Schedule a Call Back

Dr Sreeram Srinivasan: Covid 19 is not a cause for chip shortage

Interviews

Interviews- Jul 13,21

Chip shortage has been in the news for quite some time now. To survive in the semiconductor industry is not easy as it is subjected to the ups and downs of regular chip cycles. When demand is high, chipmakers struggle to keep up with requirements. But, if supply exceeds demand, chip prices fall drastically. The present chip shortage crisis has been blamed on the work-from-home scenario needing more electronic gadgets and Covid 19 pandemic. However, Dr Sreeram Srinivasan, CEO of Syrma Technology and an industry veteran with 36 years of experience, believes chip supply crisis was going to happen sooner or later and one cannot blame Covid pandemic alone for the same. Syrma Technology - a part of Tandon group with over 40 years of expertise in the electronics manufacturing space - is considered to be a pioneer in electronics manufacturing services (EMS). In this exclusive interview with Rakesh Rao, Dr Sreeram Srinivasan explains the reasons behind the current chip crisis and also shares his growth plans for Syrma Technology.

How is Syrma Technology serving its customers?

Syrma, operating for the last more than 15 years, has two main divisions - ODM (original design & manufacturing) and EMS businesses. We offer services like designing, manufacturing, rapid prototyping, etc for all electronics components and parts. About 85 per cent of our revenues come from exports (mainly to US and Europe) as we cater to global OEMs. Our domestic business is also growing strongly. In the future, our exports to domestic ratio is expected to be 60:40 from the present 85:15. With IoT becoming prevalent, almost every product - right from automotive, white goods products, to toothbrush, footwear, etc - are becoming smarter with electronic components. This is helping us broaden our domain.

What is the company coping with Covid 19 pandemic?

Except for initial few weeks of nationwide lockdown in 2020, Syrma was able to continue its manufacturing operations, with all safety precautions in place, as we serve healthcare and other sectors manufacturing essential products. With lot of uncertainty in the market with respect to supply of raw materials and logistics, we had to carry more inventory than normally we would. Being a design and manufacturing company helped us, as we were able to suggest alternate components to customers and manufacture them quickly. Most of the customers, knowing situation around, were patient with us and very supportive.

As Syrma has many overseas customers, there was steady stream of orders to work on. Despite Covid, our sales growth was significant last year.

How is the electronic manufacturing services (EMS) market (globally and in India)?

Globally, market size of EMS is around $ 6-7 trillion with China cornering 40% market share and India accounting for about 3-3.5%. Even with this small share (of about $ 200 billion), India EMS market is big compared to what it was 5-6 years back. Mobile phones revolution has been one of the key drivers of EMS market in India. It is estimated that Indian EMS market will touch $ 400 billion by 2024-25, which now looks like a reality. If this projection comes true, then Indian EMS market can reach $ 1 trillion in the next 10 years.

What kind of opportunities does the EMS market offer to companies like Syrma?

It offers huge opportunity. Before pandemic, one would have said that US firms are very China focus when it comes to manufacturing. If they want design, they look at India. However, today the situation has changed (due to Covid pandemic) not only for Syrma, but also for other Indian companies. Now, customers in the US and Europe are opting for China Plus One strategy. These companies are now willing to talk about procuring from India, in spite the fact that the country lacks a robust supply chain ecosystem for electronic components and products. This is a positive sign. We were successful in acquiring new customers during the Covid pandemic.

While India is a huge consumption market for electronic goods, the majority of these are imported into the country. What are the reasons for this?

We raced ahead in software, but we fell behind in hardware. Realising this, the Government of India came with special incentives for electronic manufacturing. However, it is still a long way to go for India to be recognised as an electronic manufacturing powerhouse. In spite of all the hindrances, we are catching up very fast in electronic manufacturing.

The Government is one step ahead in framing policies for electronic hardware industry. In the last 3-4 years, the government has been proactively engaging with the industry to bolster electronics manufacturing in the country. Building infrastructure to produce parts and components that go into electronics take time. Things are improving and gradually the imports will come down as supply chains for electronics manufacturing develop in the country.

Given India's entrepreneurial spirit and proactive policy support of the government, many companies are committing themselves to invest in electronic hardware manufacturing.

Will the Production Linked Incentive (PLI) scheme announced for the electronics industry be of any help?

PLI scheme has provided a spark for entrepreneurs to bloom again. It has helped in creating awareness among global companies to seriously look at India to invest in setting up manufacturing base. More than the incentive offered in the scheme, it is sending an important message to the industry that the government is creating a conducive environment for the industry’s growth. This gives a confidence to the investors.

