Schedule a Call Back

New trends in cobots: large payloads, micro payloads, and mobility

Industry News

Industry News- Jun 29,22

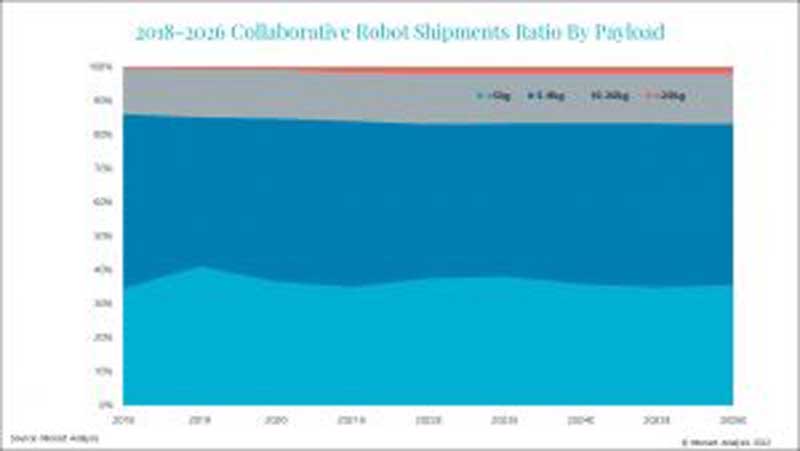

Payload: bigger and smaller cobots taking an increasing market share

In 2021, light duty cobots (with payloads of <10 kg), accounted for 83% of total shipments. Larger payload cobots (with payloads of >10 kg) accounted for 17%. This market share will grow slowly over time, particularly in the 10-12 kg range as they penetrate new scenarios where heavy lifting is involved such as the semiconductor industry, automotive and logistics. Mainstream cobot manufacturers such as UR, Techman and AUBO are leading vendors of models with these larger payloads. Additionally, because heavier cobots are more expensive, the market share increase in terms of revenue will show a more impressive increase, from 20% in 2021 to 25% by 2026.

At the other end of the spectrum, very small collaborative robots are also gaining traction in the markets. Desktop collaborative robot arms with payloads of around 500g are seeing greater use in precision operations in industries such as electronics. Kawasaki, ABB and DOBOT are big players here.

Mobile cobots gaining market acceptance

The mobile collaborative robot, such as those produced by FANUC, where the collaborative arm is mounted on a mobile chassis, has to date seen fairly limited deployment across the industrial sector, though mobile solutions have already seen strong penetration in some markets. The main barriers have been technological – how to achieve integrated functionality across key parts of the robot – the chassis, the sensors, the robot arm, and the end-effectors. These challenges have had an impact on pricing. But technology has advanced, and we are seeing greater market acceptance of these machines.

The semiconductor industry – a sector which is a major investor in automated equipment – accounted large portion of mobile cobot deployments in 2021, the technology being applied in such scenarios wafer manufacturing and packaging, as well as loading, unloading, and material handling. The second largest end-user of mobile cobots is the new energy sector, where applications include power inspection, data center inspection and the screen-printing process in the photovoltaic industry. Meanwhile, the third largest market is consumer electronics.

We see huge potential in the application of mobile cobots on manufacturing production lines, because they bring the flexibility that modern manufacturing increasingly demands. However, mobile cobots can also be quickly deployed in non-manufacturing scenarios such as warehouses and automated supermarkets. Other niche applications being researched or piloted are education, medicine, file management and pharmacy management.

We anticipate that mobile cobots will make up more than 10% of the total cobot market by 2025, and that there will be over 11,000 units shipped in 2026. Whilst the technology will only take a minority share of the market, it will have a much higher year-on-year growth rate than its static counterpart.

Chassis and arm: mobile robot companies dominate integrated production of mobile cobot solutions

In the initial stages of mobile collaborative robot production, machines were developed mainly by enterprises that had mobile chassis and cobot production capabilities, such as Omron and Siasun. Systems integrators also played an important role, purchasing mobile chassis and collaborative robot arms for customized assembly. A recent trend has been for mobile robot companies and collaborative robot vendors to cooperate in the development and production of mobile collaborative solutions. At present, mobile robot manufacturers dominate the market with a near 70% share, with collaborative robot manufacturers also developing their own customized mobile solutions and taking a 10% slice of the market. Customer project focused integrators occupy the remainder, basing their offerings on their ability to tailor their solution to the needs of bespoke projects that they are already managing.

About the author:

Maya has an interdisciplinary technical background in vehicle electrification, system automation and robotics. Based in China, she is the lead analyst for Interact Analysis’ Li-ion battery and forklift research, also covering markets for industrial and collaborative robots.

Email: maya.xiao@interactanalysis.com

Related Stories

The human-machine symbiosis: Why Industry 5.0 is the future of manufacturing

Industry 5.0 marks a shift from pure automation to human-machine collaboration. Dijam Panigrahi, Co-founder and COO, GridRaster Inc, explains how technologies like robot rentals, cobots, AR/VR, and ..

Read more

Driving Efficiency: Schmalz Gripping Systems for India's Manufacturing Future

As the market demands speed, agility, and reliability, Schmalz gripping systems are enabling the next generation automation of Indian manufacturing sector.

Read more

Global industrial robot shipments down in 2024, recovery likely in 2025

As investment cycles pick up and demand stabilises across key industries, 2025 could mark the beginning of a new growth phase, albeit one characterised by tighter margins and more nuanced competitio..

Read moreRelated Products

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.

Robotic Welding SPM

Primo Automation Systems Pvt. Ltd. manufactures, supplies and exports robotic welding SPM.

Heat Exchanger Scale Removal Compound -hesr-300

Hi There!

Now get regular updates from IPF Magazine on WhatsApp!

Click on link below, message us with a simple hi, and SAVE our number

You will have subscribed to our Industrial News on Whatsapp! Enjoy