Schedule a Call Back

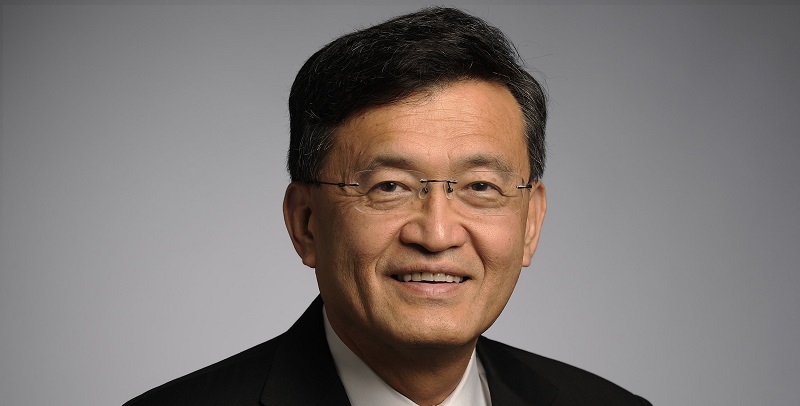

Lip-Bu Tan to be advisor for Yali Capital; India’s first deep-tech venture fund

Industry News

Industry News- Jul 16,24

Related Stories

Texas Instruments Opens New Semiconductor R&D Centre in Bengaluru

Texas Instruments has inaugurated a 550,000-sq-ft R&D centre in Bengaluru, marking 40 years in India and reinforcing its commitment to semiconductor design and innovation.

Read more

Concord Control Systems Wins Rs 1.85 bn KAVACH 4.0 Rail Safety Order

Concord Control Systems has secured a Rs 1.85 billion order for KAVACH 4.0, India’s indigenous ATP system, to be executed over 12 months, reinforcing its role in railway safety modernisation.

Read more

Sagar Defence Invests in EndureAir to Advance Indigenous Aerial Robotics

Sagar Defence Engineering has announced a strategic investment in EndureAir Systems to strengthen indigenous unmanned and autonomous aerial robotics capabilities for India’s defence ecosystem.

Read moreRelated Products

Integrated Electric Gripper S Series

IBK Engineers Pvt Ltd offers a wide range of integrated electric gripper S series.

Geared Electric Motors

Delco Fans Pvt Ltd offers single phase capacitor run and three

phase geared Instrument motors, totally enclosed face/foot mounted.

“Kusam-Keco” Partial Discharge Acoustic Imager - Model - Km-pdai

‘Kusam-Meco’ has introduced a new “Partial Discharge Acoustic Imager Model KM-PDAI.