Schedule a Call Back

US tariff: Partnerships and innovation to drive Indian machine tools demand

Articles

Articles- Sep 01,25

India has firmly established itself as the world’s fifth-largest manufacturing nation, with industries such as automobiles, electronics, pharmaceuticals, and textiles making substantial contributions to the country’s economy. This growth is supported by a combination of factors, including a vast domestic consumer base, competitive labor costs, abundant natural resources, and proactive government initiatives like the Make in India program and the Production Linked Incentive (PLI) scheme.

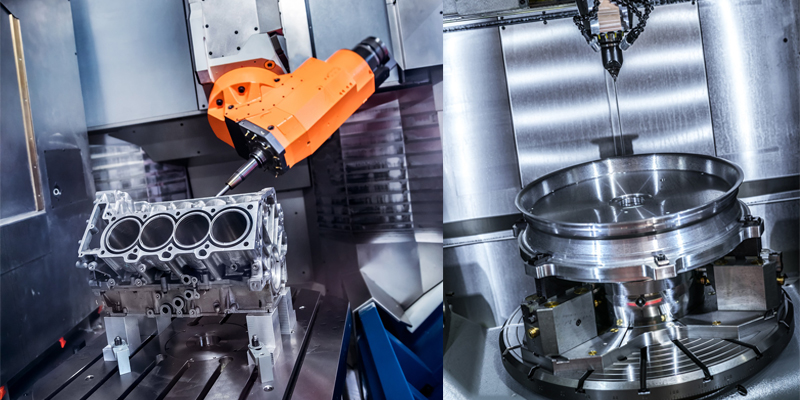

At the heart of this expansion lies India’s steadily growing machine tool industry, often regarded as the “mother industry” for manufacturing. Valued at over $ 1.7 billion in FY 2024–25, the sector is witnessing strong momentum, fuelled by rising demand for precision engineering, increasing adoption of industrial automation, and a policy push toward building resilient infrastructure and achieving greater self-reliance.

"The Indian manufacturing and machine tools industry is in the midst of a transformational phase, backed by strong government initiatives such as Make in India and PLI schemes. Demand for high-precision tooling is increasing as OEMs and tier suppliers strive for higher productivity and global quality standards. Domestically, sectors like automotive—including electric vehicles (EVs)—aerospace, and defence are showing significant growth due to localisation and technology upgrades. Internationally, India is emerging as a trusted hub for high-value manufacturing, creating strong export potential. We expect steady double-digit growth over the next 5–7 years, particularly in sectors demanding tighter tolerances and high-performance machining,” comments Tosher Hormusjee, Managing Director, GUSTI Tool Works LLP.

Global machine tools industry

Since 2023, the global machine tool industry has faced a challenging economic environment, driven by geopolitical tensions, supply chain disruptions, and protectionist trends. Dr Markus Heering, Executive Director, German Machine Tool Builders’ Association (VDW), elaborates, "The best way to describe the situation is probably turbulent. After years of steady growth, the global machine tool industry has been facing a difficult economic environment since 2023. In 2024, global machine tool production declined by more than 5 per cent. Geopolitical tensions, supply chain disruptions, and protectionist tendencies have exposed the vulnerabilities of international trade and created volatile markets. At the same time, structural changes in key customer industries—particularly automotive—are adding pressure. The transition to low-emission drives, AI-supported assistance systems, and enhanced in-car connectivity is forcing these industries to reinvent themselves, slowing down investments and directly impacting the machine tool sector."

According to Filip Geerts, Director General, European Association for Manufacturing Technology (CECIMO), the global manufacturing and machine tool sector are running at very different speeds across regions. “European industrial activity has slowed due to weak demand, high energy costs, and geopolitical uncertainty, all of which are negatively impacting investment levels. In China, the sector is still significant but under pressure because of trade frictions, and supply chain shifts linked to the international environment. India is currently outperforming, thanks to government programs, infrastructure investments, and its role in supply chain diversification, which are strengthening its manufacturing and industrial conditions,” he states.

At the same time, the machine tool industry is going through a structural transition. Geerts adds, “Demand is increasingly driven by automation, precision requirements, and localized production, as manufacturers adapt to new supply chain realities, geopolitical pressures, and the broader push for industrial resilience."

