Schedule a Call Back

Mobile hydraulics market reaches $18.7bn in 2021

Industry News

Industry News- Jun 07,22

London

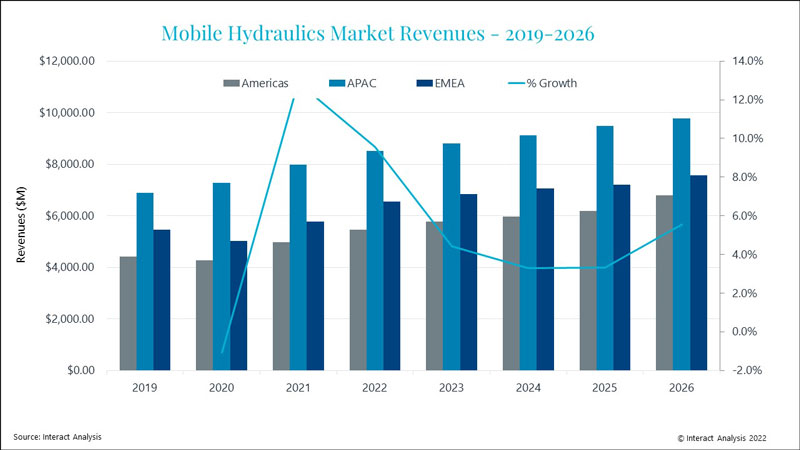

Updated research from Interact Analysis shows that despite a slight contraction in 2020, the mobile hydraulics market did well in 2021, hitting $18.7bn in terms of revenues. In total, between 2019 and 2021, the market grew with a CAGR of 5.2%. Mostly, this strong growth was due to a boom in the material handling market and increased demand for construction equipment. It is expected that new hydraulic technologies such as digital and electro hydraulics will improve hydraulic efficiency, an important consideration in the wider context of vehicle electrification.

The COVID-19 pandemic shook the mobile hydraulics market in EMEA and the Americas. In 2020, these regional markets contracted by -9.7% and -3.2% respectively. EMEA’s share in the agricultural machinery production market (a dominant user of hydraulic equipment) has since eroded. However, a boom in the material handling sector in the region will boost the hydraulics market significantly. Both EMEA and the Americas rebounded in 2021, and this is expected to continue into 2022 as order backlogs are met. APAC showed impressive growth throughout the past two decades and accounted for 50% of the market in 2020. Despite this, growth in Asia will stabilize as the regional market matures. Whilst 2022 remains positive for the APAC regions, growth is likely to decelerate as a result of a slowdown in the construction sector. Towards the end of the forecast period, the research shows that growth in the Americas will pick up exponentially because of the major infrastructure overhaul scheduled for 2026.

The material handling market is expected to show strong growth out to 2026. In 2020, the sector accounted for 25% of the market; this will increase to 28.8% by the end of the forecast period. At a CAGR of 8%, material handling will outpace growth of the overall market which will show a CAGR of 5.3%. Ongoing supply chain issues have caused knock-on effects for mobile hydraulics. For example, the average selling price of hydraulics increased between 2020 and 2022 after a period of erosion. This is due to volatility in material prices, such as aluminium, which is now forcing the average selling price of hydraulic components up, which out to 2026 will increase between 1.6% and 2.1% annually.

Brianna Jackson, Research Analyst at Interact Analysis comments, “One thing

that came as a surprise when conducting this research was that vehicle

electrification is not driving the increased demand for hydraulic substitutes

at the rate we expected. Many OEMs are still prioritizing cost over efficiency.

Even in applications where replacing hydraulics with an electro-mechanical

counterpart seems most feasible, uptake has been slow as vehicle OEMs is reluctant

to make changes to vehicle architectures. Improvements to hydraulic

architecture are being overlooked by vehicle OEMs, yet, without these

improvements, full electrification for off-highway vehicles will be virtually

impossible. Despite this, by the end of the forecast period we expect that the

average selling price of hydraulic components will increase slightly as a

result of an increase in demand, when OEMs finally begin to attach more

importance to efficiency.”

Related Stories

Addverb and Mondial Relay to revolutionise global logistics through automation

Designed to handle Mondial Relay's high volume of parcels for its delivery operations, these advanced robots streamline the sorting process.

Read more

Female Apprenticeship surges 20X, driving diversity in manufacturing & services

This surge in female apprenticeship enrollment not only reflects the growing momentum towards gender equality but also signifies a paradigm shift in the roles women are undertaking

Read more

Indian medical device makers seek extension for Class C, D device licensing

The Association of Indian Medical Device Industry (AiMED), representing domestic medical device makers, sent a letter dated September 25 to Health Minister Mansukh Mandaviya, outlining their concern..

Read moreRelated Products

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more