Schedule a Call Back

Steel exporters to tap demand in China

Industry News

Industry News- Jun 12,20

In a bid to

survive in this tough time, steel companies are eying on Chinese markets for

exports on account of the weaker demand domestically. The Covid 19 pandemic led

to serious disruptions in the steel market. Apart from China, the EU and CIS

nations are also being tapped by the steel exporters.

ÂÂ

China is said to be building capacities to achieve

global demand. In the last 2 months, China has changed its economy

completely. The Chinese are currently not using the steel melt facilities

but only operating their mills to cater to their construction sector and

infrastructure requirements. They are spending 1.7 trillion dollars on domestic

infrastructure projects. They have steered their economy in a much better

way post-Covid 19. This will create a huge domestic business base that can be

leveraged later for exports.

According to the World Steel Association (WSA), a

reduction in global steel demand this year will be mitigated by an expected

faster recovery of in China, compared to the rest of the world. The

association expects Chinese steel demand to increase by 1 per cent in 2020. In

contrast, demand in developed countries will decline by 17 per cent.ÂÂ

Steel Authority of India (SAIL) has exported around 130, 000 tonne of

semi-finished steel to China between April and May. Combined steel exports of

SAIL of the said two months stood at 200, 000 tonne. Rashtriya Ispat Nigam

Limited (RINL) exported 90, 000 tonne steel to China in May. ÂÂ

VR Sharma, MD, Jindal Steel & Power Ltd (JSPL),

shared about how exports were the right option during the lockdown phase, in a

Webinar held by IPF. He states, “For us at JSPL, export has rescued us. We have

exported more than 400,000 tonne material during the Covid 19

time. Generally, we export only 500,000 to 600,000 tonne a year. Our

maximum is around 800,000 tonne a year. But this year by May end, we have

crossed 700,000 tonne. It comprises of semi steals, plates and blooms for

Railway France and some parts to China as well.â€ÂÂÂ

“We had started very humbly booking some export orders, and we found that demand

was coming from all over the world – especially for finished steel from Europe

and the Middle East, and for semi-finished steel from Asia,†Sharma said.ÂÂ

Indian steel exports rose by 29.5 per cent to 8.24 million tonne in its fiscal

year ended March 31, 2020, according to the country’s Ministry of

Steel. JSPL has sold large tonnages of billet to China during the Covid-19

crisis, Sharma revealed, with Chinese re-rollers forced back into the import

market for the semi-finished product in March amid higher construction demand.

He expects China to continue

importing semi-finished steel throughout this year.

JSPL has also found success in

exporting to the European Union amid the pandemic.

“There was a big problem in

Europe with the virus peaking in March and early April in Spain, Italy and

Germany. Most mills were down or operating at reduced capacity and there was

uncertainty in the market,†he said.

“Traders thought there could

be a shortage of steel [in Europe] during May and June so they placed a lot of orders

with us for the plate,†he said.

Sharma stated that the foreign trade policy (FTP)

is at one end and the export competitiveness is on the other. Indian products

too have an equal appeal in the global markets.

ÂÂ

FTAs for exports

Signing free trade agreements (FTAs) with the

different governments like EU and USA will definitely help to do away with the

quota system for Indian exports.ÂÂ

There is a craving need to address three issues.

First, on the government’s side, discussing FTAs over the quota system to ease

out finances. Second, FTA discussions will help companies to get the packing

credit. Third, need a check whether ports are working efficiently. If these

three-step agenda is met, exports may see a boost.

The current export incentives stand at less than 3 per cent for the steel

industry products whereas in comparison most of the countries have more than 10

per cent.

“We want the government to allow the export

incentives over and above the working capital. In order to encourage

exports, there is a need for additional help. We are looking at short-term

packing credit against the letter of credit from the buyers

bank. Currently, Indian commercial banks are offering the packing credit

but that is within the working capital limits,â€Â emphasises Sharma.

Currently, Indian engineering exports have

registered a fall of 5.8 per cent and all 25 top global nations are registering

the drop. India had average gains from the countries like Nigeria and Malaysia

but noticed the biggest falls in Belgium, Singapore, Turkey, Indonesia, Sri

Lanka. India has a good share of 15 per cent exports to China. A

tremendous growth is in CIS countries, meaning Armenia, Azerbaijan, Belarus,

Kazakhstan, and Kyrgyzstan.ÂÂ

Meanwhile, 40 per cent the export-oriented business

were dependent on the European Union (EU) and the US, due to the Generalized

System of Preferences (GSP), meaning exports from India to these countries had

a special preference.ÂÂ

The Indian refractory market,

a key raw material supplier for the production of steel, cement, and glass, is

experiencing a steep fall in demand domestically due to lower activity in

construction and infrastructure segments.

Operations in the manufacturing sector in India

came to a complete standstill after the lockdown was announced from March 25,

2020. Situation is quite alarming as shown by the latest Purchasing Managers'

Index (PMI) numbers - which dropped like a freefall showing the lowest figures

since it began in 2005. IPF Webinar focused on challenges before manufacturers as

they restart their production plants and also offered probable solutions to

mitigate Covid 19 problem.

Related Stories

Steel Sector Holds the Key to India’s Manufacturing Resilience

India’s steel sector is emerging as a strategic pillar in strengthening manufacturing resilience amid global volatility, supporting infrastructure growth, self-reliance, and long-term industrial c..

Read more

Hi-Tech Pipes Starts Commercial Output at Kathua Plant

New Jammu unit boosts capacity and strengthens northern market reach

Read more

Centre Launches Third Round of PLI Scheme for Speciality Steel

Scheme aims to boost high-end steel capacity and global competitiveness

Read moreRelated Products

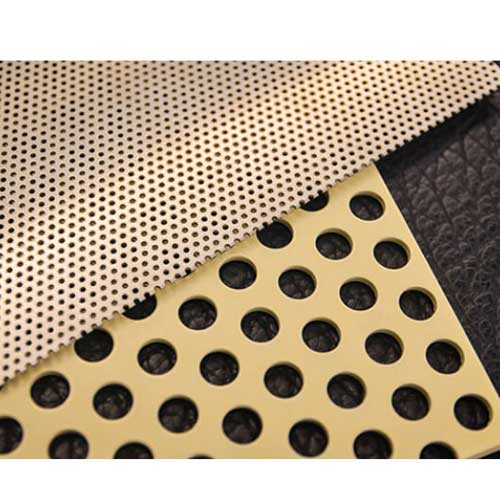

Perforated Sheets

Raj Filters & Wiremesh Pvt Ltd offers a wide range of perforated sheets.

Fibro Die Mounted Cam Unit

Fibro India Precision Products Pvt Ltd offers a wide range of fibro die /mounted cam unit. Read more

Metal Pallets

Metal Impacts manufacturers a high quality steel pallets that are available in different sizes, forms and construction designs to meets the needs and requirements of our huge client base. These ste Read more