India’s machine tools market

As per the World Machine Tool Survey 2024 by Gardner Intelligence, India is ranked 9th globally in production and 4th in consumption. Jibak Dasgupta, Director General & CEO, Indian Machine Tool Manufacturers' Association (IMTMA), elaborates, "The Indian machine tool industry continues its upward trend, with production in FY 2024-25 estimated to have increased by 7 per cent to reach Rs 145.66 billion (around $ 1.7 billion), while consumption is projected to have risen by 17 per cent to reach Rs 317.81 billion (around $ 3.7 billion) during the period. This is the highest-ever domestic production and consumption. In FY 2024-25, machine tool imports amounted to Rs 186.86 billion, and machine tool exports amounted to Rs 14.72 billion."

Industry experts anticipate strong growth in key sectors such as automotive, aerospace, and electronics. Government initiatives, particularly the Make in India program, are playing a pivotal role in driving advancements in high-end machine tool manufacturing.

Speaking about key changes that have taken place in India’s manufacturing sector over the last decade, Dr Nagahanumaiah, Director, Central Manufacturing Technology Institute (CMTI), says, "The most significant shift has been a move towards quality consciousness. Earlier, a ‘jugaad’ approach was common, but now industries recognise that such quick fixes are not sustainable. They are increasingly adopting scientific, technology-driven methods. Digitization has also democratised access to knowledge and collaboration. Manufacturers now understand the value of cooperation and partnerships, both within India and globally. Another change is the growth of entrepreneurship and risk-taking. When I was a student, the idea of starting a company was unheard of. Today, startup culture is ingrained, with young engineers encouraged to innovate and establish their own ventures."

Today, India is one of the fastest-growing major economies and is considered to be a crucial market by global companies. Geerts opines, "While India rapidly builds its industrial base and invests in new technologies, Europe brings long-standing expertise in precision engineering, automation, and sustainable manufacturing. Together, this creates strong potential for collaboration in areas such as digital manufacturing, green technologies, and advanced materials. Europe’s leadership in low-carbon, energy-efficient machine tools supports India’s climate and energy goals, while Indian manufacturers are eager to accelerate their Industry 4.0 transition with European know-how."

However, there are some regulatory hurdles faced by global companies. One of them is the Union government’s new safety regulations for machinery and electrical equipment - the Machinery and Electrical Equipment Safety (Omnibus Technical Regulation) Order, 2024 – which covers more than an estimated 50,000 types of machinery, including machine tools.

Geerts elaborates, "Challenges remain—most notably the Omnibus Technical Regulation (OTR) introduced by India’s Ministry of Heavy Industries, which will require mandatory BIS certification for a wide range of machinery, including machine tools and components. Although its enforcement has been postponed until September 2026, the scheme creates a major barrier to trade as it does not recognise EU certifications, adds heavy administrative burdens, and risks disrupting the fast-growing export flow of European technologies to India. We hope this barrier can be lifted for European companies, allowing industry partnerships to expand on a fair and mutually beneficial basis."

US tariff impact

The Donald Trump administration’s imposition an additional 25 per cent tariff on shipments from India to the US, effectively doubling the tariff on most goods exported from the country, has delivered a significant blow to the Indian engineering exports sector, for which the US is the biggest market.

Dasgupta explains, "The Indian machine tool industry majorly supplies to the auto segment, with a significant amount of auto components being exported to the US. A tariff on the auto sector would have a cascading effect on the machine tool industry. However, the Indian machine tool industry is expanding its footprint into other sectors like aerospace, defence, railways, electronics, and a few others. We believe that in the future, these will grow and nullify the impact of tariffs, and even during a slowdown, the Indian machine tool industry can sustain itself."

