Schedule a Call Back

South Korean battery giants face Chinese competition, eye innovation to stay ahead

Industry News

Industry News- Sep 15,23

Related Stories

SME Magazine Honours India’s Fastest Growing Engineering Companies at NSE

The Smart Manufacturing & Enterprises (SME) Conference & Awards 2026 - held on February 11, 2026 at National Stock Exchange (Mumbai) - highlighted resilience and technology as the cornerstones of In..

Read more

MIC Electronics Signs MoU to Enter Refurbished Electronics Segment

MIC Electronics signs an MoU with Refit Global to evaluate entry into the refurbished and circular electronics market, with due diligence in final stages.

Read more

Schneider Electric Opens Liquid Cooling Factory in Bengaluru

Schneider Electric launches its first Motivair liquid cooling plant in India, strengthening local manufacturing for AI-ready, high-density data centres and boosting export capabilities.

Read moreRelated Products

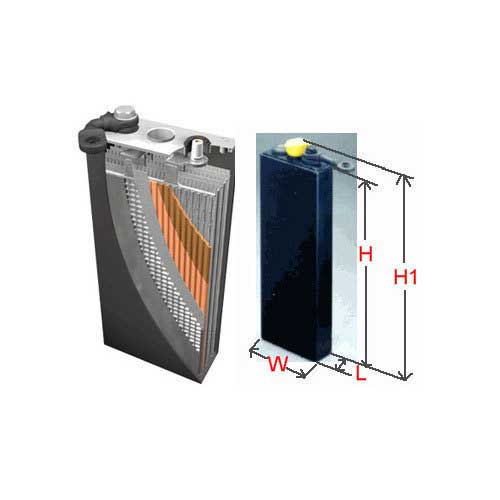

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Kusam Meco -Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more