Schedule a Call Back

Gujarat

Technical Articles

Technical Articles- Oct 01,13

The recent economic setback notwithstanding, Gujarat continues to attract fresh investments in its industrial sector. Moreover, the news of Narendra Modi having been chosen as the BJP's prime ministerial candidate may give this drive some extra power.

Finally, what had been tossed back and forth is now confirmed news. BJP President Rajnath Singh on September 13 declared Gujarat Chief Minister Narendra Modi as the party's prime ministerial candidate for the upcoming general elections. "Judging by sentiment and party's cadre vote we have anointed Narendra Modi as our party's PM candidate," Singh announced. The speculation has now shifted to what will happen to Gujarat's fortunes if Modi should win. Will he continue to favour the industrial growth of his home state once he is occupied with matters more pressing on the national level?

Meanwhile, for the moment, Gujarat continues to rake in a large share of new industrial investments, proof of which lies in the fact that the state cornered almost 25 per cent of the total investment proposals this year, while as many as 18 states individually accounted for less than 1 per cent of the total investments, pointing towards rising disparity among states in terms of industrialisation. According to the data released by the Ministry of Commerce and Industry, India has received industrial investment proposals worth Rs 2,19,628 crore from about 1,149 industrial undertakings till May this year.

But there's a flip side to it also. In a worrisome trend, a staggering 43 per cent of total investment projects worth Rs 52 lakh crore were a non-starter in India as of March 2013 with Gujarat topping the list of states with lowest implementation rate, a report by industry body ASSOCHAM says. "Gujarat has recorded the lowest implementation rate as over half of the total investment projects remain a non-starter and just about 46 per cent of projects are under the implementation stage," it states. Interestingly, with over 82 percent of investment projects under implementation, Haryana recorded the highest rate of implementation of investments among industrialised states throughout India.

The ASSOCHAM report further states that over 34 per cent of these investments are stuck at the stage of announcement; implementation of about 6 per cent of projects has been stalled; and there is no information of the remaining 3 per cent projects. "These dismal figures showcase that owing to the prevalence of global recessionary trends and slowdown of Indian economy, investments across states, Gujarat included, have been kept on hold which is a cause for concern for a country that desperately needs investments," opines D S Rawat, National Secretary General, ASSOCHAM.

Concurs Falgun Pandya, CEO of Ahmedabad-based Saimona Air-Mech Private Limited, manufacturer of compressors: "It is the current economic climate to blame for some of the projects not taking off. We hope to see a different picture after a new government comes to power."

Deals & Policies

This is not to say, however, that the industrial set-up in Gujarat has slowed its pace to the extent that it will miss the bus. Fresh deals are being conducted every day. For example, the Aditya Birla Group is close to concluding a deal to buy out Jaiprakash Associates' cement plant in Gujarat, ending protracted negotiations which have gone on a for a year. The Kumar Mangalam Birla-controlled conglomerate is likely to pay close to Rs 3,500 crore to acquire the 4.8 million TPA unit. According to a report in The Economic Times, the deal will help the group's cement company, Ultratech Cement, to ramp up capacity. "We have blueprinted an audacious growth plan. By 2015, our goal is to scale up our cement capacity to 64.45 million tonnes per annum from the current 53.90 million tonnes," group chairman Kumar Mangalam Birla had said in a recent letter to shareholders.

There has been positive movement on the policy front too. Gujarat, which accounts for about a quarter of India's total exports, is mulling a five-year export policy to focus on value-added exports in sectors such as textiles, agriculture and dairy. The move by the top exporting state in the country comes on the back of sagging efforts by the Centre to boost dwindling exports. As a precursor to the policy, the Federation of Indian Exports Organisation (FIEO) undertook a study for Gujarat on the state's export competitiveness and identified sectors with export potential. "We are working on improving exports from the state and will take steps to increase the share to 35 per cent of India's total exports by 2020," said a state government official.

The government may announce incentives ranging from exemption from value-added tax (VAT) in some sectors to 'focus market scheme' and 'focus product scheme' to offset the high freight cost and other externalities to select international markets and promote products with high-export intensity. India's overall exports declined by 1.76 per cent in 2012-13 to USD 300.6 billion, as demand in the US and the EU subsided on slowing economy. Following this the centre announced a series of incentives in the annual supplement of the foreign trade policy. Given that over 90 per cent of Gujarat cotton goes to other states for value addition, emphasis would be laid on readymade garments.

