Schedule a Call Back

Are IIOT sales strategies holding up adoption of Industry 4.0 in manufacturing?

Articles

Articles- Oct 01,25

- Yet, many organizations and technology providers face a common reality: selling IIoT platforms is harder than selling hardware. Unlike a physical product that can be touched, tested, and measured, the value of a digital platform is often abstract, future-oriented, and dependent on integration within complex ecosystems.Research has shown several recurring challenges across markets:

- Value perception gap: Customers struggle to connect platform capabilities with tangible ROI.

- Digital readiness mismatch: Many companies are still early in their transformation journey, with fragmented systems and unclear budget ownership.

- Sales capability gaps: Traditional sales teams are strong on product knowledge but often lack confidence in explaining platform benefits.

- Competitive noise: With AI agents, startups, and OEMs all pitching digital platforms, differentiation becomes harder.

Moreover, customer psychology also plays a key role. Factors like alignment with strategic goals and sustainability commitments, evidence of ROI through PoCs (Proof of Concepts), and simple, relatable narratives that avoid jargon often outweigh pricing or technical specifications in driving IIoT buying decisions. Going forward, it is felt that companies will need to reframe their sales playbooks. Instead of focusing on features, the conversation is shifting toward business outcomes and customer transformation journeys. In the market, this would mean selling value stacks instead of products, generic messaging, consultative engagement, sales enablement and establishing proof of concept.From a research conducted by one of the authors, it appears that companies need to keep in mind the following factors to succeed in the IIOT market.From proposals to proof: Customers are more convinced by a working dashboard that shows real savings than by a 100-slide pitch deck. With multiple vendors claiming similar features, the one that proves ROI through a live PoC (Proof of Concepts) wins trust. For hesitant customers, PoCs de-risk decisions by demonstrating practical benefits tied to their own data.Incorporating government bodies in go-to-market strategy: Government policies are significantly influencing the subjective norm and eventually purchase intention. Hence the go to market approach should transform a bit and must include government organizations, consultants, auditors, and other institutional bodies. These additions will be helpful in increasing Schneider Electric’s market reach and target the customers which need IIoT platform driven energy management solution.Aligning business models with diverse company strategies: Company strategy is the main factor behind perceived usefulness and the purchase intention. However, the strategy differentiates from company to company. Building customers have company strategy to increase energy efficiency and cost savings for operational management. Industry having MNC parent organizations need energy management systems for reporting to headquarters, including energy, safety, and cybersecurity metrics. Their Indian ancillary organizations need systems that address inventory and quality control needs for Original Equipment Manufacturers (OEMs). Rest owner-driven businesses focusses on solutions that provide a fast return on investment (ROI) hence a bundled solution of meters and software can be a good solution. Overall, business model should be transformed in such a way that it aligns with the specific company strategy.Addressing company-specific problems in marketing: Problems in the company are the strong influencers for purchase intentions, hence it is necessary to understand problems related energy management from segment to segment. In the marketing pitch it is necessary to ensure clear value propositions that demonstrate how your platform helps customers achieve their goals (e.g., energy savings, improved inventory management).Provide targeted customer faqs to ease the convincing process: Build the comprehensive list of the potential concerns or questions that customers generally have about the IIoT software. Create special FAQ sheet for those specific audiences with questions and concerns most likely to arise with these audiences and their specific interests. Provide this list of questions to the salesforce to ensure they are ready to readily counter check with clients and thus making it easy to persuade the customers on why they should acquire the software.Implement advanced training programs for sales expertise: Shift from novice trainings to professional specialisation training that will help to establish substantial qualifications among the sales force. These programs should include detail knowledge and understanding of products, commercial skills, and knowledge in specialized fields. Offering constant staff training and development on IIoT and its software products is crucial to make the sales employees to be masters of the trade resulting to better sales.ConclusionAs Industry 4.0 matures, IIoT platforms will be the backbone of digital transformation. But adoption depends as much on how they are sold as on what they deliver. The new sales playbook is clear:- From products to platforms

- From features to outcomes

- From RFPs to PoCs

- From transactional selling to consultative partnerships

IIoT sales is not just a technical challenge—it’s a human one. Companies that combine proof-driven engagement with a structured framework will lead the way in turning Industry 4.0 from vision into reality.About the authors:R Jayaraman is the Head, Capstone Projects, at Bhavan's S P Jain Institute of Management & Research (SPJIMR). He has worked in several capacities, including Tata Steel, for over 30 years. He has authored over 60 papers in academic and techno economic journals in India and abroad. Jayaraman is a qualified and trained Malcolm Baldrige and EFQM Business Model Lead Assessor.Aditya Gupta is Deputy GM (Business Development & Product Marketing) at Schneider Electric. He is an experienced business leader with 14+ years across B2B and retail strategy, specialising in product marketing, business development, and customer-centric innovation. Currently, driving growth for the Switched & Wiring Devices division at Schneider Electric.(This article has used research findings from Aditya Gupta’s Capstone Project that he did in his course PGEMP at Bhavans SPJIMR, Mumbai)

Related Stories

India is at a pivotal ‘Make in India’ inflection point: Manoj Patil

In this interview, Manoj Patil, Promoter and Managing Director, Patil Automation Limited, outlines its growth journey, capacity expansion, acquisitions, design-led approach, market challenges, and t..

Read more

ABB India launches ArTu Formula LV switchgear for safer power distribution

ABB India introduces IEC-compliant ArTu Formula LV switchgear to support diverse applications and India’s growing power needs

Read more

Manufacturing Excellence in the Age of Integrated Automation and Industry 4.0

Manufacturing leadership is shifting from scale-driven efficiency to integrated, data-led systems that deliver resilience, sustainability and enterprise-wide performance through Industry 4.0 and aut..

Read moreRelated Products

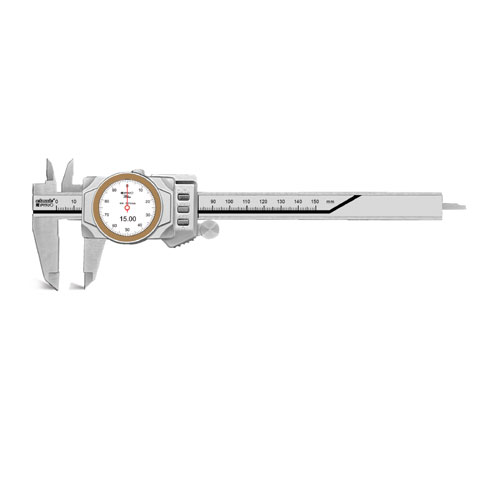

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.