Schedule a Call Back

India is key a contributor to ZF’s global success

Industry News

Industry News- Mar 29,22

ZF Commercial Vehicle Control Systems India Limited (formerly known as WABCO India Ltd) became part of the ZF Group in May 2020 following ZF’s successful acquisition of WABCO. It is a key regional business within ZF’s Commercial Vehicle Solutions (CVS) division which was launched on January 1, 2022. CVS aims to help shape the future of commercial transportation systems by being the preferred global technology partner to the commercial vehicle industry. P Kaniappan, an industry veteran, is leading the CVS business in the country as Head of CVS India. In this interview with Rakesh Rao, Kaniappan elaborates on emerging trends in the commercial vehicle market and ZF's plans to provide solutions for the industry's next generation mobility.

In your new role, what are your priorities at present?

ZF is one of the leading global tier 1 suppliers to the automotive industry with sales of Euro 38.3 billion in 2021. ZF aims to be the leader in the next generation mobility solutions like autonomous, connected and electrical vehicles with a strong focus on sustainability. We have globally proven technologies in these segments.

Before my new role as the Head of CVS India, I headed the WABCO business in the country from 2009 to 2020. During this period, we were able to position WABCO as technology leader and innovation partner with OEM and established a strong manufacturing and engineering foot print in India.

With the takeover of WABCO by ZF, we believe another journey of excellence has started for the company in India. Two companies are technology leaders in their space and the combined entity offers an opportunity of greater engagement with OEMs because of the complementary technologies of ZF and WABCO.

In commercial vehicle space, OEMs need India specific solutions at a price point which is acceptable to the market. We bring global technologies and blend it with Indian team capabilities to offer highly differentiated solutions to the OEMs. We essentially contribute to the success of our customers.

We also have a strong local engineering capability, which is a part of the group’s global engineering network that offers solutions to worldwide requirements. We would like to leverage this capability further to make India a key contributor to ZF’s global success.

We already export 40% of our production from India. This again offers a big opportunity to drive growth.

ZF acquired WABCO globally in May 2020. What kind of synergies has it created?

Two companies offer complementary technologies. For example, by combining WABCO’s control system to ZF transmission line, we can offer AMT (automated manual transmission), which is now widely in demand.

Similarly, ZF has excellent air suspension product and WABCO offers electronic control to make air suspension smart and intelligent. Today, we are in a position to offer smart suspension, which is a differentiated solution, to the customers. ZF is a leader in the electric vehicle technology. We are already in discussion with OEMs for making electric buses, a segment which is quick to adopt electrification in the CV sector. ZF is also supporting makers of light CVs - used for last mile delivery - in their journey towards electrification. In these areas, we will be using India’s capabilities and tweak these products to suit Indian requirements and increase localisation as the volume rises.

We have ZF technology centres in Hyderabad and Chennai which offers solutions to not just Indian but also global customers. In autonomous, ZF has ADAS (Advanced Driver Assistance Systems) solution, which we will bring to India.

We are now in position to offer solutions to address auto OEMs’ needs for three mega trends - i.e. autonomous, connected and electrification.

How has been the market growth in the recent months?

Business has been good. After a subdued demand in Oct-Dec 2021 quarter, demand for commercial vehicles seems to be picking up in the Jan-Mar period - the last quarter of the financial year, which has traditionally been high sales quarter for OEMs. We need to see whether this demand is sustained in the coming months, as there are some events (like Russia-Ukraine war, rising fuel prices, etc) which may cast dark clouds on the market.

How is the electrification trend in the Indian commercial vehicle market? How is ZF CVS India tapping this trend?

Electrification has started in the CV segment. While there was temporary slowdown in the bus production due to COVID, it is now picking up. We are connected with few OEMs for making electric buses.

For EVs, we offer many products. Our electronic braking systems support energy savings (i.e. reduce energy consumption) due to in-built intelligence in them. Besides, we offer electrically driven air compressors (e-compressors) and we plan to release future generation of e-compressors as well.

To save energy, we need to have products that assist in efficient braking. For this, we offer disc brakes for front axles in buses. This is very important for electric vehicles, as they need to conserve electric power. Our tyre pressure monitoring systems and many other products help EVs to save energy.

By 2030, a large part of buses will be electric. Besides bus, light commercial vehicle segment is witnessing lot of progress towards electrification.

How has been the exports performance?

We export mainly products related to braking systems such as compressors for our global plants. Besides, we design and develop actuators for global markets. For global customers, we also supply electronic control unit for air suspension that is used in high-end cars. We position our self as producer of high-quality products for global market at a competitive price.

How geared up are you to tap the connected vehicle segment?

