Schedule a Call Back

MUDRA Yojana helps generate 1.12 cr additional employment between 2015 to 2018

Industry News

Industry News- Apr 07,21

Ministry of Finance is committed to provide financial inclusiveness and support to the marginalized and hitherto socio-economically neglected classes. Financial needs of all stakeholders ranging from the budding entrepreneurs to the hard-working farmers has also been catered to through various initiatives. A key initiative towards this is Pradhan Mantri MUDRA Yojana (PMMY), which has given wings to the dreams and aspirations of millions, along with a feeling of self-worth and independence.

PMMY was launched by the Prime Minister on April 8, 2015 for providing loans upto Rs10 Lakh to the non-corporate, non-farm small/micro enterprises. As we are celebrating the sixth anniversary of PMMY, we take look at the major aspects of this scheme and its achievements so far.

India is a young country brimming with youthful enthusiasm and aspirations. In order to provide a fertile ground for sowing the seeds of India’s development it is very important to harness this innovative zeal of young India which can provide new age solutions to existing gaps in the economic ecosystem of the country. Understanding the need to harness the latent potential of entrepreneurship in India, the NDA Government in the very first budget launched the Pradhan Mantri MUDRA Yojana.

Under PMMY collateral free loans of upto Rs 10 Lakh are extended by Member Lending Institutions (MLIs) viz Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Non Banking Financial Companies (NBFCs), Micro Finance Institutions (MFIs) etc.

The loans are given for income generating activities in manufacturing, trading and services sectors and for activities allied to agriculture.

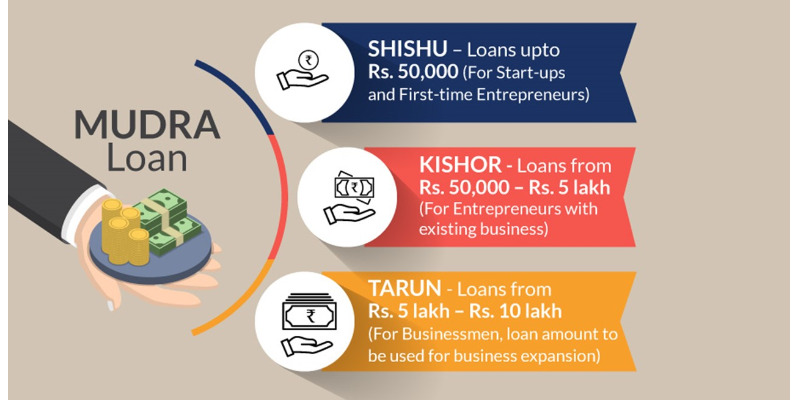

Mudra loans are offered in three categories namely, Shishu, Kishore and Tarun which signifies the stage of growth or development and funding needs of the borrowers:-

- Shishu: Coves loans upto Rs 50,000/-

- Kishore: Covers loans above Rs 50,000/- and upto Rs 5 lakh

- Tarun: Covers loans above Rs 5 lakh and upto Rs 10 lakh

With an objective to promote entrepreneurship among the new generation aspiring youth, it is ensured that more focus is given to Shishu Category loans and then Kishore and Tarun categories.

Achievements of this Scheme as on March 19

More than 28.68 cr loans for an amount of Rs 14.96 lakh crore have been sanctioned since launch of the scheme as on March 19.

- Rs 4.20 cr PMMY loans sanctioned in 2020-21 and Rs 2.66 lakh cr sanctioned in FY 2020-21 as on March 19.

- The average ticket size of the loans is about Rs 52,000.

- 88 per cent of the loans are of Shishu category.

- Almost 24 per cent of the loans have been given to new entrepreneurs.

- About 68 per cent of the loans have been given to women entrepreneurs

- About 51 per cent of the loans loan have been given to SC/ST/OBC borrowers.

- SCs and STs constitute 22.53 per cent of the borrowers.

- OBCs constitute 28.42 per cent of the borrowers.

- About 11 per cent of the loans have been given to Minority community borrowers.

- As per a survey conducted by Ministry of Labour and Employment, PMMY helped in generation of 1.12 cr net additional employment from 2015 to 2018. Out of the 1.12 crore of estimated increase in employment, Women accounted for Rs 69 lakh (62 per cent).

Related Stories

Will revised MSME classification solve their funding puzzle?

Only 14 per cent of credit needs of Micro, Small and Medium Enterprises (MSMEs) - the backbone of India's economy - are met through formal channels. The revised MSME classification may mark a pivota..

Read more

Will the US tariff war add to MSMEs’ funding woes?

While Micro, Small and Medium Enterprises (MSMEs) continue to face barriers in accessing funds (due to high collateral norms, lack of credit history, slow approvals, etc), the new tariff war could a..

Read more

MSMEs in 2024: Key policy announcements that shaped the sector

Companies with turnover above Rs 2.5 billion and all central public sector enterprises (CPSEs) were required to join the TReDS platform by March 2025 to enhance payment cycles.

Read moreRelated Products

Gantry Goliath Cranes

Eddycranes Engineers (P) Ltd offers a wide range of gantry goliath cranes.

Surge Protection With an Overall Width of 3.5 Mm

Phoenix Contact India Pvt Ltd offers a wide range of surge protection with an overall width of 3.5 MM.

Wheel Aligners, Computerised

Samvit Garage Equipments offers a wide range of wheel aligners, computerised.