Schedule a Call Back

Budget 2019: Putting economy back on track

Articles

Articles- Aug 27,19

Related Stories

Waaree Energies Sets India First With 1 GW Solar Module Output in a Month

Waaree Energies has become the first Indian solar manufacturer to produce over 1 GW of modules in a single month, marking a major milestone for India’s renewable energy manufacturing sector.

Read more

Waaree Energies Greenlights Rs 81.75 Bn Capex for Battery Expansion

Waaree will scale up its lithium-ion battery plant capacity from the current 3.5 GWh to 20 GWh, representing a five- to sixfold increase.

Read more

Waaree Solar Americas secures 599MW US deal, expands clean energy presence

The modules will be produced at Waaree’s modern manufacturing plant in Brookshire, Texas, with deliveries scheduled for the 2026 calendar year.

Read moreRelated Products

Precision Cutting Tools1

S S Trading Corporation offers a wide range of precision

cutting tools.

Slotting Head Unit for All Cnc Turn Mill Centers

Sphoorti Machine Tools Pvt Ltd offers a wide range of

slotting head unit for all CNC turn mill centers.

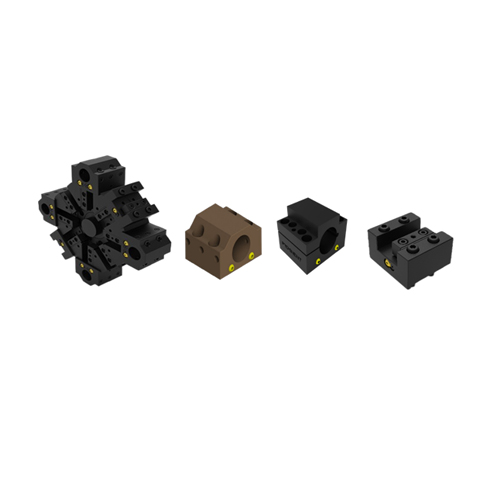

Slotted Tool Disc and Tool Holders

Prominent Machine Tools offers a wide range of slotted tool disc and tool holders.