Schedule a Call Back

"The failure rate of distribution transformers in India is estimated at 10-15 per cent"

Interviews

Interviews- Sep 05,14

- Suresh Srivastava, Senior Vice President, Archon Engicon Ltd

What is the present state of transformers and switchgear market in India?

The transformers market in India has been in a healthy state for quite some years now. The market is further expected to witness healthy growth rates and stimulating demand for the coming years. The initiatives undertaken by the Government of India along with the need of replacement of transformers installed in the earlier years is expected to drive growth in the Indian transformers market. The transformer market in India can be pegged at more than Rs13,000 crore. Power transformers contribute 45 per cent of the total market and distribution transformers 55 per cent. Over the last two years, the market has grown at a very moderate rate at less than 4 per cent, due to the slowdown of power generation capacity addition and T&D infrastructure expansion.

Do you agree with the fact that the country has inadequate power distribution infrastructure? What are the major reasons?

Yes, we are badly lacking in quality and efficient power distribution infrastructure. The scenario is largely noticed in villages, small towns and remote areas.

Most of the transformers get burnt leading to power failures in India. What factors lead to such scenario? What can be the solution?

High failure rate of distribution transformers is a big concern for the transformer industry in India. The average operational life of a transformer is between 25 to 30 years; however, transformers in India are known to be recalled for repair as early as in three years. The failure rate of distribution transformers in India is estimated at 10-15 per cent (in stark contrast to the less than 2 per cent in developing countries). This is due to the low entry barriers in the distribution transformer market leading to unorganised players entering the market, and competing on the price factor. SEBs historically follow a L1 vendor selection criteria, which has led to proliferation of many small players, that compromise on the quality of transformers manufactured. The other reasons are due to overloading or poor quality maintenance. Timely maintenance and timely upgradation according to increasing demand will avoid such incidents.

Is India still lacking in terms of advanced technologies for transformers and switchgear?

No, not anymore. In fact, apart from catering to domestic demand, India exports transformers to over 100 nations including the US, Europe, Malaysia, Singapore, Bangladesh and to several African and Gulf countries. India is also an importer of certain types of transformers; the major source countries include China, Germany, USA, Korea, and Japan.

What kind of technological advancements should be encouraged?

We have almost all the best global brands operating in India. The issue of quality that crops up periodically is certainly valid, which is mainly due to manufacturers in the unorganised sector. The unorganised sector needs to upgrade their systems and quality. As far as the big players are concerned, they need to make more robust transformers and switchgear considering Indian scenario (theft and overloading).

What challenges does the industry face? How do you cope up?

We lack quality testing facilities. The growth in testing infrastructure has not kept pace with that of production, both, quantitatively and qualitatively. Testing infrastructure available at India's premier agency, the Central Power Research Institute (CPRI) is proving short of demand. Manufacturers of large power transformers at times need to send their equipment for testing to overseas facilities like Korea Electrotechnology Research Institute (KERI) and KEMA, which is expensive. Apart from this, huge logistical costs and lead times are also involved.

Future outlook?

The Indian power and distribution transformer markets are highly dependent on investments planned by the Government of India. The programmes, when fully implemented as scheduled, are expected to drive the demand for both power and distribution transformers. The Government currently plans to strengthen transmission lines and create a National Grid interconnecting the five regions (northern, southern, eastern, western and northeastern) through the creation of 'Transmission Super Highways'. The scheme is expected to drive the demand for higher-rated power transformers. With T&D companies actively striving to reduce aggregate technical and commercial (AT&C) losses, the demand for energy efficient transformers would get a boost. With huge investments proposed across sectors such as power, infrastructure, etc., and the entry of new players, will have a positive impact.

Related Products

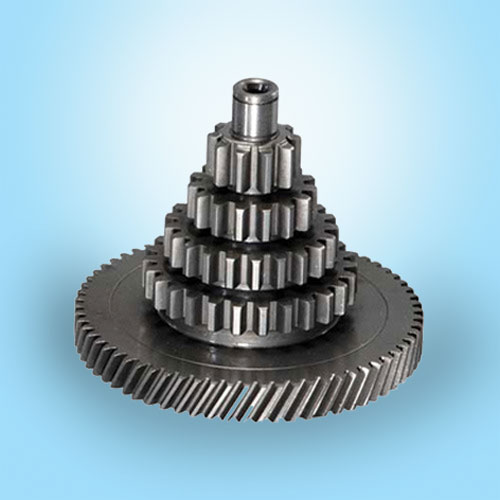

Cluster Gears

Trishla

Gear Industries is engaged in manufacture and supply of a wide range of cluster

gears.

Servo Drives, Fully Digital

Bristol

Industrial Electronics offers optimum quality, fully digital servo drives.