Schedule a Call Back

Water and wastewater are the most promising sub-sector among PCE

Articles

Articles- Oct 19,19

- SOX- Flue Gas Desulfurization (FGD) units will be installed in 414 plants by 2022, covering 161,522 mw capacities. Remaining 235 plants are either complying with SOx norms or are planned for phase-out.

- PM- 222 plants will need to install/upgrade electrostatic precipitator to achieve PM norms. This entails capacity of 161,402 mw.

- NOx- pre-combustion modifications in boiler, installation of low NOx burners, over fire air along with installation of selective catalytic/non-catalytic reduction technology (SCR/SNCR) systems (no concrete roadmap seen)

| Promising sub-sectors in PCE industry | Sub sector Projected growth rate |

| Water and wastewater management | 15-20 per cent |

| Air pollution control | 10-20 per cent |

| Municipal solid waste management |

6-8 per cent

|

Related Stories

Indian economy grows in 24-25 as rural spending increases: RBI

Rural spending is outpacing urban segments, narrowing the rural-urban divide, as highlighted by the recent monthly per capita consumption expenditure (MPCE) survey of the NSSO.

Read more

IDC MarketScape names Siemens a Manufacturing Execution System Leader for 2023

Siemens is the only company to be named as a Leader across all 5 Manufacturing Execution Systems (MES) IDC MarketScape reports for 2023

Read more

Water and wastewater are the most promising sub-sector among PCE

Almost 63 per cent of municipal wastewater and 40 per cent of industrial wastewater is left untreated and discharged. India is also one of the largest and fastest growing greenhouse gas emitters.

Read moreRelated Products

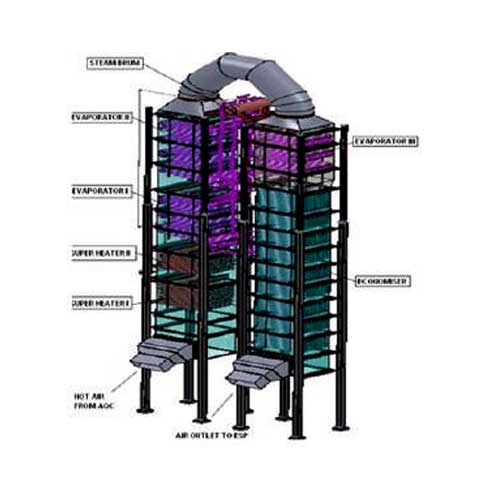

Waste Heat Recovery Boilers

Sitson India Pvt Ltd offers a wide range of waste heat recovery boilers.

Reinforced Water Activated Paper Tape

Mexim Adhesive Tapes Pvt Ltd offers a wide range of reinforced water activated paper tape.

Hot Water System

Haadi Enterprises offers a wide range of hot water system, solar. Read more