs 11.2 trillion

- Rs 100 billion SME Growth Fund proposed to create future MSME champions

- Biopharma SHAKTI launched with Rs 100 billion outlay over five years

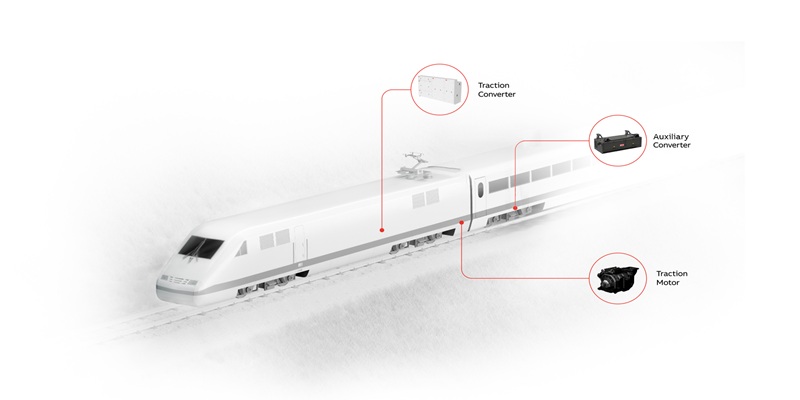

- Seven high-speed rail corridors announced as growth connectors

- Twenty new National Waterways to be operationalised over five years

- Rs 50 billion allocation per City Economic Region over five years

- Safe harbour threshold for IT services raised from Rs 3 billion to Rs 20 billion

Related Stories

Fujiyama to Commission 1 GW Solar Cell Manufacturing Plant at Dadri

Fujiyama Power Systems has announced the commissioning of a 1 GW solar cell plant at Dadri, Uttar Pradesh, strengthening its integrated manufacturing capabilities and reducing reliance on imports.

Read more

Trane Launches DCDA CDU Series for High-Density Data Centres in Asia Pacific

Trane Technologies unveils the DCDA series, the first locally developed coolant distribution unit for Asia Pacific data centres, addressing liquid cooling needs for high-density and AI workloads.

Read more

Legrand Inaugurates One of Its Largest Global Manufacturing Facilities in Nashik

Group Legrand India has inaugurated a 30,000 sq m manufacturing facility in Nashik, reinforcing India’s role as a global manufacturing and export hub.

Read more