Schedule a Call Back

Tariffs are reshaping automation supply chains: Blake Griffin

Articles

Articles- Dec 01,25

Related Stories

India must focus on R&D alongside electronics manufacturing: Sanjay Huprikar

In this interview with Rakesh Rao, Sanjay Huprikar, Chief Global Officer of the Global Electronics Association, explores trends in global electronics industry, India’s manufacturing ambitions, and..

Read more

How India Can Build Manufacturing Strength in a VUCA World

As global manufacturing resets under VUCA pressures, India stands at a strategic inflection point, balancing resilience, technology, sustainability and leadership to shape future supply chains, says..

Read more

How Indian Manufacturing Is Learning to Scale While Thriving in a VUCA World

Global manufacturing is being reshaped by a VUCA world, where resilience, adaptability and reliability outweigh efficiency, creating challenges and strategic opportunities for India’s manufacturin..

Read moreRelated Products

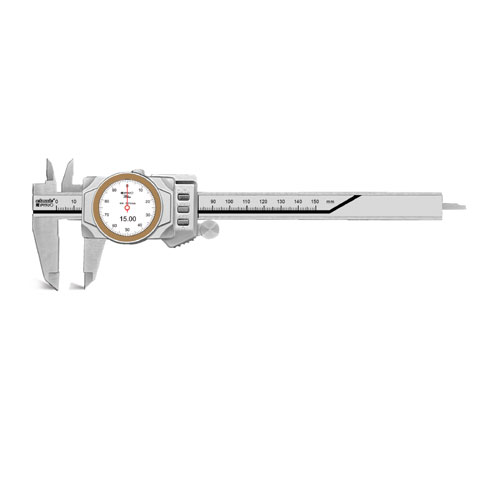

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.