Schedule a Call Back

KEC Reports 19% Revenue Rise and 88% PAT Growth in Q2 FY26

Articles

Articles- Nov 14,25

KEC

International Ltd, a global infrastructure EPC major and part of the RPG Group,

has reported strong financial results for the quarter and half year ended 30

September 2025 (Q2 and H1 FY26), with significant growth in revenue and

profitability.

The

company’s consolidated revenue stood at at Rs 60.92 billion for Q2 FY26, a 19

per cent rise from Rs 51.13 billion in the same period last year. Profit after

tax (PAT) surged 88 per cent year-on-year to Rs 1.61 billion. For H1 FY26,

revenue increased 15 per cent to Rs 111.14 billion, while PAT rose 65 per cent

to Rs 2.85 billion.

EBITDA grew

to Rs 4.3 billion in Q2 FY26, with margins improving to 7.1 per cent from 6.3

per cent last year. The profit before tax (PBT) climbed 88 per cent to Rs 2.13 billion,

reflecting enhanced operational efficiency and cost control.

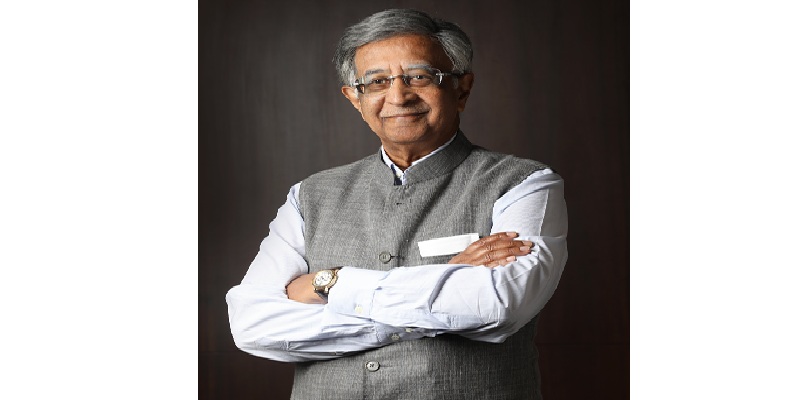

Vimal

Kejriwal, MD & CEO, KEC International Ltd said, “We have delivered another

quarter of strong performance, marked by robust revenue growth, significant improvement

in profitability and healthy order intake. Our EBITDA margins have continued

their upward trajectory, expanding by 80 bps to 7.1 per cent in Q2 FY26,

compared to 6.3 per cent in the same quarter last year. The bottom line has

also seen exceptional growth, with PBT and PAT rising by 88 per cent YoY. The

order book has been substantially strengthened with multiple strategic wins,

taking the combined order book and L1 position to a record level of over Rs 440

billion. With a strong focus on execution, robust order book and a substantial

tender pipeline, we are well positioned to drive sustained and profitable

growth in the coming quarters.”

KEC also

reported a 20 per cent year-on-year growth in order intake, with total orders worth

Rs 160.5 billion booked so far this financial year. The company’s combined

order book and L1 position has reached an all-time high of over Rs 440 billion.

Image Source: https://tse1.mm.bing.net/th/id/OIP.fcAdYdA1CcOGpcyT7kHaQAHaE8?cb=ucfimg2ucfimg=1&rs=1&pid=ImgDetMain&o=7&rm=3

Related Stories

MIC Electronics Secures Rs 44.5 million Eastern Railway Orders

MIC Electronics Limited has received Rs 44.5 million LoAs from Eastern Railway, Howrah Division, for advanced Passenger Information and Communication Systems projects.

Read more

Bharat Forge Reports Strong Sequential Growth in Q3 FY26

Bharat Forge Limited posted 7.0 per cent sequential revenue growth in Q3 FY26, supported by strong domestic automotive performance and defence order execution.

Read more

India is at a pivotal ‘Make in India’ inflection point: Manoj Patil

In this interview, Manoj Patil, Promoter and Managing Director, Patil Automation Limited, outlines its growth journey, capacity expansion, acquisitions, design-led approach, market challenges, and t..

Read moreRelated Products

Integrated Electric Gripper S Series

IBK Engineers Pvt Ltd offers a wide range of integrated electric gripper S series.

Geared Electric Motors

Delco Fans Pvt Ltd offers single phase capacitor run and three

phase geared Instrument motors, totally enclosed face/foot mounted.

“Kusam-Keco” Partial Discharge Acoustic Imager - Model - Km-pdai

‘Kusam-Meco’ has introduced a new “Partial Discharge Acoustic Imager Model KM-PDAI.