Schedule a Call Back

CRISIL forecasts a 35% surge in road and renewable energy investments by 2024

Industry News

Industry News- Sep 01,23

Related Stories

Rays Power Secures 300 MW RE Project from Maharatna PSU

Rays Power Infra has won a 300 MW renewable energy project worth Rs 19.12 billion from a Maharatna PSU, to be developed in Karnataka under its co-development model.

Read more

Gulf Oil Expands OEM Tie-Ups in Construction Lubricants

Gulf Oil Lubricants India Ltd has forged OEM partnerships with ACE – Action Construction Equipment Ltd, Ammann India and XCMG to deliver application-specific, high-performance lubricants for India..

Read more

Expanding Industrial Base Pushes Lubes Demand

The global industrial lubricants market is expected to rise from 22.82 billion litres in 2025 to 23.61 billion litres in 2026, reaching 27.95 billion litres by 2031, according to Mordor Intelligence..

Read moreRelated Products

Power Conversion Systems

POM Systems & Services Pvt Ltd offers a wide range of

PCS power conversion systems energy storage.

Hot Water Generators

Transparent Energy Systems Private Limited offers a wide range of Hot water generators - Aquawarm Superplus.

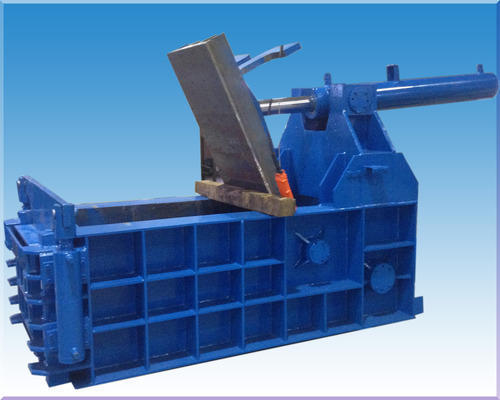

Scrap Baling Press

Fluid Power Machines offers hydraulic scrap baling press. Read more