Schedule a Call Back

New tech to mould the future of tooling

Articles

Articles- Mar 29,23

Tooling is the process of producing or acquiring the manufacturing components required for bulk production of parts used in bigger machines such as automobiles, trucks, heavy engineering components, and others. Tooling - which helps machines function properly, repeat results and reduce man-hours - delivers finished products within a specific tolerance that cannot be broken and degraded easily. In addition, it allows manufacturers to provide high-quality and customised products while keeping production costs low.

Tooling includes production of molds and dies (presses), forging, gauging, jigs & fixtures, and cutting tools for the manufacturing of different components such as automotive parts, turbines, propellers, plastic components, and others. According to IMARC Group, the global tooling market, valued at $ 235.8 billion in 2022, is expected to reach $ 361.8 billion by 2028, exhibiting a growth rate (CAGR) of 6.9 per cent during 2023-2028.

Indian market

Currently, the market size of Indian tooling industry is close to Rs 180 billion with 70 per cent of its demands being met domestically and 30 per cent from imports, according to a report by NRI Consulting and TAGMA (Tool & Gauge Manufacturers Association of India). While captive tooling supply has not changed much in the last few years, imports have captured a larger portion of incremental demand than commercial tool rooms.

Auto manufacturers in India still rely on imports to meet their demands for tools & auto parts. “In terms of types of moulds, plastic moulds are the biggest segment accounting for 42 per cent of total demand, followed by sheet metal dies at 37 per cent. More than half of the total demand is attributed to the automotive and auto components sector. Most global auto manufacturing hubs have a strong domestic tooling industry with India being a notable exception, where a significant portion of tool demand is still met via imports,” says Devaraya M Sheregar, President, TAGMA India & Managing Director, Devu Tools Pvt Ltd.

The tooling industry faces challenges of finding skilled workforce, keeping pace with the evolving technology, having access to finance, and an inverted duty structure. Fluctuating raw materials prices also hamper the demand for dies and molds to manufacture the detailed parts in the high-end manufacturing industries such as aerospace and automotive. To deal with this, the Indian tooling industry requires support from the government like low-interest financing, establishment of R&D centres, and the creation of tooling clusters/ SEZs. Government has already taken some measures in this direction.

"With increased mobility, demand for public and private transportation is projected to strengthen. Future market development is expected to be fuelled by new trends such as vehicle electrification, particularly for three-wheelers and small passenger automobiles. The government is encouraging indigenous tooling technologies through several initiatives such as the 'Make in India' program and is providing incentives to domestic tool manufacturers in the form of lower taxes and easier access to finance. These measures will contribute to the development of a thriving and competitive local manufacturing sector for cutting-edge and environment friendly technologies on a worldwide scale. Additionally, the advantages will spread across the entire supply chain," says Pankaj Abhyankar, Senior Vice President and Business Head, Godrej Tooling (a business vertical of Godrej & Boyce Mfg Co Ltd). Godrej Tooling is one of the top suppliers of high-precision tooling and components to the defence, railway and automotive and other industries.

Thanks to the government’s and industry’s efforts, there has been a noticable change in the perception of OEMs of Indian tool rooms in the last few years, as they are willing to collaborate with Indian tool manufacturers more than before.

Tooling trends

The designing and manufacturing of tools directly affects the production quality of the end-user industry. Moreover, every manufacturing company requires tooling to conduct the production process of parts manufactured for assembling the machine; therefore, the tooling industry is termed as the backbone of the manufacturing industry.

At present, there is a rise in the adoption of tooling in the manufacturing industry to produce parts of numerous machines. This, along with a considerable reliance on electrical devices for carrying out everyday tasks easily and conveniently, represents one of the key factors driving the market. Moreover, there is an increase in the customisation of moulds and dies that are used in automotive industry. "The tooling market is directly affected by fluctuations and developments occurring in the end-user industries. For instance, increase in consumption of consumer electrical and electronic (E&E) devices drive the growth of the tooling market to sustain high production demand for the E&E device manufacturers. Furthermore, rise in focus on product customisations fuels the requirement of new molds and dies, which are specifically designed for the manufacturing of products such as automotive engines, fuel tanks, turbines, propellers, shafts, and others; thereby, driving the global tooling market growth," according to Allied Market Research (AMR).

The escalating demand for light commercial vehicles (LCVs) around the world on account of the inflating global oil prices is positively influencing the market. Furthermore, key market players are focusing on different varieties of tool production in the automotive industry. They are also focusing on expanding their product portfolio to offer more economical products. The burgeoning plastic industry and new developments in biodegradable polymer material are offering a positive outlook to industry investors.

