Schedule a Call Back

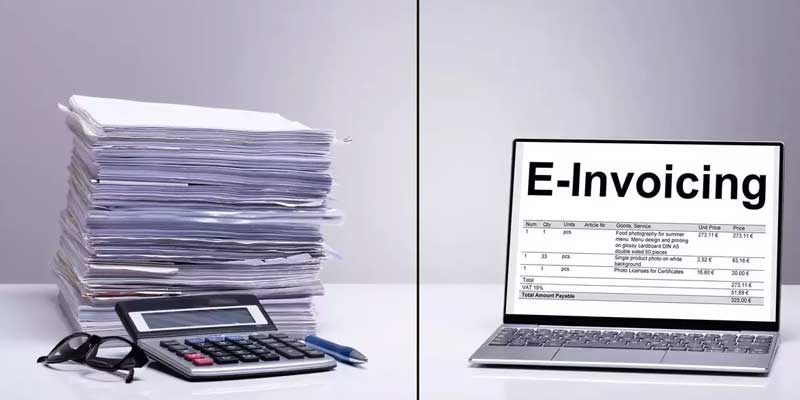

GST reporting window extended to 30 Days for over Rs 100 cr turnover firms

Industry News

Industry News- Sep 13,23

Related Stories

India’s Two-Wheeler Industry Rebounds in December; FY2026 Growth Seen at 6–9%

India’s two-wheeler market rebounded strongly in December 2025, with ICRA projecting 6–9 per cent domestic volume growth in FY2026, supported by policy measures, exports and improving demand con..

Read more

C-DEP–IIT Delhi Study Flags Tech Logistics Gains for MSMEs, Warns of GST Risks

C-DEP–IIT Delhi study shows tech-enabled intra-city logistics cut MSME costs, boost efficiency, but warns GST 2.0 may raise taxes.

Read more

EV transition and tariff wars redefine India’s auto components play

India’s auto component industry is poised to hit $ 145 billion by FY30 from $ 80 billion in FY25. Yet high US tariff, EV transition and heavy reliance on imports from China expose vulnerabilities,..

Read more