Schedule a Call Back

Niti Aayog member Virmani encourages Chinese investment to push local production

Industry News

Industry News- Aug 05,24

Related Stories

Covasant Launches Agent Management Suite for Scalable Enterprise Agentic AI

Covasant has launched CAMS, an end-to-end AgentOps platform enabling enterprises to govern, scale and secure autonomous AI agents across hybrid and multi-cloud environments.

Read more

Fujiyama to Commission 1 GW Solar Cell Manufacturing Plant at Dadri

Fujiyama Power Systems has announced the commissioning of a 1 GW solar cell plant at Dadri, Uttar Pradesh, strengthening its integrated manufacturing capabilities and reducing reliance on imports.

Read more

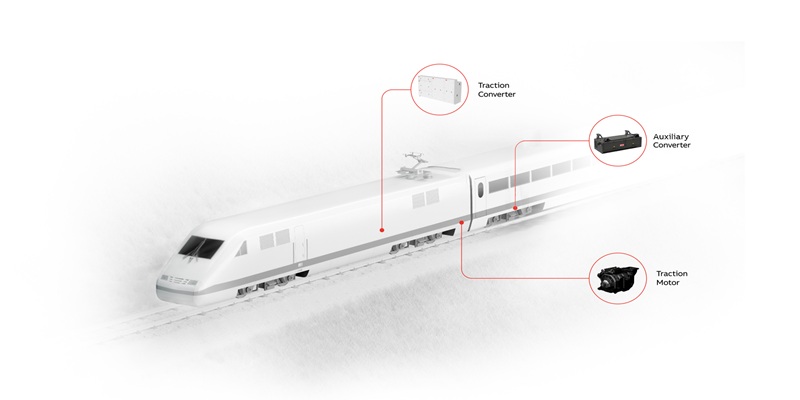

ABB Wins Mumbai Metro Lines Propulsion and TCMS Order

ABB has secured a major order from Titagarh Rail Systems to supply propulsion systems and TCMS software for Mumbai Metro Lines 5 and 6, strengthening its role in India’s metro expansion.

Read more