Schedule a Call Back

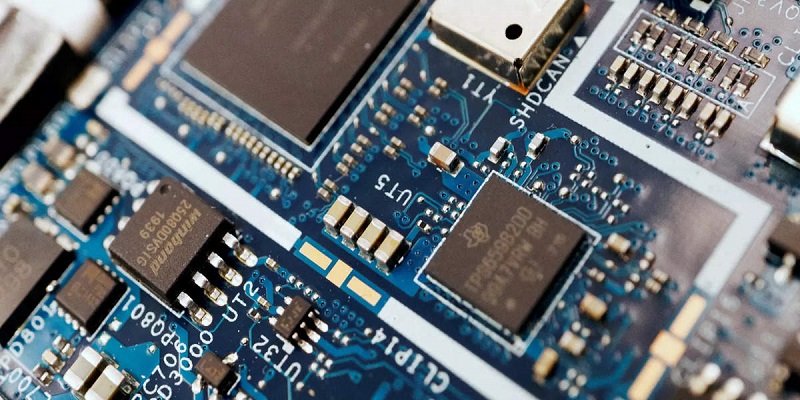

Budget 2024 to boost India’s manufacturing industry

Articles

Articles- Jul 30,24

Related Stories

Lubrizol and Polyhose ink MoU to manufacture medical tubing in Chennai

This agreement reinforces Lubrizol’s commitment to Make-In-India and broadens a previously committed $350 million investment to support local manufacturing.

Read more

Honeywell India partners with IISc to support deep science startups

HHSIF has extended research and financial support to over 40 Indian startups and nine entrepreneurs-in-residence (EIRs) through this collaboration.

Read more

Dixon partners with Nokia to manufacture fixed broadband devices in India

This partnership is expected to generate around 3,000 new jobs and significantly boost local manufacturing.

Read more