Experts believe this phase is expected to be short-lived. As global conditions stabilise, the industry is well-positioned for a robust rebound. Furthermore, the recently concluded FTA with the UK is set to enhance export opportunities, creating a more favourable market for Indian machine tool manufacturers. T K Ramesh, Managing Director, Ace Designers Ltd, opines, "At present, India accounts for less than 1 per cent of the global machine tool market. So the immediate impact of tariff wars on our exports is limited. However, our customers — particularly auto component exporters — are being affected. Looking ahead, we expect a shift from open globalisation to regionalisation, with blocs like Asia, Europe, and the US forming strong trade alliances and FTAs. For Indian companies like us, this means we may need to establish regional manufacturing bases, build partnerships, and adopt distributed manufacturing strategies to stay competitive."

Dr Heering agrees, "A free trade agreement between India and Europe would provide a strong boost, offering companies a more attractive business environment while reducing bureaucratic hurdles and modernising infrastructure. Given today’s global uncertainties, India stands to benefit from companies diversifying their supply chains, and we believe this will only accelerate India’s rise as a manufacturing powerhouse. India is an enormously important growth market for us. Industrialisation there has gained significant momentum, and advanced machine tools are essential for building efficient, globally competitive industries."

Import pressures

The Indian manufacturing sector is currently in a period of uncertainty, influenced by geopolitical tensions and disruptions in global shipping routes. Amid this, imports continue to pose challenge to the domestic industry. India’s machine tool imports registered a sharp increase in FY25, rising 22 per cent year-on-year to reach Rs 186.86 billion ($ 2.2 billion) compared to Rs 153.52 billion in FY24. This surge was largely fuelled by robust domestic industrial demand and higher consumption. "Large-scale low-cost imports of machines, including high-technology and high-precision ones from Asian countries, are flooding the Indian market. Faster delivery schedules, large volume orders demand higher capacity requirements, which is a drawback for the domestic industry. The capability of global suppliers for faster delivery and volume supply is impacting demand for domestic suppliers," elaborates Dasgupta.

In fact machine tools were one of the key non-oil, non-gold categories which witnessed higher import activity in FY25. To boost domestic production of capital goods—including machine tools—the government has rolled out the Scheme for Enhancement of Competitiveness in the Indian Capital Goods Sector, implemented in two phases.

Dasgupta adds, "Under the Phase II of this scheme, products and technologies are being developed. The focus is on the indigenisation of machine tools and subsystems. The Indian machine tool industry also needs to grow strong to compete with global players, and the challenge lies in building better indigenous high-precision technologies. There is a need to build sector-specific, technologically advanced machines, provide customisation, and offer application-specific solutions."

Experts believe the biggest challenge before Indian machine tools industry is scale. “If you look at global leaders: China manufactures at enormous volumes, Korea and Japan have large-scale companies, and Europe thrives on innovation with export orientation. India, in contrast, has many small and medium-scale enterprises (SMEs),” explains Ramesh.

According to Ramesh, the Indian machine tool industry faces following key challenges:

Innovation & R&D: Breakthrough innovations remain limited in this sector, which, unlike IT, requires significant investment, long development cycles, and comparatively modest returns.

Skill shortages: For nearly two decades, many engineers moved to IT and electronics, creating a gap in manufacturing skills; however, this trend is gradually reversing as the focus on manufacturing intensifies.

Global competitiveness: Indian manufacturers must find a balance between cost, quality, and timely delivery to remain competitive on the global stage.

Addressing these challenges requires stronger collaboration between government, academia, and industry. Policy support, coupled with industry investment, can create an ecosystem that fosters local innovation and global competitiveness, he adds.

Auto drives demand

The automotive sector continues to be one of the largest consumers of machine tools, and companies are working to expand their presence by building new partnerships across emerging industrial hubs. While the first half of the financial year has been relatively subdued, the long-term growth outlook remains strong. R K Purohit, MD, Sphoorti Machine Tools Pvt Ltd, says, "The auto industry forms the backbone of the machine tool business, accounting for a significant share of demand. Our B2B business model is strongly routed through machine tool builders, while B2C engagement happens through sales partners, key accounts, and global stockists."

A particularly promising area is electric mobility. Purohit explains, "The rise of electric vehicles (EVs) has created additional visibility for us, but it has not reduced opportunities in the traditional auto segment. In fact, both conventional and EV-related manufacturing are growing simultaneously, driven by the rising mobility needs of rural, semi-urban, and urban India."

