Schedule a Call Back

There is an increased focus on welding safety and ergonomics

Interviews

Interviews- Apr 29,24

The Indian Institute of Welding (IIW-India) is a professional body devoted to the cause of promotion and advancement of welding science and technology in India. Established in the year 1966, with its registered office at Kolkata, it has 13 branches and two centres located all over India. Deepak Acharya, President, Indian institute of Welding (IIW India), gives a brief overview of the welding industry and also shares the emerging trends in this interview with Rakesh Rao.

What is the market size of the welding industry in India? Which segments within the welding industry are showing strong growth?

The welding industry in India is experiencing steady growth, driven by infrastructure development, manufacturing expansion, and investments in sectors like automotive, construction, and energy. However, specific market size figures can vary year by year due to economic factors and industry trends.

In terms of market size, the Indian welding industry is estimated to be worth around $3.5 billion by 2025. This figure includes welding equipment, consumables, and services.

Segments within the welding industry that were showing strong growth included:

Automotive welding: With the growth of the automotive sector in India, demand for welding equipment and technologies used in automotive manufacturing also increased. This includes welding robots, automated welding systems, and advanced welding consumables.

Infrastructure and construction: As India continues to invest in infrastructure projects such as roads, bridges, and buildings; there is a growing demand for welding in construction activities. This includes welding of structural components, pipelines, and other infrastructure elements.

Energy sector: The energy sector, including power generation, oil, and gas, requires welding for various applications such as pipeline construction, maintenance of power plants, and fabrication of equipment.

Heavy machinery and fabrication: Industries involved in heavy machinery manufacturing and fabrication, such as industrial equipment, agricultural machinery, and mining equipment, contribute to the demand for welding products and services.

Defence and aerospace: With a focus on indigenisation and defence manufacturing in India, the defence and aerospace sectors are also driving growth in welding technologies, particularly for specialised applications requiring high precision and quality.

How has the welding industry changed in the last few years? Which industries are driving the demand for the welding industry?

In recent years, the welding industry has undergone significant changes driven by technological advancements, evolving market trends, and shifts in industrial demand. Some of the key changes and trends include:

Automation and robotics: There has been a notable increase in the adoption of automation and robotics in welding processes. Automated welding systems, robotic welders, and advanced welding technologies have become more prevalent, leading to improved efficiency, precision, and safety in welding operations.

Digitalisation and industry 4.0: The integration of digital technologies, data analytics, and IoT (Internet of Things) in welding equipment and processes has enabled real-time monitoring, predictive maintenance, and optimisation of welding operations. This digital transformation has enhanced productivity and quality control in the welding industry.

Advanced materials and processes: The demand for welding solutions capable of handling advanced materials such as high-strength steels, aluminium alloys, and composite materials has increased. Advanced welding processes like laser welding, friction stir welding, and electron beam welding have gained prominence for their ability to weld these materials effectively.

Focus on sustainability: There is a growing emphasis on sustainability and environmental impact in welding operations. This includes the adoption of eco-friendly welding consumables, energy- efficient welding processes, and waste reduction measures to minimise the environmental footprint of welding activities.

Skill development and training: With the technological advancements in welding, there is a need for skilled welders and technicians capable of operating and maintaining modern welding equipment. Training programs, certification courses, and skill development initiatives have become crucial in addressing the skill gap and ensuring a qualified workforce in the welding industry.

What are some of the emerging trends in the industry? (With respect to equipment, accessories, consumables, raw material, etc.)

Several emerging trends are shaping the welding industry, influencing equipment, accessories, consumables, raw materials, and overall practices. Here are some of these trends:

Advanced welding equipment: The industry is seeing a rise in advanced welding equipment that offers enhanced capabilities such as multi-process functionality, integrated automation features, and connectivity for data monitoring and analysis. This includes welding machines with built-in welding intelligence, touch screen interfaces, and remote control capabilities for improved user experience and productivity.