The state already has potential in the textile sector, as nearly 23 per cent of the state gross domestic product comes from textile and related industries. Other areas that Gujarat contributed to India's exports in 2011-12 include 70 per cent in the gems and jewellery sector; 30 per cent in pharmaceuticals; 20 per cent in textiles; 12 per cent in engineering; and 18 per cent in chemicals. "Gujarat should strive to increase its exports by shifting its focus from lower-end markets to value-for-money markets," says Ajay Sahai, Director General and CEO, FIEO.

"As of now, it has been supplying domestic and international markets with raw materials but with proper R&D and focused investments, Gujarat should introduce high value-added products of global standards. Only a quarter of export units have an export house or upward status for special benefits," the FIEO study notes. The state has 41 minor and intermediate ports and 55 SEZs, involved in sectors like biotechnology, power, handicraft, and gems and jewellery. Gujarat also has a comparative advantage in many commodities like spices and seeds, minerals and metals, and cotton.

Textiles

While the textile industry in Gujarat has always maintained a lead position in the country's total textile production scenario, modernisation in powerloom units in Surat will now get a boost with the Cabinet Committee on Economic Affairs giving its approval for continuing the Technology Upgradation Fund Scheme (TUFS) during the 12th Plan period with a major focus on the powerloom sector. The total budget outlay for continuation of the TUFS will be about Rs 11,900 crore, out of which Rs 2,400 crore has been allocated for the financial year 2013-14. According to industry sources, the overall incremental target in the 12th Plan is about 16 per cent in the weaving sector whereas it was only 9 per cent in the 11th Five Year Plan.

Some of the major features of the scheme include

promotion of indigenous manufacturing of the textile machinery; interest reimbursement (IR) on second-hand imported shuttleless looms to be reduced from 5 per cent to 2 per cent; and capital subsidy on new shuttleless looms to be raised from 10 per cent to 15 per cent, etc. In an important decision, the sectoral cap of 26 per cent will be applicable only for the spinning segment and that the sectoral caps for all the other segments including powerloom have been removed to enable balanced growth across the value chain.

The powerloom weavers in the Diamond City are likely to be benefited as a pilot project for hire-purchase of new shuttleless looms shall be introduced with a plan outlay of Rs 300 crore. This will enable marginal powerloom weavers, having limited capacity to make capital investments, to upgrade their looms through payment of easy instalments. "The TUFS allocation has come as a blessing for the city's powerloom weavers. As there are no sectoral caps, except for the spinning sector, the powerloom sector has an edge. We are hopeful that the revised TUFS will boost modernisation in the textile sector," says Kamlesh Yagnik, President, Southern Gujarat Chamber of Commerce and Industry.

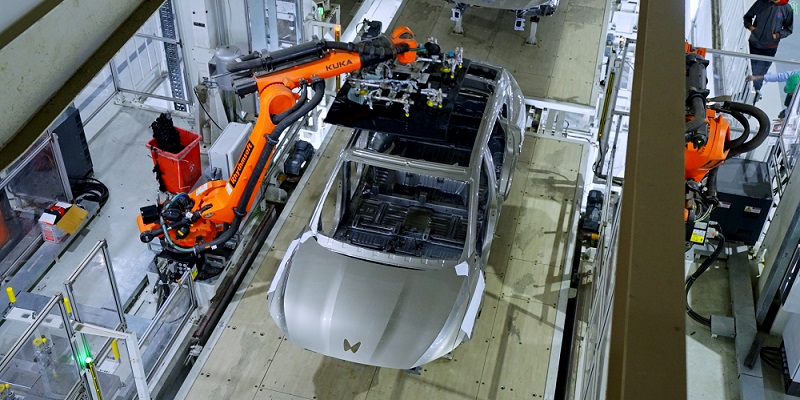

Automotive

Ever since Tata Motors shifted its base for manufacturing the Nano to Gujarat, the state has been in the limelight for doing its best in attracting an increasing number of automotive players within its boundaries. Maruti Suzuki India Limited, for instance, has signed an agreement with the Gujarat government to set up a manufacturing facility to manufacture 2.5 lakh cars per annum at Hansalpur in north Gujarat, 100 km from Ahmedabad. Initially the company will invest Rs 4,000 crore in the facility, its seventh in India and first outside Haryana.

"The plant coming up over 700 acres will be commissioned in 2015-16 and create 2,000 direct jobs," states Shinzo Nakanishi, MD and CEO of Maruti Suzuki. "The agreement will help Gujarat emerge as an automotive hub as Maruti plans to raise the capacity of 15 lakh in a phased manner in 14 years," says Maheshwar Sahu, principal secretary in the state's department of industries.