With the rapid rise of electric vehicles alongside increased foreign direct investment, demand for advanced machine tools is projected to accelerate significantly. As EVs increasingly depend on lightweight materials such as aluminium and composites to enhance efficiency and range, advanced machine tools are essential for accurate machining that meets stringent quality standards. In particular, CNC and laser-based machining systems play a critical role in manufacturing components for lithium-ion batteries and other key EV parts.

Hormusjee elaborates, “The shift to electric mobility has created new challenges in tooling—lightweight materials, harder alloys, and tighter tolerances for batteries, motors, and drivetrain components. At GTW, we have developed advanced solutions including specialised tools for aluminium and copper machining, geometries for non-ferrous and abrasive composites, and precision reamers and drills for EV motor housing and battery assembly. By working closely with our customers, we focus on optimising cycle times, minimising scrap, and improving part quality to support the rapid expansion of the EV ecosystem."

Demand engines beyond auto

In addition to automotive, industries such as defence & aerospace, railways, electronics, etc are emerging as promising areas, with growth momentum already visible in India. Ramesh says, "Many automotive components exported globally are manufactured on Ace machines. Today, similar opportunities are emerging in electronics, defense, aerospace, EVs, and medical devices. As these industries scale, they will require strong vendor ecosystems, and machines are the backbone of component manufacturing. We are well-positioned to support these sectors with world-class CNC solutions. At the same time, our products are now mature and competitive enough to serve international markets. Thus, we are focused on both 'Make in India for India' and 'Make in India for the World'.”

Elaborating on potentials of other industries such as railways, defence, electronics, etc, Hormusjee says, "Each of these sectors presents unique opportunities. The railways sector requires precision tools for bogies, wheelsets, and high-speed train components. In defence, indigenous manufacturing programmes demand aerospace-grade tooling for high-precision applications. The electronics industry is witnessing rapid growth in semiconductors and miniaturised components, driving demand for micro and small-diameter cutting tools. We are actively expanding our portfolio in these areas, with a strong focus on tight-tolerance, high-precision applications that align with India’s localisation drive."

With the current government push and investment in sectors such as railways, defence, and electronics, it has become essential for machine builders to focus on them. Many companies see these sectors as long-term growth drivers that will complement their core business. "Indian industries have taken up contract manufacturing for the global, civil and defence aerospace sector and have proved their mettle. Defence Procurement Policy, import-substitution targets, and the “Indigenisation List” have created opportunities for domestic suppliers of precision manufacturing equipment. Railways and metro rail networks demand various equipment, including presses, press brakes, and laser cutting machines. Railways sector is a core client for the machine tool industry as it sources the machine tools and solutions needed for coach manufacturing and building engine parts. Cell phone manufacturing, consumer goods manufacturing, and wearables demand CNC machines, fixtures, and tools, which offer huge opportunities for Indian industries. All these developments are creating opportunities for machine tool demand for Indian players,” Dasgupta opines.

Technology transformation: Automation, AI, digital

Technological advancements are reshaping the Indian machine tool industry, with automation, including robotics and integrated solutions, gaining momentum. Dr Heering elaborates, "Automation is now the primary driver of investment. It replaces manual processes, increases transparency, and ensures efficiency and quality. Companies are seeking flexible solutions—ranging from pallet changers and handling systems to fully autonomous factories—that can handle both mass production and customised products cost-effectively. Artificial intelligence (AI) is further enhancing efficiency, enabling real-time monitoring, predictive maintenance, and smarter assistance systems for operators."

Automation is no longer optional but is fast becoming industry imperative. With customers increasingly conscious of this trend, manufacturers are expected to deliver solutions that align with evolving expectations. Purohit comments, "Automation and digitalisation are no longer optional — they are essential for staying competitive. All our CNC machines are equipped with HMIs, enabling better monitoring, reduced errors, and improved efficiency. We are also enhancing our digital presence, ensuring that our products and capabilities are visible not just physically but across digital platforms, helping us reach the global industrial community."