Robotics and automation: Automation and robotics continue to be a significant trend in welding. Collaborative robots (cobots) are gaining popularity for their ability to work alongside human operators, increasing efficiency and safety in welding operations. Automated welding systems with vision systems and programming flexibility are also becoming more prevalent for complex welding tasks.

Digitalisation and IoT integration: The integration of digital technologies and IoT in welding equipment enables real-time data collection, monitoring, and analysis. Welding machines and accessories equipped with IoT sensors can provide insights into welding parameters, productivity metrics, and predictive maintenance requirements, leading to optimised performance and reduced downtime.

Augmented Reality (AR) and Virtual Reality (VR): AR and VR technologies are being applied to welding training and simulation. Virtual welding simulators allow trainees to practice welding techniques in a virtual environment, providing a safe and cost-effective way to enhance welding skills and proficiency.

Environmentally friendly consumables: There is a growing demand for environmentally friendly welding consumables, including low-emission shielding gases, eco-friendly welding electrodes, and recyclable packaging materials. Manufacturers are focusing on developing sustainable welding solutions that minimise environmental impact without compromising performance.

Advanced welding processes: Emerging welding processes such as laser welding, friction stir welding, and electron beam welding are gaining traction for their ability to weld dissimilar materials, high-strength alloys, and thin-gauge components with precision and efficiency. These processes offer advantages such as reduced heat-affected zones, minimal distortion, and superior weld quality.

High-performance materials: The use of high-performance materials such as advanced alloys, composites, and lightweight materials is driving the demand for specialised welding consumables and techniques. Welding solutions capable of handling these materials while maintaining structural integrity and quality are in demand across industries like aerospace, automotive, and electronics.

Welding safety and ergonomics: There is an increased focus on welding safety and ergonomics, leading to the development of ergonomic welding equipment, personal protective gear, and safety features in welding machines. This includes innovations such as lightweight welding helmets with integrated respiratory protection, ergonomic welding torch designs, and safety interlocks in automated welding systems.

With usage of automation and robotics increasing, how is the welding industry reacting to this trend?

The welding industry is actively embracing the trend of automation and robotics due to the numerous benefits they offer in terms of productivity, precision, safety, and cost-effectiveness. Here are some ways in which the welding industry is reacting to the increasing usage of automation and robotics:

Integration of robotic welding systems: Welding companies and manufacturers are investing in robotic welding systems that can handle a wide range of welding tasks with high precision and repeatability. These systems often include articulated robots equipped with welding torches, vision systems, and advanced programming capabilities.

Collaborative Robots (Cobots): Collaborative robots, or cobots, are becoming more common in welding applications. These robots can work alongside human operators, enhancing productivity and flexibility in welding operations. Cobots are designed to be safe, easy to program, and adaptable to changing production needs.

Automated welding cells: Welding companies are setting up automated welding cells that integrate robotic welding systems, welding fixtures, material handling equipment, and quality control systems. These cells are designed for continuous operation and can be configured for various welding processes and product types.

Welding automation software: There is a growing demand for welding automation software that facilitates programming, simulation, optimisation, and monitoring of robotic welding processes. These software solutions help optimise weld parameters, reduce cycle times, and improve overall welding quality.

Training and skill development: As automation and robotics become more prevalent in welding, there is a need for skilled technicians and engineers capable of operating, programming, and maintaining robotic welding systems. Training programs and certification courses focused on robotic welding are being offered to meet this demand. Safety and risk mitigation: Welding companies are prioritising safety measures and risk mitigation strategies when implementing automation and robotics. This includes safety features such as fencing, light curtains, emergency stop buttons, and collaborative robot programming that ensures safe interaction with human workers.

Customised robotic solutions: Manufacturers are offering customised robotic welding solutions tailored to specific industries, applications, and production requirements. These solutions may include specialised robotic arms, end-effectors, welding torches, and accessories optimised for optimal performance and efficiency.

Data analytics and optimisation: Automation and robotics enable data collection and analytics during welding processes. Welding companies are leveraging this data to optimise parameters, detect defects, predict maintenance needs, and improve overall process efficiency and quality.

