Schedule a Call Back

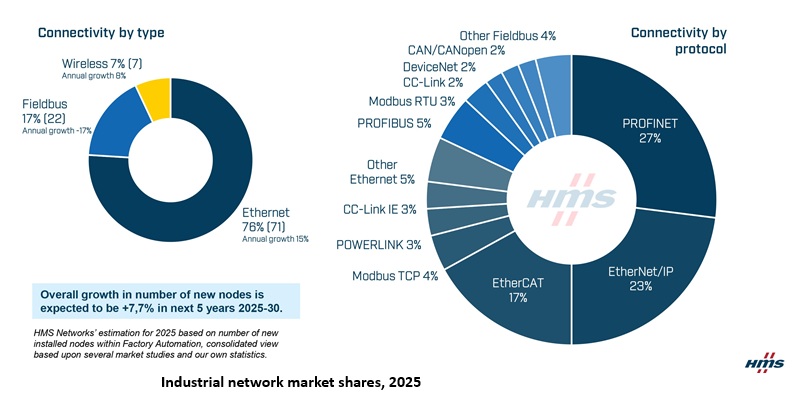

Industrial Ethernet now powers 76% of factory automation nodes: HMS Networks

Industry News

Industry News- Jun 04,25

- PROFINET leads at 27%, rising from 23 per cent last year

- EtherNet/IP holds 23 per cent

- EtherCAT strengthens to 17 per cent

- Modbus TCP remains at 4 per cent

- Other Ethernet standards, such as POWERLINK and CC-Link IE, maintain niche yet stable positions

- PROFIBUS leads but drops to 5 per cent

- DeviceNet, CC-Link, and Modbus RTU each see a 1-point decline

- CAN/CANopen holds at 2 per cent

- Other legacy protocols collectively account for 4 per cent

- Europe: Strong growth in PROFINET and EtherCAT, with rising interest in APL (Advanced Physical Layer) and Single Pair Ethernet (SPE) for enhanced process automation.

- North America: EtherNet/IP leads. Adoption of IO-Link, APL, and SPE is gaining pace as smart device integration intensifies.

- Asia: Both PROFINET and EtherCAT are expanding in China, while CC-Link IE maintains a strong foothold, being the first to adopt TSN (Time Sensitive Networking).

Related Stories

AI on the edge will transform the shop floor: Sameer Gandhi

In this interview with Rakesh Rao, Sameer Gandhi, MD, OMRON Automation Pvt Ltd, elaborates on trends and opportunities as the manufacturing sector opts for data-led decision-making, quality and safe..

Read more

Automation is accelerating structural shift in Indian manufacturing: Atul Patil

In this interview, Atul Patil, GM – Marketing, FA Systems, Mitsubishi Electric India, explains how are automation technologies—robots, cobots and digitalisation—reshaping Indian manufacturing...

Read more

Can AI be the game changer for Indian manufacturers?

While manpower issues and quality are driving adoption of industrial automation, cost and lack of knowledge are causing hindrances. Artificial intelligence (AI) can be the game changer, writes Rakes..

Read moreRelated Products

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.

Robotic Welding SPM

Primo Automation Systems Pvt. Ltd. manufactures, supplies and exports robotic welding SPM.