Indian machine builders are prioritising the integration of automation across their processes and products. These efforts are aimed at enhancing efficiency and securing long-term competitiveness in both domestic and international markets. Ramesh explains, "Like cars transforming into computers on wheels, machine tools will increasingly integrate IIoT, sensors, and embedded intelligence. Machines will monitor their own health, track output quality, and provide predictive maintenance alerts. Machines will not only produce parts but also generate data, enabling connected manufacturing ecosystems with real-time analytics, efficiency monitoring, and adaptive programming."

The Indian machine tool industry is catching up with the adoption of automation and digitalisation. Dasgupta elaborates, "All the advanced machines manufactured by Indian machine tool players are being designed and built with embedded sensors, IoT connectivity, and real-time monitoring to predict failures and schedule servicing before breakdowns, reducing downtime. Collaborative robots (cobots) and robotic arms are being integrated for loading and unloading parts, tool changes, and repetitive operations, especially in high-volume production. There still remains a gap that the industry needs to address, as only OEMs are integrating digitalisation. SMEs still face challenges due to cost and a lack of resources, but they are undergoing a transition phase of adopting new technologies."

The adoption of IoT and AI in machine tools is enabling greater precision and efficiency in component manufacturing. Automation has become essential for scaling up mass production of EV parts, while hybrid technologies that combine 3D printing with CNC machining are opening new avenues for advanced manufacturing.

Green machining

Machine tools industry is increasing investments in R&D with a special focus on sustainability, including energy-efficient machines, waste reduction, lightweighting, and circular economy practices. Dasgupta says, "Emphasis is on green manufacturing with a reduced carbon footprint and carbon tax. Industries are moving towards adopting sustainable solutions which would have a limited impact on the environment."

Dr Heering adds, “Sustainability is central: New machine investments already deliver energy savings of around 25 per cent, while trends such as recycling, reduced material consumption, and the circular economy are becoming integral to industrial strategy."

Sustainability has become a key factor in capital investment decisions, and the machine tool industry has to balance energy efficiency, CO? reduction, and manufacturing precision. Dr Heering states, "This is an opportunity for the machine tool sector to position itself as a strategic partner to industries navigating decarbonisation and digitalisation. Key areas such as hydrogen technologies, battery production, microelectronics, sustainable materials, and climate-neutral manufacturing are expanding rapidly. To succeed, machine tool companies must provide specialised solutions for new materials, high-precision components, and efficient production processes. Speeding up the transfer of technology into industrial applications and setting global standards in emerging markets will be essential. If achieved, the machine tool industry can look forward to a bright future defined by resilience and sustainability."

According to Geerts, “Companies are investing in energy-efficient machines, lightweight designs, and circular approaches that extend machine lifespans, cut emissions, and reduce waste. Digitalisation supports this by improving reliability and lowering resource use."

Skilling for growth

A persistent challenge is the shortage of industry-ready engineers. "It is true that only a small percentage of engineering graduates are immediately industry-ready. This is due to a decline in practice-based learning and overreliance on digital or theoretical methods. Earlier, public sector companies invested heavily in training fresh graduates. With the decline of such programs, industry today expects graduates to be productive from day one, which is unrealistic. However, I believe today’s graduates are far more intelligent and resourceful than earlier generations. What is missing is hands-on exposure and the willingness of employers to invest in training. Industry must treat training as both an investment and a social responsibility," opines Dr Nagahanumaiah.

Ramesh sees additional opportunities in skill development. “Operating CNC machines requires trained manpower, and we plan to expand training programs in machine operations, maintenance, and programming. This will create a talent pipeline to support the growth of Indian manufacturing,” he states.

Building resilience: From Uncertainty to Opportunity

Dr Nagahanumaiah believes India has a unique opportunity to become a global manufacturing hub, especially as companies seek alternatives to China. “But for long-term sustainability, we must not rely solely on being a ‘China Plus One’ option. Instead, India must focus on creating original technologies and domestic IP. Developing indigenous technologies, protecting IP, and fostering collaboration will be key drivers of India’s future industrial landscape,” he stresses.