Will the rise in the electric vehicles industry affect the demand for welding?

Yes, the rise of the electric vehicles (EVs) industry is expected to have a significant impact on the demand for welding in several ways:

Lightweight materials: Electric vehicles often utilise lightweight materials such as aluminum and high-strength steels to improve energy efficiency and extend driving range. These materials require specialised welding techniques, including aluminum welding and advanced high-strength steel welding, which can drive demand for welding consumables and expertise.

Battery manufacturing: Welding plays a crucial role in the manufacturing of batteries for electric vehicles. Welding is used to assemble battery cells, modules, and packs, as well as to connect electrical components. The increasing demand for EV batteries is likely to lead to a corresponding increase in welding activities within the battery manufacturing supply chain.

Chassis and body assembly: The chassis and body assembly of electric vehicles often involve welding processes for joining structural components, frame elements, and body panels. As the production of electric vehicles grows, so does the demand for welding equipment, robotic welding systems, and skilled welders capable of handling EV-specific materials and designs.

Electric powertrain components: The electric powertrain components of EVs, including motors, inverters, and charging systems, require precise welding for assembly and integration. Welding technologies such as laser welding and ultrasonic welding may be used in the fabrication of these components, contributing to the demand for advanced welding solutions.

Manufacturing expansion : The growth of the electric vehicle industry is driving investments in manufacturing facilities, including vehicle assembly plants, battery factories, and component suppliers. These facilities rely on welding for various production processes, leading to increased demand for welding equipment, consumables, and services.

Innovations in welding technology: The demand from the electric vehicle sector is also pushing innovations in welding technology. For example, there are developments in laser welding for dissimilar materials joining, advancements in robotic welding systems for complex EV components, and improvements in welding processes to meet the stringent quality and performance requirements of electric vehicles.

Supply chain collaboration : Collaboration across the EV supply chain, including automakers, battery manufacturers, and suppliers, fosters knowledge sharing and technological advancements in welding processes specific to electric vehicle production. This collaboration can lead to the development of tailored welding solutions for EV applications.

What are the main hurdles for the growth of the welding industry in India? What are probable solutions for it?

Several challenges hinder the growth of the welding industry in India. Here are some of the main hurdles and potential solutions:

Skill shortage: One of the significant challenges is the shortage of skilled welders and technicians. This shortage can lead to quality issues, productivity slowdowns, and safety concerns in welding operations.

Solution: Implement comprehensive skill development programs in collaboration with vocational training institutes, industry associations, and welding equipment manufacturers. Offer specialised training in advanced welding techniques, automation, robotics, and safety practices. Encourage apprenticeships and on-the-job training to bridge the skill gap and create a qualified workforce.

Quality control: Ensuring consistent quality in welding processes can be challenging due to factors such as material variations, welding parameter control, and weld inspection procedures. Solution: Invest in quality management systems that include weld procedure specifications (WPS), welding procedure qualifications (WPQ), and non-destructive testing (NDT) methods. Implement digital welding solutions for real-time monitoring of weld parameters, defect detection, and quality assurance. Conduct regular audits and certifications to maintain high-quality standards.

Technology adoption: Limited adoption of advanced welding technologies, automation, and digitalisation can hinder productivity improvements and competitiveness in the industry.

Solution: Promote awareness and education about the benefits of advanced welding technologies, such as laser welding, friction stir welding, and robotic welding systems. Provide incentives and subsidies for small and medium enterprises (SMEs) to invest in modern welding equipment and automation solutions. Facilitate technology transfer and collaboration with international welding technology providers.

Regulatory compliance: Compliance with welding standards, codes, and safety regulations can be complex and challenging for welding companies, especially small-scale enterprises.

