Schedule a Call Back

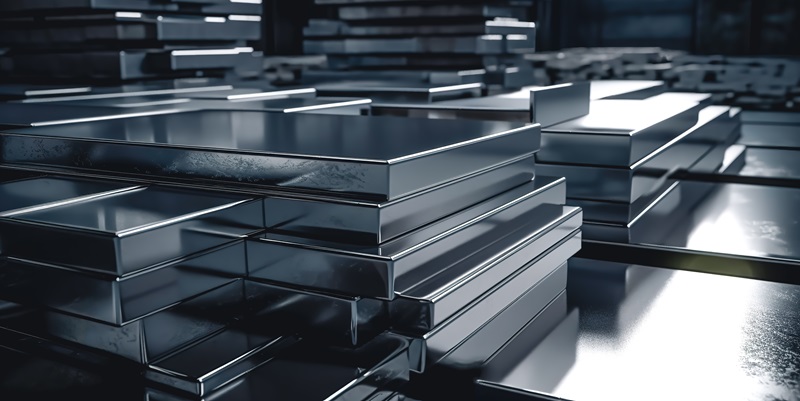

Rising costs and weak demand may force steel companies to cut output

Industry News

Industry News- Sep 06,24

Related Stories

Jindal Stainless Signs PLI 1.2 MoU for Speciality Steel Expansion

Jindal Stainless signs MoU under PLI 1.2 to expand speciality steel capacity, supporting Rs 118.87 billion investments and 8.7 million tonnes addition by FY 2031.

Read more

Resilience in Metal: Forging the Make in India Future in a VUCA World

The article examines how India’s stainless steel sector can turn global volatility, CBAM and supply risks into strategic advantages through sustainability, quality enforcement and digital transfor..

Read more

Steel Sector Holds the Key to India’s Manufacturing Resilience

India’s steel sector is emerging as a strategic pillar in strengthening manufacturing resilience amid global volatility, supporting infrastructure growth, self-reliance, and long-term industrial c..

Read moreRelated Products

Heavy Industrial Ovens

Hansa Enterprises offers a wide range of heavy industrial ovens.

High Quality Industrial Ovens

Hansa Enterprises offers a wide range of high quality industrial ovens. Read more

Hydro Extractor

Guruson International offers a wide range of cone hydro extractor. Read more