Railways: Putting industry on the right track

In the budget 2023-24, Indian Railways received its highest-ever allocation of Rs 2.4 trillion for 2023-24 - Rs 1 trillion higher than the previous year. The Railways has kept a capital spend target of Rs 2.6 trillion for FY24. According to the Railways Ministry, the department will opt for aggressive expansion plans by increasing the pace of construction (to built new lines and double existing tracks). At the same time, it plans to roll out two to three Vande Bharat trainsets, produced simultaneously in four factories, from the railway stables every week in 2023-24. While currently Vande Bharat is manufactured only in ICF, Chennai, the Ministry intends to expand the production to factories in Sonepat (Haryana), Latur (Maharashtra) and Raebareli (Uttar Pradesh).

Investment in railway expansion will present more opportunities for toolmakers. For example, Godrej Tooling recently signed an MoU with Renmakch for developing workshop equipment and introduce the latest technology for the rail industry from Europe and other developed countries and indigenise it for India. The association will contribute to the 'Make in India' and 'Atmanirbhar Bharat' initiatives by developing depot equipment, which is an import substitute. Godrej Tooling supplies jigs & fixtures, automation solutions, and workshop equipment for Railway workshops & Metro depots. According to Pankaj Abhyankar of Godrej Tooling, the collaboration will contribute to improving the speed, quality, and safety of railway and metro coaches during maintenance. The company expects to acquire a 20-30 per cent market share in this sector over the next 5 years.

Auto top driver; but, E&E to propel demand in future

Within the tooling market, the dies & moulds segment is anticipated to dominate the market in the coming years, owing to its growing adoption in manufacturing of various automotive parts such as engines, clutch housings, gear box housings, cylinder barrels, steering components, and many others.

The automotive segment of the market accounted for over half of the global tooling market share in 2020, owing to increase in production of light vehicles followed by growing focus of manufacturers to increase different varieties of tool production in automotive industry. In India, the automotive industry consumes over 60 per cent of the tool production. With the auto industry showing a strong come back in 2022, it is aiding the growth in production of tools. “Trends such as lightweight, electric vehicle (EV), localisation, electrification of automotive, and safety & security norms are some of the trends in the automotive industry which are driving the demand for toolmakers. We expect these trends to continue in the coming years,” comments Devaraya Sheregar.

With the emergence of many sectors in India, tooling companies are diversifying into other sectors as well to mitigate the risk and expand the business.

The E&E industry is expected to be the fastest growing segment by 2030, owing to increased consumption of electronics in normal household activities. Production Linked Incentive Scheme (PLI) for large scale electronics manufacturing (LSEM) was notified by the Government on April 1, 2020 with an aim to bring an additional investment in electronics manufacturing to the tune of Rs 11,000 crore. As of September 2022, the PLI scheme for LSEM has attracted investment of Rs 4,784 crore, and led to a total production of Rs 203,952 crore, including exports of Rs 80,769 crore. With electronics manufacturing capability expected to increase to Rs 24 lakh crore by 2025-26, the electrical and electronics segments have been projected to drive the most demand for the tooling sector with 21 per cent and 14 per cent respectively in the coming five years.

Besides auto and E&E industries, the increasing demand for renewable energy systems, such as wind power energy generation, solar energy generation, and hydro-electricity plants, is also impelling the market growth. Moreover, growth of the renewable energy systems require sophisticated and properly designed die molds, measuring devices, and machine tools to produce the parts and machines. Thus, growth in renewable sources industry is expected to drive the growth of the tooling market.

Some other emerging industries that are expected to create demand for tools in India include plastic, consumer durables, medical, white goods, and defence.

Technologies to mould the future

With many Indian firms today serving global customers who demand high precision and fast turnaround, Indian toolmakers will have to adopt the latest technologies to meet those requirements. The growing market of electric vehicles (EVs) presents big opportunity for the toolmakers. Further, the rising automation and growing popularity of artificial intelligence (AI) technology are augmenting the adoption of tooling worldwide. Additive manufacturing and 3D Printing are increasing cost-efficiency and reducing product development time for companies while ensuring increased product customisation and minimal wastage. "We have recently expanded our capabilities into 3D printing and additive manufacturing to develop high-precision dies for components with complex geometry to meet higher functional standards in EVs. With the help of newer technologies like AI, Machine Intelligence (MI), and additive manufacturing, we are hoping to cover all bases in simulation, production, and design assembly of components for electric mobility," says Pankaj Abhyankar of Godrej Tooling.

