Schedule a Call Back

GST Council introduces Reverse Charge Mechanism on metal scraps

Industry News

Industry News- Sep 11,24

The 54th Goods and Services Tax (GST) Council meeting, held on September 9, 2024, has introduced the Reverse Charge Mechanism (RCM) on metal scrap, a move that is expected to significantly impact the scrap industry. Typically, the seller charges the buyer for GST. However, under the newly introduced RCM provision, the buyer will be responsible for paying the tax directly to the government.

The Council clarified that businesses selling metal scrap and not registered for GST will not charge the buyer for tax. Instead, the buyer, if registered for GST, will be required to remit the tax to the government. Additionally, the Council stated that unregistered metal scrap sellers exceeding a certain sales threshold will need to register for GST. Once registered, they will follow the same RCM rules.

The Council also recommended a 2% Tax Deducted at Source (TDS) on the supply of metal scrap in business-to-business transactions involving registered sellers. This policy is expected to benefit organised metal scrap recyclers like Gravita India and Pondy Oxide & Chemicals, who had lobbied for its introduction. According to Emkay Research, RCM will eliminate the competitive edge previously enjoyed by unorganised lead recyclers who evaded GST, levelling the playing field for organised players.

Market expert Rakesh Arora highlighted that smaller, unorganised recycling companies often did not pay GST to small scrap sellers. Under the new rules, scrap buyers, regardless of size, must now pay the GST, ensuring parity with larger buyers. Emkay also noted that this development will benefit Gravita India, as the RCM mechanism will create a transparent system, allowing companies to access a wider market for scrap procurement.

(NDTV Profit)

Related Stories

India’s Two-Wheeler Industry Rebounds in December; FY2026 Growth Seen at 6–9%

India’s two-wheeler market rebounded strongly in December 2025, with ICRA projecting 6–9 per cent domestic volume growth in FY2026, supported by policy measures, exports and improving demand con..

Read more

New technologies are transforming metal forming industry

The Indian metal forming sector is witnessing steady growth, driven by rising investments, advanced technologies and strong demand from automotive and allied industries. Emerging processes, digital ..

Read more

India-EU FTA: How Will the ‘Mother of All Deals’ Affect Indian Industries?

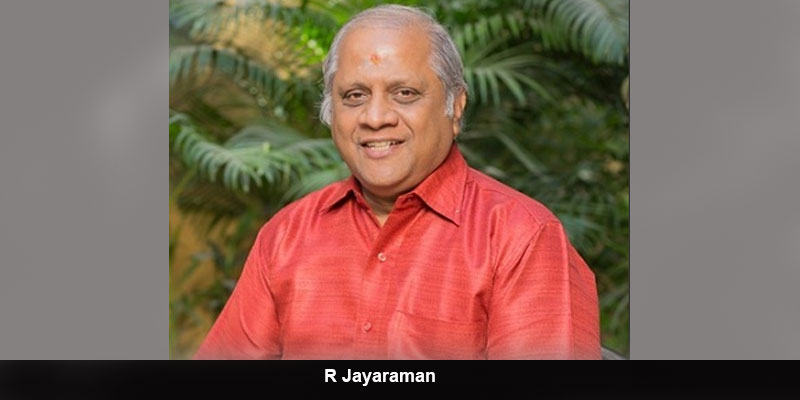

The India-EU FTA offers India significant scope to expand goods and services exports through duty reductions and improved market access, though gains may initially favour the EU, writes R Jayaraman.

Read more