Schedule a Call Back

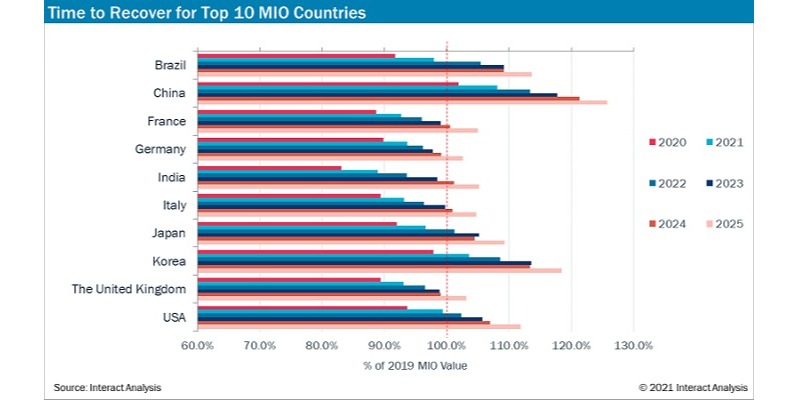

Contraction in global manufacturing output lower than expected at 3.9% in 2020

Industry News

Industry News- Feb 25,21

Related Stories

Why Batteries Trail Strategy in Humanoid Robot Development

Battery makers are racing ahead of robot OEMs in positioning humanoids as the next growth frontier. This press release examines developments from both perspectives and considers how deeper cross-ind..

Read more

New technologies are transforming metal forming industry

The Indian metal forming sector is witnessing steady growth, driven by rising investments, advanced technologies and strong demand from automotive and allied industries. Emerging processes, digital ..

Read more

IMTEX Forming celebrates human ingenuity & machine intelligence: Jibak Dasgupta

In this interview with Rakesh Rao, Jibak Dasgupta, Director General & CEO, Indian Machine Tool Manufacturers' Association (IMTMA), explores trends in the machine tools industry and shares some highl..

Read moreRelated Products

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.