Schedule a Call Back

The three paths for mobile hydraulics amidst electrified powertrains

Articles

Articles- Sep 20,24

Related Stories

Rising demand and material limits could trigger supply crunch for OEMs

Blake Griffin, Research Manager, Interact Analysis, explains that rising trade tensions and rare earth restrictions could disrupt supply chains for industrial automation OEMs, with delayed 2025 orde..

Read more

Automation to Drive Packaging Machinery Market Surge

Rising labour costs, regulatory pressures, and the growing influence of e-commerce are driving the demand for end-of-line and warehousing packaging machineries. This growth is reshaping packaging st..

Read more

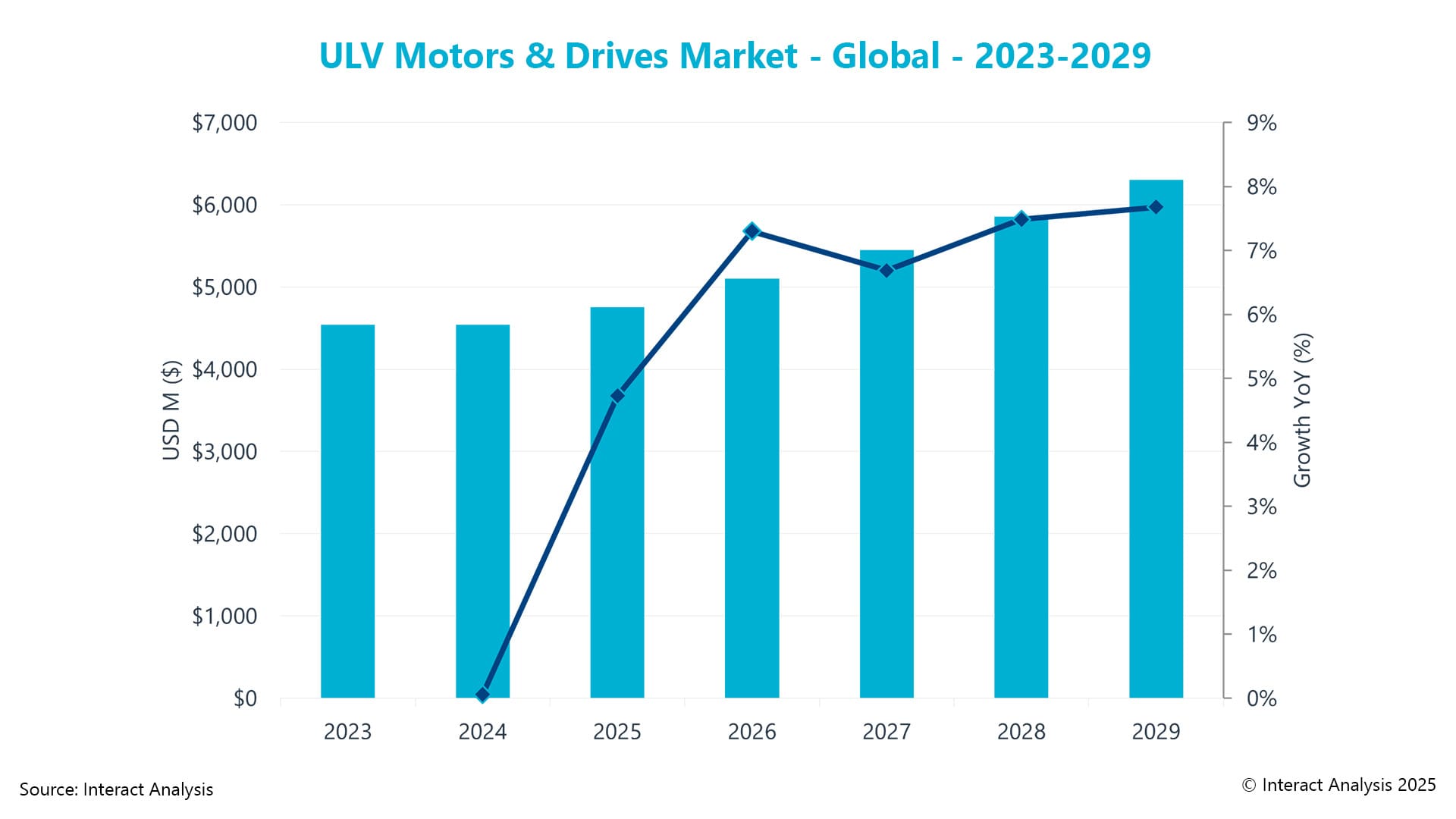

Ultra-low voltage motors and drives sector rebound in 2025: Interact Analysis

After growing at 0.1 per cent in 2024, the ultra-low voltage (ULV) motors and drives market is set for recovery in 2025, driven by mobile robotics and renewed industrial automation demand.

Read moreRelated Products

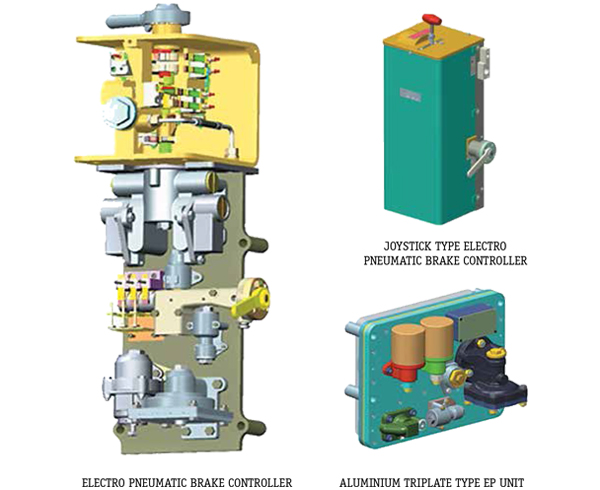

Electro - Pneumatic Brake System for Emu

Escorts Kubota Limited offers a wide range of electro - pneumatic brake system for EMU.

Indef Powered Crane Kit

Hercules Hoists Ltd offers a wide range of Indef powered crane kit.

Jib Crane

DC Hoist & Instruments Pvt Ltd offers a wide range of Jib crane.