Solution: Provide guidance and support for regulatory compliance through industry associations, government agencies, and certification bodies. Offer training programs and workshops on welding standards (e.g., ASME, AWS, ISO) and safety protocols. Streamline regulatory processes and documentation requirements to reduce compliance burdens. Material availability and cost: Availability of high-quality welding materials, consumables, and equipment at competitive prices can be a concern, particularly for specialised applications. Solution: Encourage domestic manufacturing and sourcing of welding materials through incentives, subsidies, and industry collaborations. Facilitate technology transfer and partnerships with global suppliers to access advanced welding consumables and equipment. Negotiate bulk procurement agreements to lower material costs for welding companies.

Infrastructure and connectivity: Inadequate infrastructure, power supply disruptions, and limited connectivity in rural areas can impact welding operations and supply chains.

Solution: Invest in infrastructure development, including reliable power supply, transportation networks, and digital connectivity. Promote cluster-based development of welding industry hubs with access to essential infrastructure, logistics support, and government incentives. Leverage digital platforms for remote monitoring, supply chain management, and business continuity planning.

What kinds of growth opportunities are present in growing segments like railways, defence & aerospace, solar/renewables, hydrogen, etc?

The growing segments such as railways, defence & aerospace, solar/renewables, hydrogen, and other emerging industries offer significant growth opportunities for the welding industry in India. Here's a breakdown of the growth opportunities in each of these sectors:

Railways

Defence & aerospace

Solar/renewables

Hydrogen

Emerging industries

What is the outlook for the welding industry in India?

The outlook for the welding industry in India is positive, with several growth opportunities, advancements in technologies and raw materials, increasing automation, and the adoption of Industry 4.0 principles. Here's an overview of the outlook for the welding industry in India:

Growth opportunities

New technologies and raw materials

Automation and industry 4.0

Quality and safety

Overall, the outlook for the welding industry in India is characterised by growth opportunities across multiple sectors, advancements in technology and materials, increasing automation and digitalisation, and a focus on quality, safety, and sustainability. Adapting to these trends, investing in innovation, skill development, and collaborative partnerships can help welding companies thrive in the evolving industry landscape.

Related Stories

INOX India launches India's first UHP ammonia ISO tank for semiconductor sector

INOX India unveils the nation’s first ultra-high-purity ammonia ISO tank, boosting global semiconductor and solar manufacturing supply chains with advanced cryogenic tech.

Read moreINOX becomes first Indian firm to receive IATF 16949 Certification for CFT

The IATF 16949 certification, a mandatory requirement for automotive OEM suppliers, validates INOX India's commitment to maintaining the highest quality management standards in the automotive indust..

Read more

There is an increased focus on welding safety and ergonomics

Deepak Acharya, President, Indian institute of Welding (IIW India), gives a brief overview of the welding industry and also shares the emerging trends in this interview with Rakesh Rao.

Read moreRelated Products

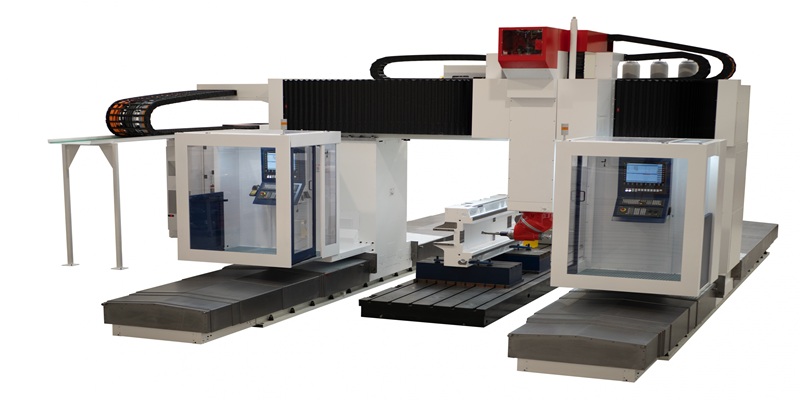

Robotic Welding System

Drupe Engineering is a manufacturer and supplier of a

wide range of

Dc Tig Welding Machine

Welding Aids offers DC TIG (inverter base)

MOSFET base welding machine.

Welding Automation

Drupe Engineering Private Limited is offering a wide range of welding automation.