Schedule a Call Back

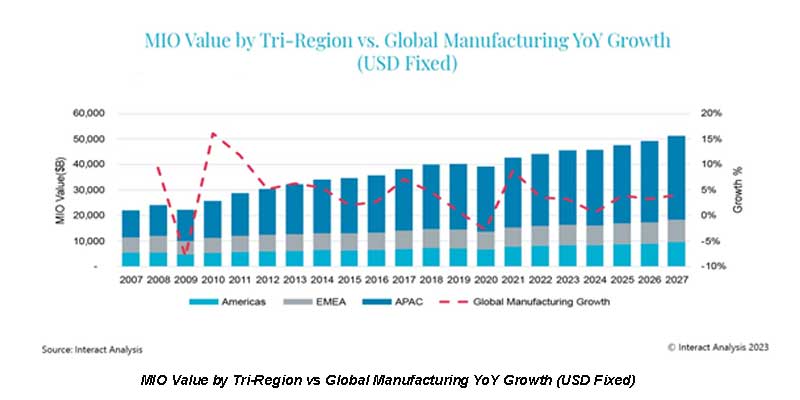

Global manufacturing growth to slow down, CAGR of 3% to 2027

Articles

Articles- Apr 27,23

Updated research by Interact Analysis, a market intelligence authority for global supply chain automation, shows that the current economic turbulence will continue to have a dampening effect on the global manufacturing industry. Previously, a global slowdown in manufacturing was forecast for 2026, but having considered the current economic landscape, it is likely that this constriction of manufacturing output will occur in 2024, much sooner than originally predicted. Overall, the APAC region is performing particularly well and is ‘propping up’ the rest of the world. As a result of rising oil and energy prices, strikes and the continued conflict in Ukraine, Europe is likely to suffer most over the next few years, with a significant fall in total manufacturing output predicted.

The Americas region fared well in terms of manufacturing growth due to a strong year in 2022 and in 2023 the region’s manufacturing output value is set to grow by $250 billion. The US government is attempting to combat inflationary pressures through interest rate hikes. For those products which are seeing high price inflation, such as foods and beverages, and raw materials; government intervention is expected to bring down prices. As with previous updates to their manufacturing industry output report, Interact Analysis found labour shortages continue to be a problem for US manufacturing, with companies struggling to fill vacant positions.

On the other hand, the APAC region, in particular China, is performing well as it emerges from Covid-19 restrictions. In 2023, China's manufacturing output growth is set to increase by 3.7 per cent. Between 2023 and 2027 moderate growth is expected to continue but the region will still suffer some of the effects of what is expected to happen globally in 2024. Despite this, the impact on China is anticipated to be less than that of the pandemic and lockdown measures that were put in place in 2020. From an industry perspective, chemicals and pharmaceutical manufacturing will enjoy the highest growth rate in China, reaching 4.7 per cent in 2023.

Overall, the landscape for European manufacturing looks bleak. In 2022, UK manufacturing shrank by 4.3 per cent and is expected to reduce by a further 1.2 per cent in 2023. This is a result of trade union strikes, inflationary pressures and the high cost of living. In the long term, between 2022 and 2027 the UK manufacturing sector is forecast to grow by a CAGR of 1.5 per cent, the lowest of all European countries. Germany is in a similar position, with inflation skyrocketing to a current level of 8.7 per cent. In 2022, Germany’s manufacturing growth shrank to 2.2 per cent but it is forecast to grow slightly by 1.8 per cent in 2023. Italy and France’s manufacturing sectors are also feeling pressure from rising energy prices, high raw material costs and labour crises.

Adrian Lloyd, CEO, Interact Analysis, commented, “Despite all the negativity currently surrounding the global manufacturing industry, total manufacturing industry output grew by 3.6 per cent in 2022, with countries such as Denmark, Hungary and Argentina performing particularly well. Overall, Europe also performed better than expected. The situation in APAC and China has also improved significantly since our previous updates as a result of Covid-19 restrictions being lifted, which has meant the manufacturing industry could get back on its feet.”

About the report: In a fast-moving sector with complex correlations, it is critical to understand the state of the market now, where it was, and where it will be. This MIO report quantifies the total value of manufacturing production with deep granularity – for over 35 industries, across 44 countries, and presents 15 years of historical data – for a complete business cycle, pre-recession to the present day.

Related Stories

HANNOVER MESSE Launches New Defence Production Area in Hall 26

This new platform fosters direct connections between suppliers and users, facilitating targeted dialog on industrial production for security-critical applications.

Read more

Evermore Elevates Precision Manufacturing with STUDER Machines

Evermore is strengthening its precision manufacturing capabilities through long-standing collaboration with STUDER, leveraging high-accuracy grinding technology to boost quality, efficiency, and com..

Read more

Musashi India Expands Bengaluru Plant to Boost Transmission Output

Musashi India has completed Phase 2 of its Bengaluru plant expansion to scale production.

Read moreRelated Products

Fanless Industrial Pc for Smart Manufacturing

CONTEC Launches BX-M4600 Series - Fanless Industrial PC for Smart Manufacturing.