Companies from the US and Europe are seriously looking at China Plus One strategy. Though India is still not a big beneficiary of this strategy so far (as it is facing stiff competition from other Asian countries like Vietnam, Philippines, Indonesia etc), whatever investment is coming its way will help in capacity building in India. Also, one must not forget that India offers a huge domestic market, unlike other competing countries. At the end of the day, our domestic market is going to bail us out.

This is what we believe in and, hence, we see our business in India growing faster and contribution to increase to about 40% of our revenues (from the present 15%) in the near future.

Shortage of chips has been in the news for quite some time. What are the reasons for this chip shortage?

There are lots of theories floating around why there is a chip shortage. If you look at the historical data of the last 10 years, the chip manufacturing industry has been consolidating through mergers and acquisitions. In the last 4-5 years, the number of chip manufacturers have come down from 15 to 5 companies. It costs about $7-8 billion to build chip manufacturing plant and it takes 3 years for a foundry to be set up. Chipmakers were increasing capacity through consolidation and not by investing in capex.

Ever since human being came on the Earth up to 2018, total data of 40 Zettabytes (1021 bytes) was created. It is estimated that from 2018 to 2021-22, 160 Zettabytes data will be generated - i.e. four times increase in the data in just 4 years. This clearly indicates the manifold rise in the need of chips.

So, Covid 19 pandemic is not a cause for chip shortage. Lack of investment in capex in the last 10 years is the real reason for the current crisis in the chip market. World is dependent on a few companies for foundries - the basic ingredient for chip manufacturing. Covid, at most, has complicated or compounded the shortage situation, which was bound to happen sooner or later.

Many projects have been either postponed or cancelled due to lack of chips; however, nobody is ready to talk about it on record. Delays have been blamed on Covid 19 pandemic. But pandemic is a too easy explanation for a complex problem.

What are the emerging trends in the EMS market?

IoT will be the trend setters for most of the products. With things becoming smarter, it will open up opportunities for all of us. Total global electronics market is estimated today at $6-7 trillion. IoT alone will present a $11-12 trillion opportunity in the next 5-10 years, with everything becoming a subset of Internet of Things. Smart revolution is touching everyone’s life without anyone realising it.

What are your growth plans for Syrma Technology?

In November 2020, Syrma Technology and SGS Tekniks announced a merger agreement. With this merger, which will be completed this year, we will be able to double our revenue. Given the opportunities in the electronic manufacturing and design, we expect the merged entity to double its size in the next 3-4 years.

Related Stories

Fujiyama to Commission 1 GW Solar Cell Manufacturing Plant at Dadri

Fujiyama Power Systems has announced the commissioning of a 1 GW solar cell plant at Dadri, Uttar Pradesh, strengthening its integrated manufacturing capabilities and reducing reliance on imports.

Read more

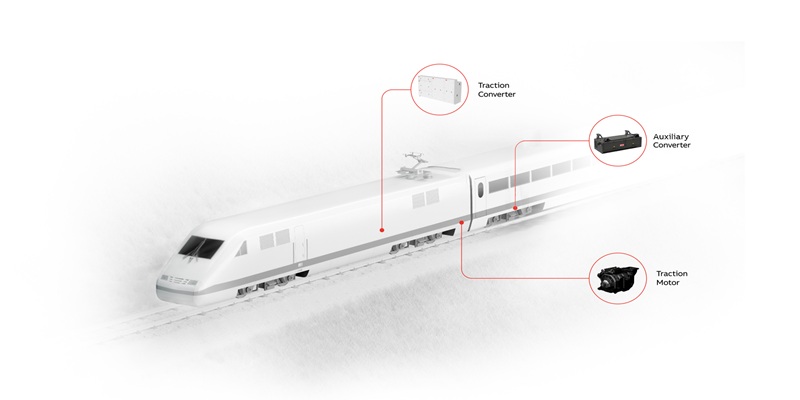

ABB Wins Mumbai Metro Lines Propulsion and TCMS Order

ABB has secured a major order from Titagarh Rail Systems to supply propulsion systems and TCMS software for Mumbai Metro Lines 5 and 6, strengthening its role in India’s metro expansion.

Read more

Why Batteries Trail Strategy in Humanoid Robot Development

Battery makers are racing ahead of robot OEMs in positioning humanoids as the next growth frontier. This press release examines developments from both perspectives and considers how deeper cross-ind..

Read moreRelated Products

Carbide Burrs

SRT Industrial Tools & Equipments offers a wide range of carbide burrs.

Jamshedji Soil Compactor

Jamshedji Constro Equip Pvt Ltd offers a wide range of jamshedji soil compactor.

Ground Pins

Hans Machineries Private Limited offers a wide range of pins, hardened & ground. Read more