Schedule a Call Back

Government extends Emergency Line Credit Guarantee till Nov 30

Industry News

Industry News- Nov 03,20

New Delhi

Taking everyone at a surprise, especially for the MSME sector and small

businesses, the Ministry of Finance has announced extension of the Emergency

Credit Line Guarantee Scheme (ECLGS) by one month till 30 November, 2020, or

till such time that an amount of Rs 3 lakh crore is sanctioned under the scheme.

However, the government was not much keen on extending Rs 3

lakh crore ECLGS for the MSME sector ahead of October. However, the sanctioned

amount so far is about 65 per cent of the target. The scheme is meant to

provide financial support to businesses, primarily Micro, Small and Medium

Enterprises (MSMEs), impacted by the slowdown triggered by the

coronavirus pandemic.

The extension is aimed at opening up diverse sectors in the economy and

the expected increase in demand during the ongoing festive season. The

extension will further provide an opportunity to the borrowers who are yet to avail

this scheme, thereby can obtain credit under the scheme.

The ECLGS was announced as part of the AatmaNirbhar Bharat Package to

provide fully guaranteed and collateral free additional credit to MSMEs, business

enterprises, individual loans for business purposes and MUDRA borrowers, to the

extent of 20 per cent of their credit outstanding as on February 29, 2020.

Borrowers with credit outstanding up to Rs 50 crore as on February 29, 2020,

and with an annual turnover of up to Rs 250 crore are eligible under the

Scheme.

Interest rates under this Scheme are capped at 9.25 per cent for banks

and financial institutions, and 14 per cent for NBFCs. Tenor of loans provided

under the scheme is four years, including a moratorium of one year on principle

repayment.

As per data uploaded by member lending institutions on the ECLGS portal,

an amount of Rs 2.03 lakh crore has been sanctioned under the scheme to 60.67

lakh borrowers so far, while an amount of Rs 1.48 lakh crore has been

disbursed.

Related Stories

Covasant Launches Agent Management Suite for Scalable Enterprise Agentic AI

Covasant has launched CAMS, an end-to-end AgentOps platform enabling enterprises to govern, scale and secure autonomous AI agents across hybrid and multi-cloud environments.

Read more

Fujiyama to Commission 1 GW Solar Cell Manufacturing Plant at Dadri

Fujiyama Power Systems has announced the commissioning of a 1 GW solar cell plant at Dadri, Uttar Pradesh, strengthening its integrated manufacturing capabilities and reducing reliance on imports.

Read more

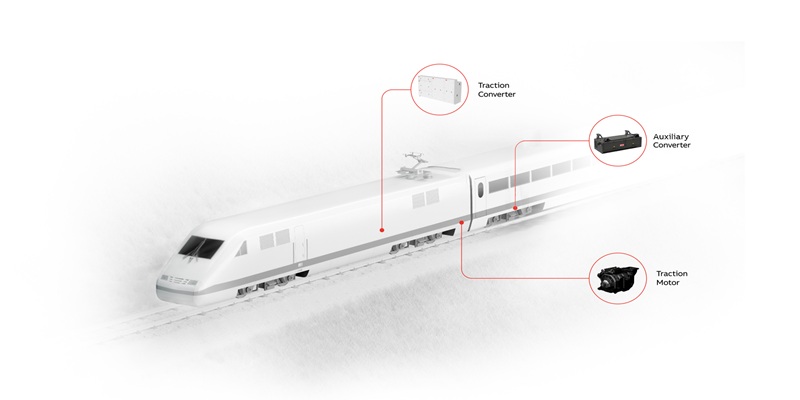

ABB Wins Mumbai Metro Lines Propulsion and TCMS Order

ABB has secured a major order from Titagarh Rail Systems to supply propulsion systems and TCMS software for Mumbai Metro Lines 5 and 6, strengthening its role in India’s metro expansion.

Read moreRelated Products

Heavy Industrial Ovens

Hansa Enterprises offers a wide range of heavy industrial ovens.

High Quality Industrial Ovens

Hansa Enterprises offers a wide range of high quality industrial ovens. Read more

Hydro Extractor

Guruson International offers a wide range of cone hydro extractor. Read more