Schedule a Call Back

Indian industries concern over EU Carbon tax data demands

Industry News

Industry News- Sep 08,23

Related Stories

India–EU FTA: Gains on Paper, Tests on the Ground

The India–EU Free Trade Agreement expands market access across goods, services and mobility, but its impact will hinge on regulatory alignment, carbon costs and execution, writes Rakesh Rao.

Read more

India–EU FTA sealed, offers preferential EU access to over 99% of Indian exports

The agreement is expected to be particularly transformative for labour-intensive sectors and MSMEs, with positive spillovers for employment generation among women, artisans, youth and professionals.

Read more

Winners Amid Slowdown

India’s manufacturing sector closed September on a slower, yet resilient note. The HSBC Flash India Composite Output Index eased to 61.9 from 63.2 in August—still the second-best in more than tw..

Read moreRelated Products

SLMG beverages launches 100% recycled PET Coca-Cola bottles

SLMG Beverages, a prominent company under the Ladhani Group and a franchise bottler for Coca-Cola in India, unveiled a significant initiative by introducing 100% recycled PET bottles for the renowned Read more

Mineral Water Plant

Richa Environmental Services Pvt Ltd offers a wide range of Mineral Water Plant.

Read more

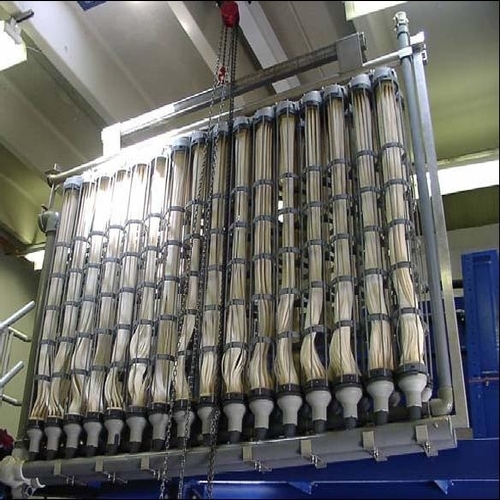

Membrane Bioreactor MBR

They offer high quality Membrane Bioreactor used for industries for their sewage treatment plants , effluent treatment plants.The MBR process involves a suspended growth activated sludge system tha Read more