Today, we are collaborating with one of the OEMs who want to make 100% connected vehicle. We are emerging as a strong enabler for OEMs for their connectivity solutions. In the aftermarket, we are providing connectivity solutions to fleets. We already have 50,000 vehicles connected to our platforms in the aftermarket. We see a huge opportunity to grow in this segment by providing right solutions to more customers.

Are you planning to increase localization in the near future?

Almost 85% of our products are made locally. We are trying to accelerate the pace of localisation in view of the challenges in the global logistics sector, which is disrupting supply chain.

Prices of commodities are rising. At the same time, chip shortage is causing problem for the auto industry. How are these events affecting the auto component industry in India?

Commodity prices have steeply increased after the first wave of COVID. Not only it increased, but also availability became a problem. Though prices have moderated recently, there is no respite from inflation.

For semiconductors, we have a global taskforce to mitigate the shortage challenge.

India has announced the PLI scheme for the auto industry. Will it help global companies operating in India?

At present, we do not have scale to manufacture products for electrification, connected vehicles and other advanced technologies in India. If you have to import and supply these products, we cannot be competitive. PLI scheme is a good initiative of the government as it incentivises companies to invest in manufacturing of these products locally. PLI schemes have been offered to not just auto OEMs and auto components but also to other sectors which support directly or indirectly to the growth of the auto industry. For example, PLI scheme for electronic production will also help automotive industry as many electronic components go into a vehicle.

We are investing in a new plant in Oragadam (Chennai) to augment capacities. We are happy to be one among 75 auto component manufacturers who have been approved by the government for incentives under the PLI scheme for automobile and auto components.

What are your short- and long-term growth plans for India?

Commercial vehicle market picked in 2018 with about 450,000 vehicles. While it was 280,000 vehicles last year, we expect market to grow to 320,000 vehicles this year. It is still a long way to go to reach the 2018 numbers. Economy is now picking up which will further accelerate CV demand from sectors like freight, construction, transportation, etc; thus, propelling the commercial vehicle market. We anticipate good growth for the CV industry for at least the next three years. The scrappage policy, if implemented correctly, will further give a boost to the demand for commercial vehicles.

We will try to grow the business by bringing in more technologies that will meet the emerging requirements of the industry. We see a good opportunity for aftermarket and are exploring many possibilities to drive exports as well. We have a positive outlook for India in the coming decade.

Related Stories

Marelli Unveils Intelligent Energy Management System for Hybrid and Electric Vehicles

This holistic approach to vehicle energy optimisation maximises efficiency across all vehicle systems, delivering enhanced battery range, optimised fast charging and improved longevity.

Read more

Can AI be the game changer for Indian manufacturers?

While manpower issues and quality are driving adoption of industrial automation, cost and lack of knowledge are causing hindrances. Artificial intelligence (AI) can be the game changer, writes Rakes..

Read more

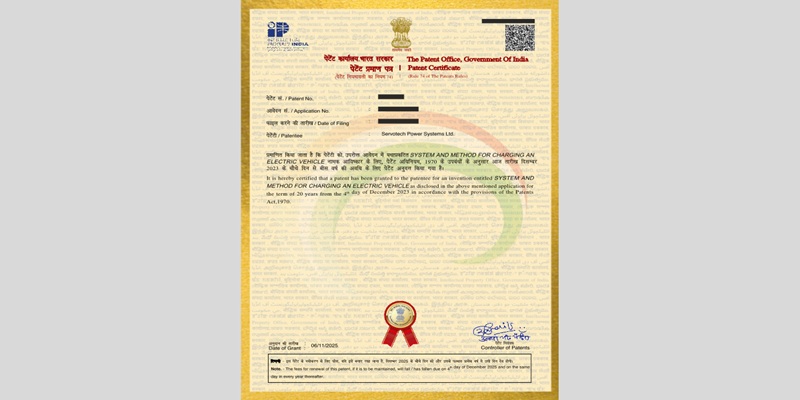

Servotech Secures Patent for Breakthrough EV Charging Compatibility Technology

Servotech’s patented device acts as a smart converter that, when connected to a CCS2 charger, allows GBT vehicles to charge safely, quickly, and efficiently.

Read moreRelated Products

Automotive Oil Pump

Kalpak Auto Pvt Ltd offers a wide range of

automotive oil pump.

Tata Motors unveils facilities for development of Hydrogen propulsion tech

Tata Motors, India?s largest automobile company, unveiled two state-of-the-art & new-age R&D facilities for meeting its mission of offering sustainable mobility solutions. The unveilings constitute of Read more

Tata Motors plans petrol powertrain for Harrier and Safari SUVs

Tata Motors is in the process of developing a new petrol powertrain for its premium sports utility vehicles, the Harrier and Safari, as confirmed by a senior company official. Currently, these models Read more