Schedule a Call Back

Geared products market to reach $14 bn by 2025: Report

Industry News

Industry News- Jan 12,22

London

New research from Interact Analysis shows that during 2020 the overall market for geared motors and heavy-duty industrial gears declined by 2.4%. Asia Pacific remained the largest market overall and was also the only one to achieve year-on-year (YoY) growth whilst other regions, namely EMEA, Japan, and the Americas experienced a period of contraction. But the market is looking better in the medium-term, with a CAGR of 4.8% predicted out to 2025,

when the total market value will be $14.1 billion.

In 2021, supply chain problems forced distributors to stockpile and pushed up prices, additionally, surging pent up demand from end users also drove growth, leading to an overall YoY growth rate of 8.4%. Economic uncertainty will see the market cool in 2022, with 2023 predicted for the lowest growth rate of the forecast period. Asia Pacific will achieve the highest growth rate globally, with a CAGR of 5% out to 2025. In China – the world’s largest market for geared products – effective COVID control has allowed things to continue almost as normal compared to many regions, although EMEA and the Americas are both expected to register a healthy CAGR of 4.7% out to 2025.

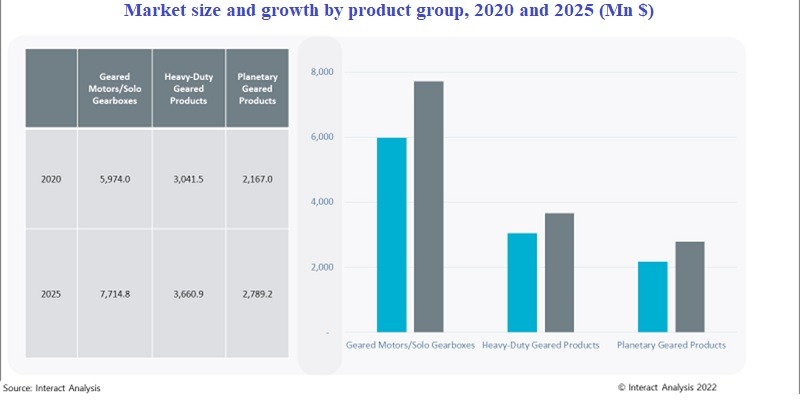

Geared motors and solo gear boxes are the leading product category globally, accounting for 53% of total revenues in 2020. They will also be the best performing product category out to 2025, with a CAGR of 5.2%. Meanwhile, planetary geared products were the only group to experience growth throughout 2020 due to a surge in demand for wind turbines. Machinery manufacturers were by far the largest consumer of geared products in 2020 with conveyors being the most dominant subcategory. The top 10 end-user sectors, including food and beverage, mining and basic metals accounted for 72% of revenues in 2020. As a result of price increases for raw materials, geared motor suppliers were forced to increase unit prices by 3.3% in 2021, and prices will not return to pre-pandemic levels until 2024.

Shirly Zhu, Principal Analyst at Interact Analysis, said, “SEW Eurodrive were the only company with a strong market presence in all major product categories in 2020. Leading Asian vendors retained share mainly within their regional markets, whilst European vendors, such as Nord and Bonfiglioli, had relatively strong global presence. Overall, the top 11 suppliers reported a combined market share of 61.5% in 2020.â€Â

Related Stories

Tariffs are reshaping automation supply chains: Blake Griffin

In this interview, Blake Griffin, Research Manager, Interact Analysis, highlights how trade wars, geopolitical tensions and rare-earth restrictions are reshaping global automation industry.

Read more

Can AI be the game changer for Indian manufacturers?

While manpower issues and quality are driving adoption of industrial automation, cost and lack of knowledge are causing hindrances. Artificial intelligence (AI) can be the game changer, writes Rakes..

Read more

Automation to Drive Packaging Machinery Market Surge

Rising labour costs, regulatory pressures, and the growing influence of e-commerce are driving the demand for end-of-line and warehousing packaging machineries. This growth is reshaping packaging st..

Read moreRelated Products

Auto Wheel Hub Bearings

Kasuma Auto Engg Pvt Ltd offers a comprehensive range of Auto Wheel Hub Bearings.

Gear Lever Kits

B S Industry offers a wide range of gear lever kits.

Automotive Gear

Matrix Precision Engineering offering a personalized array of automotive gear.