Schedule a Call Back

Lithium-ion battery charging the future green

Industry News

Industry News- Jul 29,24

Related Stories

Government boosts logistics digitally: Arvind Devaraj

The use of technologies in logistics cannot be only the burden on the shoulders of government. For something to be created there should exist an environment consisting of private businesses, emergin..

Read more

Exide Industries in battery talks with EV makers

Hyundai is set to become the first Indian automaker to use locally manufactured battery cells for electric vehicles through its agreement with Exide’s subsidiary, Exide Energy Solutions, signed in..

Read more

Foxconn to develop EVs for Mitsubishi

The vehicle will be developed by Foxtron, manufactured in Taiwan by Yulon Motor Co, and launched in the Oceania region (Australia and New Zealand) in the second half of 2026.

Read moreRelated Products

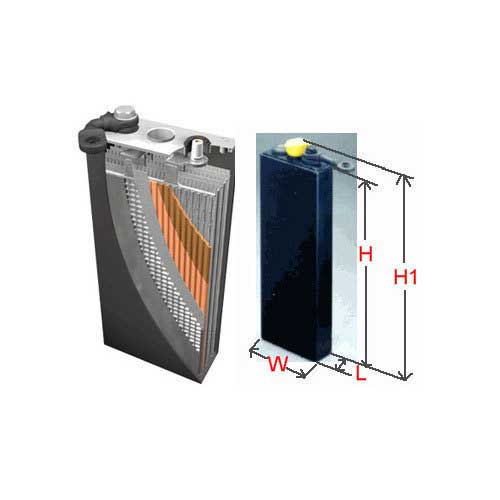

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Kusam Meco -Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more