Schedule a Call Back

Assessing the trade-offs of making the switch to electrical actuators

Articles

Articles- Oct 24,24

Related Stories

Is your facility ready to handle the energy demands of full automation?

As warehouses scale AI-driven automation, energy demand is emerging as a critical constraint alongside productivity gains. Strategic power planning is now essential, writes Emily Newton.

Read more

How is AI shaping the future of cement milling?

AI is transforming cement milling by enabling dynamic, data-driven control that improves energy efficiency, stabilises throughput and enhances asset reliability. By leveraging real-time data, predic..

Read more

4 Low-VOC Industrial Paints That Deliver High Performance in Tough Environments

Volatile organic compounds (VOCs) - contaminating air and water - can affect health. In this article, Emily Newton explores four high-performance, low-VOC industrial paint options that reduce harmfu..

Read moreRelated Products

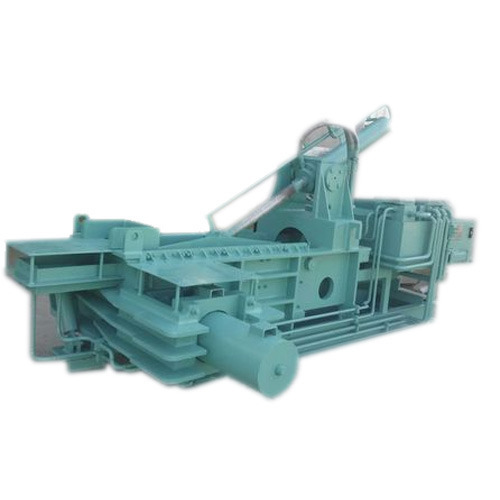

Baling Machine

Mask Hydraulic Machineries provide triple action scrap baling machines. Read more

Manifold Block

Om Shakthi Hydraulics offers a wide range of hydraulic manifold blocks. Read more

Exclusive Hydraulic Fittings

Supreme Engineers is engaged in manufacturing and supplying an exclusive range of hydraulic fittings. Read more