Reacting to this new venture, Modi, in whose presence the agreement was signed, was quoted as saying that automotive companies choosing Gujarat for their facilities will change the identity of the state. So far Gujarat is known for its chemical and pharmaceutical industry, which are polluting. We plan to set up automotive clusters as well as clusters for engineering units, which are non-polluting," he said. American car maker General Motors has its facility at Halol near Vadodara while Ford Motors India and French car maker PSA Peugeot Citroen are also setting up their facilities at Sanand near Ahmedabad.

Chemicals & Pharmaceuticals

Always known for its pharmaceutical industry, Gujarat continues to be in the fast lane and the most recent news is that the former promoters of Zandu Pharmaceuticals, the Parekh family, are back after a five-year hiatus to invest Rs 150 crore in a nutraceutical facility in Gujarat. The production will start by January and would have an annual capacity of 250 crore tablets, 60 crore capsules and 200 crore softgel capsules. Ahmedabad-based Parekh family co-founded the 100-year-old ayurvedic company along with the Vaidya family. In 2008, the Vaidya family sold off its 24 per cent stake to Kolkata-based personal healthcare company Emami that later made an open offer to the Parekhs.

After holding off the offer for five months, the Parekhs sold their stake for Rs 243 crore to Emami that finally took over the company through open market transactions. The Parekhs own Gujarat Research Allopathic Foundation (GRAF) Laboratories Ltd., an allopathic unit of Zandu set up in 2000 that was not sold to Emami. The nutraceutical facility will be set up under GRAF at Ganeshpura near Ahmedabad. The unit would also house allopathy drug production apart from nutraceuticals. "We have zeroed down on nutraceuticals as a main focus for GRAF's future growth," said Shivender Aggarwal, Executive Director, GRAF Laboratories, adding, "Initially we will target prescription sales and later enter the OTC nutraceutical segment." The Indian nutraceutical market is pegged at Rs 70,000 crore plus. "Changing lifestyles and rising health literacy amongst the people have led to an exponential growth opportunity for the preventive healthcare segment," he added.

Another piece of good news is that the Ministry of Chemical and Fertiliser proposes to recommend lifting of the environmental ban on the chemical industrial areas of Ankleswar and Vatva in Gujarat. This follows recommendation of the Gujarat government, which has assured the central government these areas have compiled with environmental guidelines and upgraded their infrastructure. The ban was imposed along with other industrial areas like Bhavnagar, Junagadh and Vapi. These areas however got the tag lifted in 2011.

Information Technology

While Gujarat is yet to achieve the same kind of status in the IT sector as Karnataka, Tamil Nadu or Maharashtra, technology companies in Gujarat are eyeing 20 per cent growth in this financial year and will focus on product development and global access. The official output figures for the state's IT and IT-enabled Services (ITeS) are not out yet, but exports from local office of the Software Technology Parks of India (STPI) have been estimated at Rs 1,500 crore. "The number of companies reporting to STPI has dropped from 200 to 80 following withdrawal of benefits to STPI, hence the drop in figures, but the industry figures are much higher," said Pankaj Shah, president of the Gujarat Electronics and Software Association of India (GESIA). Of the 1,500-odd IT, ITeS and electronics companies in Gujarat, about 340 are members of GESIA.

Skill Development

In what could be termed the right strategy, the focus is not just on attracting larger investments to drive industrial growth but also on creating new cadres of talent. In a big impetus to M S University's Faculty of Technology and Engineering, a MoU to set up a Rs 102 crore worth Centre for Industrial Automation was signed earlier in September. So far, it is the largest investment promised to a MSU faculty under the public-private-partnership mode.

MSU's FTE is one of the five institutes in Gujarat selected for setting up such a centre for excellence. "The agreement is to set up seven laboratories under this centre. This includes laboratories for automation, electrical, mechatronics, machines, advanced manufacturing, design, validation process control," Girish Karhadkar, head of MSU's Mechanical Engineering Department, who had prepared the project proposal, told the media.

Related Products

Ceramic Reinforced Grinding Wheels

Rüggeberg GmbH & Co KG,

PFERD-Werkzeuge, has launched new reinforced grinding wheels with ceramic oxide

grain.

Potential Transformers Outdoor Type

Ereva Transformers & Switchgear is a

manufacturer and trader of supreme quality potential transformers.

Dispersion Kneader

Indian Machine Mart offers a quality range

of dispersion kneaders in different ranges and specifications.