Schedule a Call Back

Indian auto industry is coming of age

Articles

Articles- Feb 12,24

Related Stories

India is among EPLAN’s fastest-growing markets: Haluk Menderes

In this interview with Rakesh Rao, Haluk Menderes, MD, EPLAN GmbH & Co KG, discusses the global engineering trends, how Indian companies can be ready for the next level of engineering automation, an..

Read more

Suzuki, Maruti to establish Osamu Suzuki Centre of Excellence in India

The centre aims to uphold Suzuki’s legacy of promoting efficiency, fairness, and inclusivity in manufacturing.

Read more

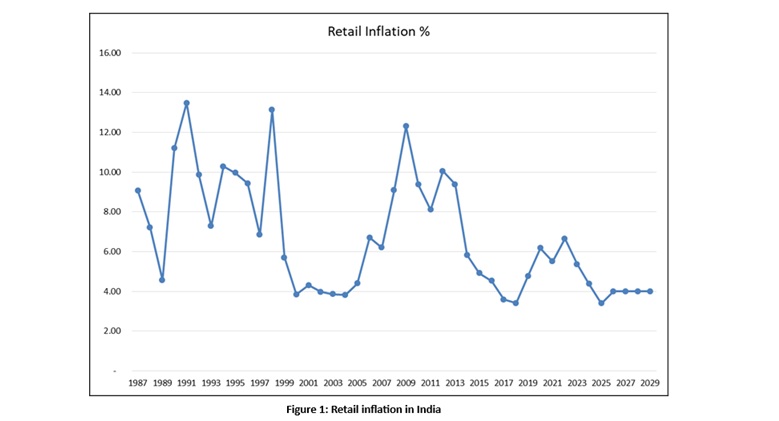

The close link between infrastructure development and inflation in India

The improvements in the infrastructure sector due to higher capital spends by the Government of India (GoI) have helped in controlling the inflation, says R Jayaraman.

Read moreRelated Products

Tata Motors unveils facilities for development of Hydrogen propulsion tech

Tata Motors, India?s largest automobile company, unveiled two state-of-the-art & new-age R&D facilities for meeting its mission of offering sustainable mobility solutions. The unveilings constitute of Read more

Tata Motors plans petrol powertrain for Harrier and Safari SUVs

Tata Motors is in the process of developing a new petrol powertrain for its premium sports utility vehicles, the Harrier and Safari, as confirmed by a senior company official. Currently, these models Read more

Electric Vehicle Charger

RRT Electro is engaged in manufacturing of customized Power Electronic Products over two decades having capability to Design, Develop, Prototyping, Regulatory Compliance testing & Certification, Manuf Read more