Schedule a Call Back

Moulding the future of manufacturing

Articles

Articles- Jan 30,24

Related Stories

IMTEX Forming celebrates human ingenuity & machine intelligence: Jibak Dasgupta

In this interview with Rakesh Rao, Jibak Dasgupta, Director General & CEO, Indian Machine Tool Manufacturers' Association (IMTMA), explores trends in the machine tools industry and shares some highl..

Read more

Is your facility ready to handle the energy demands of full automation?

As warehouses scale AI-driven automation, energy demand is emerging as a critical constraint alongside productivity gains. Strategic power planning is now essential, writes Emily Newton.

Read more

Schaeffler Appoints Maximilian Fiedler as Regional CEO Asia/Pacific

Schaeffler has appointed Maximilian Fiedler as Regional CEO Asia/Pacific, effective 1 January 2026, with a seat on the Group Executive Board representing the region.

Read moreRelated Products

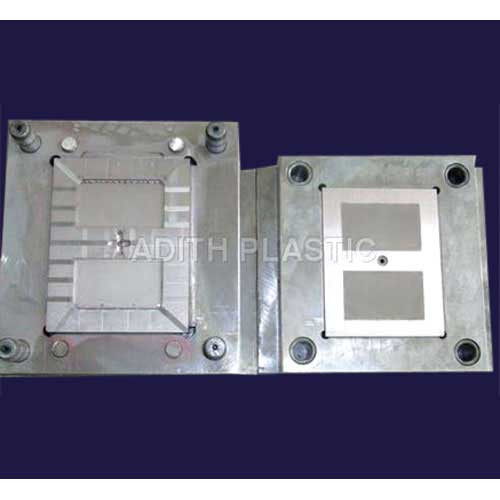

Industrial Moulds

Adith Plastic offers moulds for industrial electronic parts.

Industrial Plastic Moulding Dies

Adith Plastic offers a wide range of industrial plastic moulding dies.

Component Moulds

Innovative Moulds & Dies offers a wide range of plastic component moulds. Read more