Dasgupta expects Indian machine tools industry to grow, in both production and consumption, by around 10 per cent in FY26. “A key focus will be on finding new markets for exports, particularly in the Middle East and African regions, while also expanding our presence in traditional markets. Under the Look East policy, India is also aiming to strengthen its base in South and South-East Asian countries. On the domestic front, the priority will be to increase market share and gradually reduce dependence on imports. In addition, the industry will move towards providing end-to-end solutions to user sectors, rather than just supplying machines,” he elaborates.

Commenting on the emerging trends, Ramesh foresees a shift from capital expenditure to operational expenditure models. “Instead of buying machines outright, customers may lease equipment and pay based on output. This will transform business models for OEMs like us."

With global machine tool builders looking at growth opportunities, India can be a high-potential market as well as a strategic partner. Geerts explains, "India is one of the most promising growth regions globally. Rapid industrialisation, large-scale infrastructure projects, and demand from sectors like automotive, aerospace, and energy are driving machine tool requirements. European machine tool builders view this momentum as a key opportunity to deepen their engagement with the Indian market. As a result, many firms now prioritise India as a key export and service market beyond their traditional bases. On the manufacturing side, India is gaining attention as a base for local assembly, component sourcing, and cost-effective production of standard machines. Competitive costs, a growing supplier network, and proximity to key markets in Asia and the Middle East make India attractive, not only as a sales market, but also as a strategic partner in global supply chains.”

Forecasting the medium-term outlook for the sector has become increasingly challenging amid rapid global shifts. A pronounced move toward protectionist trade policies, coupled with evolving tariff structures and changing international dynamics, is intensifying pressure on both the industry and global supply chains. Simultaneously, escalating geopolitical uncertainties are complicating long-term strategic planning. These factors highlight the critical need for resilience, diversification, and robust international partnerships to enable Indian machine tools industry to sustain investments, and achieve durable growth.

T K Ramesh, MD, Ace Designers Ltd

At present, India accounts for less than 1% of the global machine tool market. So the immediate impact of tariff wars on our exports is limited. However, our customers — auto component exporters — are being affected.

Jibak Dasgupta, Director General & CEO, IMTMA

The Indian machine tool industry needs to grow strong to compete with global players, and the challenge lies in building better indigenous high-precision technologies.

Dr Nagahanumaiah, Director, CMTI

What is missing is hands-on exposure and the willingness of employers to invest in training. Industry must treat training as both an investment and a social responsibility.

Dr Markus Heering, Executive Director, VDW

FTA between India and Europe would provide a strong boost, offering companies a more attractive business environment while reducing bureaucratic hurdles.

Filip Geerts, Director General, CECIMO

India is one of the most promising growth regions globally. Rapid industrialisation, large-scale infrastructure projects, and demand from industrial sectors are driving machine tool requirements.

R K Purohit, MD, Sphoorti Machine Tools Pvt Ltd

The rise of electric vehicles (EVs) has created additional visibility for us, but it has not reduced opportunities in the traditional auto segment.

Tosher Hormusjee, MD, GUSTI Tool Works LLP

The electronics industry is witnessing rapid growth in semiconductors and miniaturised components, driving demand for micro and small-diameter cutting tools.

Related Stories

IMTEX Forming 2026: Charting the Next Chapter of India’s Metal Forming Ecosystem

IMTEX Forming 2026, Asia’s largest metal forming and manufacturing technology exhibition, is set to return to Bengaluru from 21–25 January 2026.

Read more

For the foreseeable future, multiple fuels will coexist and grow: Farrokh Cooper

In this conversation with Rakesh Rao, Farrokh Cooper, CMD, Cooper Corporation, shares his views on manufacturing, technology and the road ahead.

Read more

High-Speed Clean Room Doors for Controlled and Regulated Environments

High-speed clean room doors are specialised industrial doors essential for maintaining controlled environments, providing an airtight barrier and enhance hygiene, safety, durability, and regulatory ..

Read moreRelated Products

Carbide Burrs

SRT Industrial Tools & Equipments offers a wide range of carbide burrs.

Jamshedji Soil Compactor

Jamshedji Constro Equip Pvt Ltd offers a wide range of jamshedji soil compactor.

Ground Pins

Hans Machineries Private Limited offers a wide range of pins, hardened & ground. Read more