Indian tooling industry is estimated to grow up to Rs 260 billion (from Rs 180 billion in 2020) in value by 2025 (on back of strong growth in key end-user segments) but government support and intervention is required on many forefronts to augment tooling ecosystem in India.

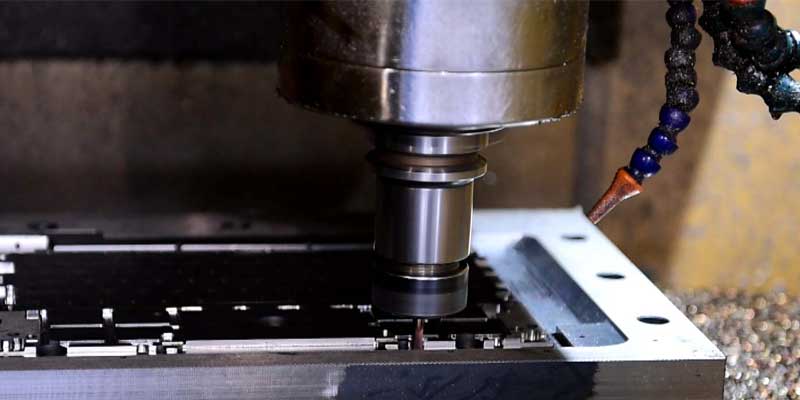

Several key die and mould components require multiple settings during machining which is why toolmakers are now investing in 5-axis CNC machines. AI in machine tools is going to lead the future for accurate metal cutting as minimal carbon and sulphur emissions become the need of the hour. Another trend is noticed in the implementation of CAD/CAM for SMEs as the segment expects lower machine tool costs.

Laser tools are promising and advanced machine tools carry huge potential. The fibre laser technology is extensively being developed and used in metal forming and cutting ensuring maximum accuracy and productivity. Also, the use of technology and IT has evolved businesses and machines to use data in real-time and developed the concept of Industry 4.0 which relies on technological advancements to shape the future.

“With the increase in a variety of products and shortening product life cycles across the globe, worldwide demand for tooling is well poised to grow significantly in future. Countries with superior capabilities and capacities in tooling will be at an advantage. Hence, it becomes even more important to facilitate the growth of Indian tool makers and enable access to new customers beyond national borders,” states Devaraya Sheregar.

References:

Promising growth drivers for Indian tool room industry

End-user industries | Expected growth rate |

Automotive | 8% |

Consumer durables | 9% |

Plastics | 12% |

Electronics | 14% |

Electrical | 21% |

Related Stories

Aimtron Electronics Enters OEM Engagement with Climate-Tech Firm Aurassure

Aimtron Electronics has partnered with climate-tech company Aurassure to manufacture IoT-enabled environmental monitoring systems supporting real-time, hyperlocal climate and air-quality intelligenc..

Read more

India’s Manufacturing Mission: What Make in India Got Right and Wrong

A decade after its launch, Make in India shows sectoral progress but structural gaps remain. As global manufacturing turns VUCA, the next phase must focus on value addition, jobs and ecosystems, say..

Read more

Why Cleantech-driven Recycling is the key for India to Lead Global Manufacturing

Cleantech-driven recycling can cut import dependence, strengthen supply chains, create jobs, and position India as a global leader in sustainable and circular manufacturing, comments Akhilesh Bagari..

Read moreRelated Products

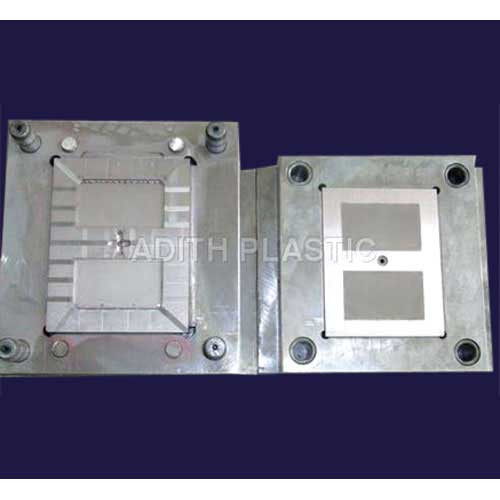

Industrial Moulds

Adith Plastic offers moulds for industrial electronic parts.

Industrial Plastic Moulding Dies

Adith Plastic offers a wide range of industrial plastic moulding dies.

Component Moulds

Innovative Moulds & Dies offers a wide range of plastic component moulds. Read more