Schedule a Call Back

Motion controls face toughest year in 2024, recovery expected: Interact Analysis

Industry News

Industry News- Feb 24,25

Related Stories

Motion controls face toughest year in 2024, recovery expected: Interact Analysis

It is projected the Americas will be the highest growing region in 2025, with an expected motion controls market growth rate of 3.5%.

Read more

Indian electronics industry's mission $ 500 billion

Indian electronics industry has set an ambitious target of $500 billion by 2030 from present $ 101 billion. The task is challenging, but not insurmountable. As a result, the industry is on the cusp ..

Read more

As AI takes off, we expect to see even greater gains: Tim Dawson

The top 5 manufacturing regions for semiconductors in 2024 were China (43%), South Korea (13.5%), Taiwan (9%), Singapore (7.1%) and Japan (6.2%) and this split has been pretty consistent for almost ..

Read moreRelated Products

Standard Series Stations and Enclosures

Esbee

Industrial Combines/Esbee Electrotech LLP offers standard series stations and

enclosures.

Fire Alarm

Safe Zone is prominent traders and suppliers of the industry, offering a wide range of wireless fire alarm.

Read more

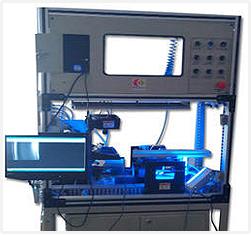

Sorting Automation Systems

Renovus Vision Automation offers sorting automation systems.

Read more