Schedule a Call Back

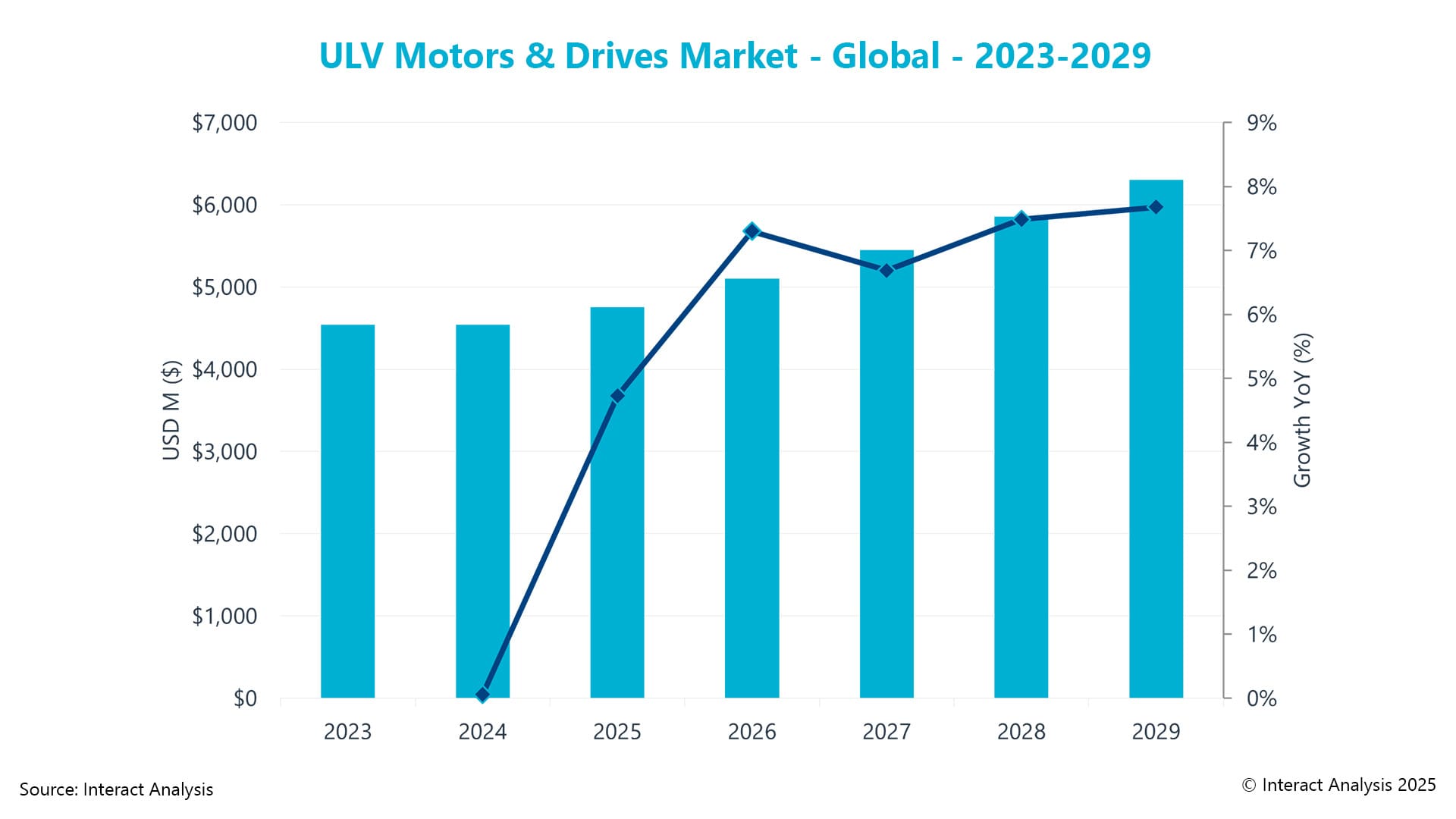

Ultra-low voltage motors and drives sector rebound in 2025: Interact Analysis

Articles

Articles- Aug 30,25

Related Stories

Honeywell Launches Hybrid Heating to Cut Industrial Energy Costs and Emissions

Honeywell’s Hybrid Heating Solution enables manufacturers to switch between gas and electric heat in real time, helping optimise energy costs, cut emissions and support the energy transition.

Read more

Minda Corp Posts Record Q3 Revenue of Rs. 15,600 Mn, EBITDA Improves

Minda Corporation reported its highest-ever quarterly revenue in Q3 FY2026, driven by strong demand, portfolio strength and improved margins, alongside key leadership appointments.

Read more

Texas Instruments Opens New Semiconductor R&D Centre in Bengaluru

Texas Instruments has inaugurated a 550,000-sq-ft R&D centre in Bengaluru, marking 40 years in India and reinforcing its commitment to semiconductor design and innovation.

Read moreRelated Products

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.