Schedule a Call Back

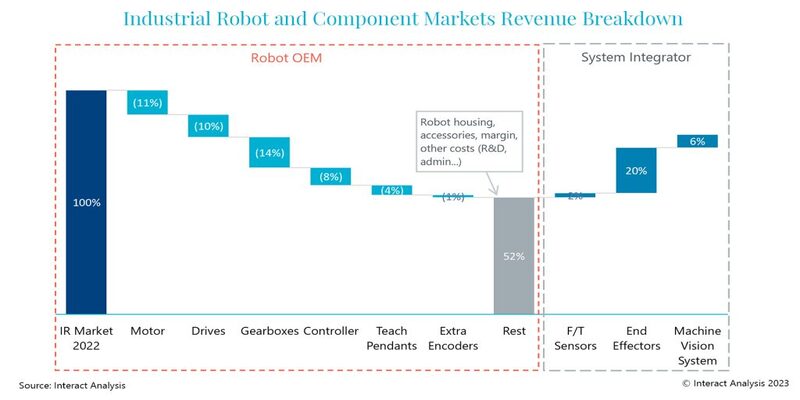

Research: 35% of the value of industrial robots comes from servo motors

Industry News

Industry News- Jun 09,23

Related Stories

Global industrial robot shipments down in 2024, recovery likely in 2025

As investment cycles pick up and demand stabilises across key industries, 2025 could mark the beginning of a new growth phase, albeit one characterised by tighter margins and more nuanced competitio..

Read more

Manufacturing Wins from UK–India Trade Pact

India-UK Free Trade Agreement (FTA) has the potential to boost bilateral trade by over £25 billion annually by 2040. Using Interact Analysis’ manufacturing industry output (MIO) tracker, Jack Lou..

Read more

Tariff uncertainty can hinder US automation recovery in 2025: Blake Griffin

From February 2024 through to January 2025, we saw a gradual improvement for machinery production in the US. While readings for March are not available yet, this momentum is likely to have faltered ..

Read moreRelated Products

Spur Helical Gear

J S Engineering Works offers an assortment of spur helical gear with primarily rolling tooth contact.

Cluster Gears

Trishla

Gear Industries is engaged in manufacture and supply of a wide range of cluster

gears.

Ground Spiral Bevel Gear

Bevel Gears (India) Pvt Ltd offers a wide range of ground spiral bevel gear.