Schedule a Call Back

Sigachi Industries expands globally with strategic partnership in Saudi Arabia

Industry News

Industry News- Oct 25,23

Sigachi Industries, a prominent player in the pharmaceutical industry, has recently unveiled a strategic partnership with Saudi National Projects Investment Limited (SNP), a reputable advisory investment firm. Through their wholly owned subsidiary, Sigachi MENA FZCO, and SNP, they have jointly established Sigachi Arabia, with Sigachi MENA FZCO holding a substantial 75% stake and SNP owning the remaining 25%.

This joint venture will operate as a holding company, overseeing distinct entities dedicated to key sectors such as pharmaceuticals, food and nutrition, and operations and management (O&M). As part of its expansion plans, Sigachi Arabia is gearing up to establish a state-of-the-art manufacturing facility in Riyadh. This facility will not only cater to the local market but also serve the Gulf Cooperation Council (GCC) countries, enhancing Sigachi's regional presence.

Saudi National Projects Investment Limited brings extensive expertise to the table, offering comprehensive global and local insights to build strategic and profitable partnerships. The firm has developed innovative analytical frameworks tailored for businesses in Saudi Arabia and China. With a global team of skilled investment analysts and managers, SNP has successfully executed deals worth over USD 50 billion, providing end-to-end guidance and support for their partners.

In a recent development, Sigachi Industries diversified its portfolio by venturing into the active pharmaceutical ingredient (API) business. This strategic move involved acquiring a majority stake in Trimax Bio Sciences, a reputable API manufacturing firm.

Sigachi Industries' shares experienced a marginal 1% decrease, closing at Rs 38.25. This joint venture marks a significant milestone in Sigachi Industries' journey, signalling its intent to expand its global footprint and strengthen its position in the pharmaceutical industry.

Source: zeebiz.com

Related Stories

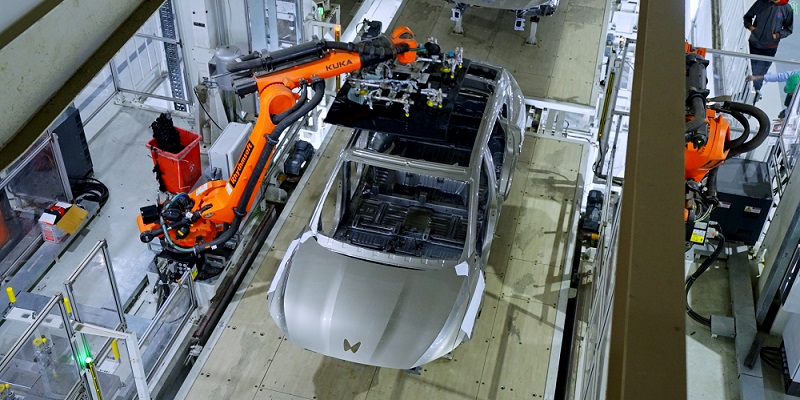

Mahindra unveils EV manufacturing & battery assembly facility in Maharashtra

Mahindra has allocated Rs 45 billion out of the total Rs 160 billion planned in the F22–F27 investment cycle— which includes powertrain development, two product top hats including software & tec..

Read more

Lubrizol buys Aurangabad land for firm’s largest manufacturing facility in India

The initial phase of the project represents a projected investment of approximately $200 million and builds on previously committed investment in the region.

Read more

Godrej and Boyce to expand in Chennai with Rs 3.5-4 bn manufacturing facility

The 27-acre Ambattur plant currently has a capacity of 90,000 tonnes per annum and has reached up to 66,000 tonnes during peak times.

Read moreRelated Products

Programmable Controllers - Pcd-33a Series

Pro-Med Instruments (P) Ltd offers a wide range of programmable controllers - PCD-33A Series.

Gasket Graphite Powder

Arihant Packing & Gasket Company offers a wide range of gasket graphite powder.

Asahi Kasei expands 3D printing filament sales in North America

Asahi Kasei, a leading resin and compounding technology provider, has initiated the sales of 3D printing (3DP) filaments in North America through Asahi Kasei Plastics North America (APNA). The soft la Read more